Next year will be good for the best and mediocre for the rest and in mining the safest bets are the royalty and streaming companies that don’t actually mine metal themselves but contract with other mines to take part of their future output. [Here are the three to consider and the reasons why.]

bets are the royalty and streaming companies that don’t actually mine metal themselves but contract with other mines to take part of their future output. [Here are the three to consider and the reasons why.]

So says John Rubino (dollarcollapse.com) in edited excerpts from his original article* entitled If You Were Going to Buy a Mining Stock, Which Would It Be?.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Rubino goes on to say in further edited excerpts:

[As mentioned at the top] royalty and streaming companies don’t actually mine metal themselves but contract with other mines to take part of their future output and they do this in a variety of ways:- buying up existing royalty agreements that call for a given number of ounces delivered over a specified period of time or

- making equity investments in mines in return for some portion of future production.

The first is passive investing, the second more like venture capital.

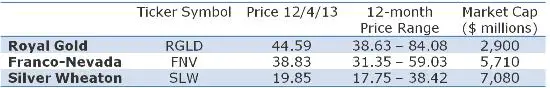

The biggest companies in this space have been able to gain interests in lots of mines on generally favorable terms. Here are the three to consider:

Not Risk-Free

A lot of these companies’ investments depend on mines expanding or continuing to produce as expected.

- Should the price of gold and silver fall much from here there will be wholesale project cancellations and mine shutdowns, which would mean less cash flow from their positions. This is a very real risk, but even so, the impact on the royalty/streaming companies would be less than on the typical miner because the former have spread their bets among so many different mines.

- The other issue is the availability of good investments going forward. The royalty companies have to invest their cash at rates that exceed their cost of capital. Such deals are scarce in this environment and will get scarcer if metals prices don’t recover. Here again, though, we’re talking about diminishing cash flow, not an existential threat.

Meanwhile, in a really bad market these companies become the king makers in the industry, deciding which juniors live or die and using that power to cut deals that become hugely favorable when prices revive and those new mines are developed.

To sum up, these companies are not as safe as owning bullion intelligently stored, but they’re safer than the typical miner, with considerable upside margin over metals prices if things turn around from here.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://dollarcollapse.com/precious-metals/if-you-were-going-to-buy-a-mining-stock-which-would-it-be/ (Copyright © DollarCollapse.com)

Related Articles:

1. Gold & Silver Streaming Companies Generate Greater Returns Than Any Other PM Sector! Here’s Why

Mining stocks have been hit or miss, offering incredible leverage during certain periods and under-performing the metals during other periods. However, one type of precious metals equity has been significantly outperforming both the metals and mining shares…[and that] is gold and silver streaming companies. Words: 2500 Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money