Is the debt issue phony? It sure sounds like a lot, doesn’t it? $17 trillion in federal government debt. Wow. It’s a big, scary number, no doubt about it, …and it’s a lot bigger than in years past, but is it really that bad? Could it be that our debt profile has been grossly exaggerated? [I think so. Let me explain why I think that is the case.]

government debt. Wow. It’s a big, scary number, no doubt about it, …and it’s a lot bigger than in years past, but is it really that bad? Could it be that our debt profile has been grossly exaggerated? [I think so. Let me explain why I think that is the case.]

So writes Arne Alsin (alsincapital.com) in edited excerpts from his original article* entitled Is The Debt Issue Phony?

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Alsin goes on to say in further edited (and perhaps paraphrased in some places) excerpts:

[In this article] we’re going to take a look at how much debt is costing us as a percentage of GDP to gauge how well (or how poorly) we’re servicing the debt and then look at our resources to see how much we’ve got backstopping the debt.Before we go any further, though, let’s establish this much:

There is nothing wrong with debt. Debt is not evil. All governments use it, as does every major corporation, even those flush with cash. Debt is a necessary tool, as it allows corporations and governments to operate more efficiently, to manage disparate and inconsistent cash flows.

How much is debt taking out of the economy?

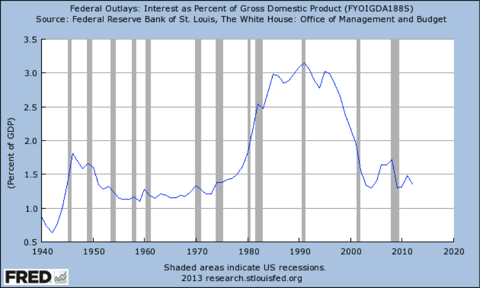

The chart below shows you how much debt service (interest) is costing us, as a percentage of the economy (GDP).

Ahem. So what’s all the hullabaloo about?

The data show that the cost of public debt is currently below the 10-year average, the 20-year average, the 30-year average. In fact, by this time next year, our debt service costs are expected to drop to levels not seen since the 1960s, to about 1% of GDP.

Wait a minute, the fear mongers will say, what happens when interest rates go up? Not much, it turns out.

The government has locked in low rates on much of the debt and there’s an offset to calculate, as higher tax revenues follow higher interest rates. Furthermore, we have lots of capacity. Our debt service cost could double, to 3% of GDP, and it would still be manageable. That’s the level it was in 1989, the year Reagan left office.

An interesting fact the fear mongers may have neglected to tell you:

A big part of the federal debt is a phantom, an accounting entry booked when one government agency borrows from another government agency. The real debt – the debt owed to outside creditors – is $12 trillion.

Let’s not quibble over a few trillion. As I’m about to show you,

$17 trillion does not constitute excessive debt leverage, given the size of the economy and our assets. In fact, our net assets are way more than the federal debt. Way, way more.

The government belongs to the people. We’re backstopping the debt accrued by the government and, yes, $17 trillion is a lot of coin…[but] the left side of our balance sheet (the asset side) has plenty of heft in it, too…

Net household assets exceeded $75 trillion last quarter, an all-time record. The ratio of $75 trillion in assets to $17 trillion in debt, though not as good as it was under Reagan, is moderate, not excessive. When Reagan left office, we had $18 trillion in net household assets, which covered $2.6 trillion in debt by a healthy margin. Factor in phantom debt and our debt to assets ratio is the same it was under Reagan.

It’s true, we put on several trillion dollars of debt during the credit crisis, but that’s what debt leverage is for, to smooth over rough patches, to provide fresh capital when it’s not readily available.

Relative to assets, and relative to how much it costs us as a percent of GDP – and with apologies to media hounds who need fodder for their content – alas, we do not have a debt problem.

If and when we develop a real debt problem – as opposed to a media fiction – the way to deal with debt is simple: Grow assets. Net household assets double every 10 to 12 years. We should be at $150 trillion in 10 years and $300 trillion in 20 years. My guess is we’ll grow debt more slowly in the years to come, as the economy appears poised for several years of healthy growth. It’s reasonable to expect debt will grow to something like $25 trillion in ten years, and to $40 trillion in twenty years. I’m sure we could comfortably grow debt to $60 trillion over the next twenty years, and we’d generate a lot more assets, but let’s not get greedy. Slow and steady, you know.

Another thing: America won’t pay off its debt, and it shouldn’t. Ever. Our debt isn’t a credit card bill. You can’t compare the American government to a family’s finances. They’re not even close to the same thing. It’s a line of credit, and it will always be rolled over. (Assuming we have good credit, of course.)

Unless we want to do a lot of harm to the economy (it would shrink it), we’re not going to make a dent in the $17 trillion of debt. Debt is going to grow, cherubs. Get over it.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

* http://alsincapital.com/blog/2013/10/4/is-the-debt-issue-phony

Related Articles:

1. Don’t Believe the Lies – THIS Is the Economic Reality – Take a Look… Then Get Prepared

Don’t believe these big lies – the following charts illustrate just what IS reality. Take a look and then get prepared for when the —- hits the fan! Read More »

2. What You Need to Know About the U.S. Budget Deficit & National Debt

Q: Don’t laugh at me, but what is a deficit? A: It’s actually not a dumb question. Here’s why. Read More »

3. Rapid Rise In Interest Rates Will Collapse U.S. Financial System – Here’s Why

There is one vitally important number that everyone needs to be watching right now, and it doesn’t have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. Here’s why. Words: 1161; Charts: 2 Read More »

4. Economics Can’t Trump Mathematics & the Math Says US In a Debt Death Spiral

The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. We are bigger fools for providing them the authority to indulge their hubris and wreak such damage. Read More »

Anyone that thinks that the U.S. economy can keep going along like this is absolutely crazy. We are in the terminal phase of an unprecedented debt spiral which has allowed us to live far, far beyond our means for the last several decades. Unfortunately, all debt spirals eventually end, and they usually do so in a very disorderly manner. Read More »

6. Why the End of This Economic Death Spiral Is So Hard to Call

Whether you are an investor, concerned citizen or merely someone trying to understand the current economic situation, you should be worried. Watch this video to get an outstanding overview of what is occurring. It is probably the best short explanation as to why the end of this economic death spiral is so hard to call. Read More »

7. Lessons of 2008 Forgotten – Debt Threatens to Undo the World Again

Little has been done in the past six years to restructure economies and cut debt i.e. learn the lessons of 2008. Because we’ve partially recovered from that traumatic period, that’s led to complacency. All the while, the debt that caused the bust in the first place has compounded and threatens to undo the world again. Let’s hope it doesn’t come to that. Read More »

8. Another Crisis Is Coming & It May Be Imminent – Here’s Why

Is there going to be another crisis? Of course there is. The liberalised global financial system remains intact and unregulated, if a little battered…The question therefore becomes one of timing: when will the next crash happen? To that I offer the tentative answer: it may be imminent…[This article puts forth my explanation as to why that will likely be the case.] Read More »

9. Japan: A Country On the Brink of Fiscal & Economic Disaster!

I wrote several years ago that Japan is a bug in search of a windshield and in January I wrote that 2013 is the Year of the Windshield. Japan is a country that is on the brink of fiscal and economic disaster Read More »

10. “Ponzi Finance”: What Must Happen To Bring It To An End?

The Boston Consulting Group has issued a paper that recommends 10 steps that developed countries must take to end what they refer to as ‘Ponzi finance’ and to return to a sustainable growth path but I believe their recommendations to be but theoretical and impractical constructs. While I believe we face – and will experience – interesting, speculative, fragile, and very challenging and very likely life-changing times going forward, I believe that the only thing that will force developed country politicians to work for common purposes is a further global financial crisis. This article provides an overview and assessment of said paper and the rationale for my position. Words: 600

11. Gov’t Debt Will Keep Increasing Until the System Implodes! Are You Ready?

Why are so many politicians around the world declaring that the debt crisis is “over” when debt-to-GDP ratios all over the planet continue to skyrocket? The global economy has never seen anything like the sovereign debt bubble that we are experiencing today. This insanity will continue until a day of reckoning arrives and the system implodes. Nobody knows exactly when that moment will be reached, but without a doubt it is coming. Are you ready? Words: 1270

“The end of the world as we know it” is what David Korowicz predicts is coming sometime this decade – an “ultimate” crash that will be irreversible – TEOTWAWKI! Words: 1395

13. Nothing Can Be Done to Avoid Coming World-wide Depression! Here’s Why

Governments everywhere are becoming more distressed and desperate as economic realities dominate the political doublespeak. The world is at a dangerous point. Much of what we thought we knew and assumed regarding governmental behavior and economics is beginning to be reassessed. Governments of the world are out of money and out of ideas. The Ponzi scam that has been perpetrated for over fifty years is collapsing under its own weight. There are not enough suckers and capital left to sustain the fraud. [Let me explain further.] Words: 999

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money