The best way to think of gold is as a non-yielding currency with a special trait: The only way to “print” it is to pull it out of the earth at great cost. As a currency with no yield and limited practical use…gold’s investment case largely rests on its ability to insure against currency depreciation. Few people expect to make money by taking out insurance policies. I don’t recommend allocating any more than 10% of a portfolio to gold. Words: 610

“print” it is to pull it out of the earth at great cost. As a currency with no yield and limited practical use…gold’s investment case largely rests on its ability to insure against currency depreciation. Few people expect to make money by taking out insurance policies. I don’t recommend allocating any more than 10% of a portfolio to gold. Words: 610

So writes Samuel Lee (www.morningstar.com) in edited excerpts from his original article* as posted on Seeking Alpha entitled Gold’s Dull Future.

The post by is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds), www.munKNEE.com (Your Key to Making Money!) and the Intelligence Report newsletter (It’s free – sign up here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Lee goes on to say in further edited excerpts:

There are many ways to own gold. Because the metal is a bet on disaster, some gold owners prefer physical possession, preferably beyond the knowledge of the tax man. They fret the government could criminalize the private ownership of gold…so if you’re truly worried about such a scenario, no exchange-traded fund is worth consideration. In fact, no mode of ownership that relies on the rule of law–gold accounts, structured notes, certificates, futures, warrants, and so on–will shield you from the government should the unthinkable occur.

For investors who aren’t worried about confiscation or a Mad Max scenario, exchange-traded funds are likely the most efficient way to own gold. SPDR Gold Shares (GLD) is synonymous with gold investing, owing to its massive size and liquidity. GLD has at times held more assets than any other ETF…

Fundamental View: Even though gold’s long-run return is almost certainly abysmal, I’m reminded that a great economist once said, “In the long run we are all dead.” Gold, as a currency, can do well for all the reasons currencies do well. It can:

-

yield more than alternatives,

-

be perceived as safer, or

-

have a favorable real exchange rate.

We’ll treat each factor in turn.

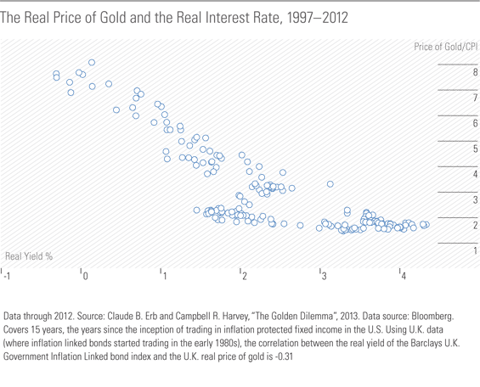

1. Yield: The biggest determinant of gold’s price is its relative yield, not inflation, as many believe. The gold run got its legs when short-term interest rates hit zero in 2008 and the Federal Reserve began its first round of “quantitative easing,” reducing fears of deflation. When short-term interest rates went negative, the opportunity cost of holding gold as opposed to cash became positive. Should real rates rise, gold investors will be slaughtered. Therefore, gold is a bet that real interest rates will remain low for a long time.

2. Safety: Another big determinant of gold’s price is market’s perception of the dollar’s safety. Since 2008, emerging-markets central banks have bought gold to diversify their foreign exchange reserves away from the currencies of the big debtor nations. Prominent investors, such as Bridgewater Associates, have advocated for gold as a strategic holding. John Paulson, who famously made a fortune betting against subprime mortgages, is GLD’s biggest shareholder. There’s a lot of fear baked into gold’s elevated price, so investors will have to get a lot more fearful than they are today for this factor to come into play.

Enjoying this article?

Then stop surfing the net looking for more informative articles.

The best of the best are posted on munKNEE.com!

Sign up here to receive them all via our Intelligence Report newsletter.

The mailing is free and restricted to only 1,000 active subscribers.

Act now!

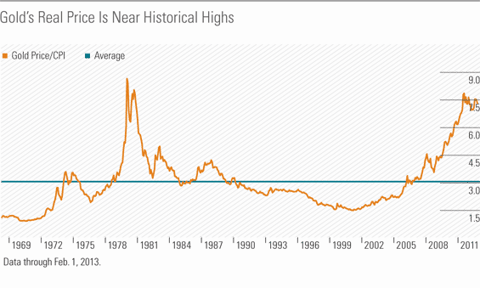

3. Real Exchange Rate: Gold has a real exchange rate, just like any other currency. Exchange rates tend to converge on the point where purchasing power is equalized. Gold’s purchasing power of real goods is at an all-time high: Since 1975, the gold price/CPI ratio averaged 3.5, but now is higher than 7, suggesting gold is overvalued by 100% in real purchasing power against its history. However, unlike with normal currency pairs, there’s no mechanism for arbitragers to buy goods in the cheap currency and sell them in the expensive one, so gold can remain expensive for a long time.

(click to enlarge) – source: Morningstar Analysts

– source: Morningstar Analysts

Additional Determinants: Aside from the currency factors, there is also a wild card in Chinese and Indian investment demand. As emerging markets become richer, gold demand may continue to rise. In this regard, gold is an implicit bet on emerging-markets growth.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/1309031-gold-s-dull-future (© 2013 Seeking Alpha)

Related Articles:

1. Central Banks Buying Gold in Record Quantities – Here’s Who & Why

If central banks are preparing for a major change in the value of the dollar, shouldn’t we? The US dollar cannot and will not survive the ongoing abuse heaped upon it by government planners and federal officials. That not only means the gold price will rise, but that many, if not most currencies, will lose a significant amount of purchasing power. This has direct implications for all of us.

2. A Look at Gold vs. Silver, the Dow & the USD Index

Comparing the gold or silver price to another assets is a great way to create an understanding of the true value [of each]. The long term charts [below] indicate that this bull market is very strong; the fundamentals keep on strengthening by the day, week, month, year….The wise lesson you can draw from these charts: the trend is your friend.

3. Gold & Silver in Super Cycles: When Will They Go “Boom” & Then “Bust”?

Commodity prices including those of…[gold and silver] tend to go through super-cycles…[which] last for many years. [Below is a review of the history of such cycles and the length of each. Where are we now in each? When will they go “boom”? When will they go “bust”? Let’s take a look.] Words: 165; Charts: 1; Tables: 3

4. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691

5. What Does a “Troy” Ounce of Gold Mean? What Does 18 or 24 “Karat” Gold Mean?

When the price of gold is mentioned as costing “x dollars per troy ounce” do you fully appreciate the signifance of the term “troy”? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 “karat” gold and another item stamped 18 “karat” gold (other than that it is much more expensive)? Let me explain. Words: 587

6. The USD & U.S. Dollar Index – What Affect Are They Having On the Price of Gold?

The U.S. Dollar Index is made up of a basket of [6] currencies that are, themselves, not static and, indeed, are involved in various forms of debasement as nations have taken the view that a weaker currency will boost their exports. As each nation enacts such policies, the result is gridlock, as every action taken to weaken one’s currency is neutralized by a similar action taken by the competing currencies. That is currently what is happening with the constituents of the U.S. Dollar Index and why, as such, the U.S. dollar has not weakened. [Given the fact that] gold tends to have an inverse relationship with the dollar, and has increased when the value of the dollar has declined, we could, as a result, continue to see a capping in the advance of gold prices, at least in dollar terms. [Let me explain in further detail.] Words: 804; Charts: 1

Bubbles tend to follow the 80/20 ratio indicated in the Pareto Principle where approximately 80% of the price move occurs in the LAST 20% of the time. That being the case it would appear that gold and silver could conceivably top out around $9,000 per troy ounce and $250/ozt respectively .This is not a prediction of future prices of gold and silver; it is an indication of what could happen in a speculative bubble environment based on the history of previous bubbles. Words: 1280; Charts: 1

8. Startling Relationship Between Gold Price & U.S. Gov’t Debt Suggests What Price for Gold in 2017?

The price of gold, on a quarterly basis, is 86% correlated – yes, 86%! – to total government debt going back to 1975… and a shocking 98% over the past 15 years! [As such,] it would seem like a no-brainer investment thesis to buy gold… as a proxy for the not-otherwise-investable thesis that US total government debt will increase in the future. [But there is more – and it is disappointment for gold bugs – read on!]

9. The Future Price of Gold and the 2% Factor

10. 3 Critical Drivers for Gold, Silver & Their Relative Securities

3 critical drivers for gold, silver and their relative securities [are once again enticing] investors to…take stakes here. These catalysts…affect both the short-term and long-term, and so, at the very least, a floor may be developing.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Certainly the Broad view to which I would add that owning Gold and/or Silver allows one to own something that is in shorter demand than paper money yet has value; something to consider in these times of many, many people worried about the value of the US Dollar and other “flat” currencies…

+

I’s suggest that if you did own 10% of your wealth in Gold you could ALSO own at least that much in Silver for many of the same reasons plus a few others like the Gov’t. suddenly making Gold illegal to own might give you some time to shift to Silver before they also grabbed that, think defense in depth against confiscation…