Financial repression occurs when governments channel funds into their own sovereign bonds in order to reduce debt levels through mechanisms such as directed lending, caps on interest rates, capital controls, debt monetization, or by other means. The promise of financial repression is that it will hold down government borrowing costs and reduce government debt levels, but critics argue that financial repression will fail to alleviate government debt unless tax increases and austerity measures follow and, as such, merely targets the producers of society, i.e., the middle class, and therefore harms the economy. Let’s take a look at financial repression ands its supposed pros and cons. Words: 1486

So says Ron Hera (www.heraresearch.com) in edited excerpts from his original article* (2425 words in length) entitled Why Financial Repression Will Fail.

[Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.]

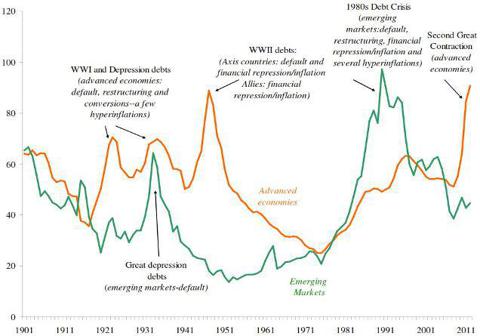

Hera goes on to say, in part: Economist Carmen M. Reinhart, et al., brought the term financial repression back into popular usage in 2011 after a long hiatus….

(Click to enlarge) The Liquidation of Government Debt, Carmen M. Reinhart and M. Belen Sbrancia (NBER 16893, 2011) Financial repression in the form of debt monetization:

(Click to enlarge) The Liquidation of Government Debt, Carmen M. Reinhart and M. Belen Sbrancia (NBER 16893, 2011) Financial repression in the form of debt monetization:

- destroys savings

- reduces government borrowing costs as the result of a zero percent interest rate policy (ZIRP),

- deprives savers and pensioners of interest income and

- can lead to inflation.

What is more important, however, is that financial repression:

- prevents capital formation.

Of particular concern in the U.S. is the link between capital formation and new business creation, which is primarily a middle class phenomenon. The vast majority of corporations in the U.S. are small businesses and they account for the majority of jobs. By preventing capital formation, financial repression:

- short circuits the engine of new business creation,

- increases unemployment and

- threatens to bring down the middle class.

Governments cannot supply entrepreneurship or innovation in the marketplace, nor can they effectively replace savings (genuine capital derived from surplus production) or private investment with bank credit or with public funds, which represent debt and a transfer of wealth, respectively. The deployed capital, inventions, products and services of new businesses drive innovation, fuel competition, provide jobs and increase the wealth of society. In contrast, financial repression can only produce economic stagnation and result in a net loss of wealth to society….

Crisis and Consequence

Despite the 2008 financial crisis, global recession and inflationary policies, confidence in the U.S. dollar, the U.S. stock market, the U.S. federal government and the U.S. economy remained largely intact….On the surface, the fallout of the crisis was effectively managed, but the basic causes of the crisis were never addressed. The lines between depository institutions and securities firms, erased in the U.S. by the final repeal of the Glass-Steagall Act in 1999, were not restored and the U.S. Financial Accounting Standards Board’s (FASB) mark-to-market rule was never reinstated.

Although bank capital ratios have improved, leverage remains excessive, bank balance sheet assets remain troubled and economic conditions have deteriorated compared to the pre-crisis period. Banks deemed “too big to fail” in 2008 have become bigger and the gross credit exposure associated with high risk OTC derivatives is roughly as large as it was before the financial crisis. By the end of 2013, the Federal Reserve’s balance sheet will have exceeded $3.4 trillion. At the same time, the U.S. federal government faces a so-called “fiscal cliff.”

The Road to Stagflation

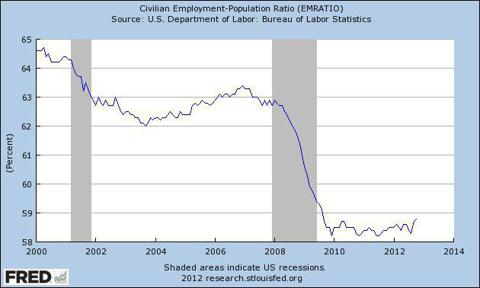

…Despite the recent uptick in U.S. manufacturing, manufacturing currently accounts for only 11.7% of U.S. GDP. In the past few decades, U.S. corporations moved production offshore, eliminating domestic jobs. Credit expansion masked the lost income of U.S. consumers, but the process inexorably reached its logical conclusion in 2007. The shift of U.S. workers to often lower paying service sector jobs was counterproductive because debt levels rose while income flowed out of the U.S. following on the heels of jobs.  (Click to enlarge) Civilian Employment-Population Ratio (EMRATIO), Federal Reserve Bank of St. Louis, One Federal Reserve Bank Plaza, St. Louis, MO 63102 U.S.A.

(Click to enlarge) Civilian Employment-Population Ratio (EMRATIO), Federal Reserve Bank of St. Louis, One Federal Reserve Bank Plaza, St. Louis, MO 63102 U.S.A.

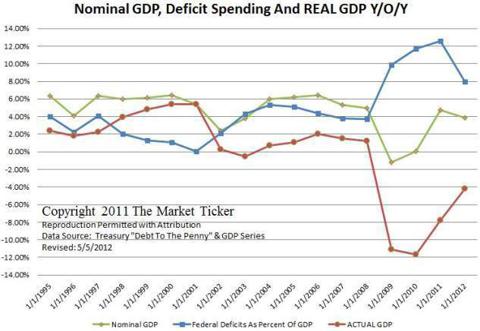

…Although the financial system has continued to function due to massive infusions of liquidity, economic activity, with some exceptions, has not generally recovered or has continued to deteriorate, e.g., the shrinking number of U.S. citizens participating in the official workforce. Ignoring improvements in the unemployment rate related to the shrinking size of the workforce, much of the U.S. economic recovery in the post crisis period can be attributed to government deficit spending.  (Click to enlarge) Karl Denninger, The Market Ticker Commentary on The Capital Markets, http://market-ticker.org/

(Click to enlarge) Karl Denninger, The Market Ticker Commentary on The Capital Markets, http://market-ticker.org/

U.S. GDP has been boosted by government deficit spending in excess of $1 trillion per year. Removing the temporary effects of extraordinary deficits, U.S. GDP remains negative. Compounding the problem, loose monetary policies, rather than spurring lending to consumers or small businesses, have created inflationary pressures and have led to stagflation.

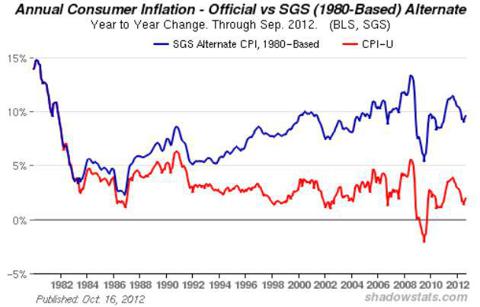

Rather than putting Americans back to work, inflationary policies have helped to push prices higher. Based on U.S. Consumer Price Index (CPI), the official inflation rate in the U.S. is roughly 2%, but the CPI does not accurately measure the cost of maintaining a constant standard of living. Using the same methodology as in 1980, the CPI should be 9.3% currently.  (Click to enlarge) Shadow Government Statistics, American Business Analytics & Research LLC, http://www.shadowstats.com/

(Click to enlarge) Shadow Government Statistics, American Business Analytics & Research LLC, http://www.shadowstats.com/

Inflationary central bank policies support government borrowing and the banking system, but increased liquidity resulting from low interest rates, central bank asset purchases or debt monetization can have destabilizing effects.

- Excess liquidity can result in price inflation, fuel financial speculation or asset price bubbles, or provoke competitive devaluations (currency wars).

- Asset purchases and debt monetization by central banks alter the distribution of money, thus of purchasing power over the economy and therefore redistribute wealth.

- Monetary inflation erodes the value of savings replacing genuine capital distributed throughout the economy with credit concentrated in banks. In the U.S., one of the Federal Reserve’s policy assumptions is that asset purchases will help small businesses by making more credit available. While it is true that small businesses rely on bank credit for operations and expansion, it is savings, not credit that fuels small business creation and therefore job growth.

Since most U.S. jobs are in small businesses, QE3 and similar policies destroy jobs by redistributing wealth from savers, entrepreneurs and investors to banks and stifling new business creation. The combination of reduced new business creation, continuing high unemployment and inflationary price pressures, set against a backdrop of high debt levels, precisely defines stagflation.

Reign of Repression

The stagflationary environment in the U.S. is a mild example of financial repression. Countries in the European periphery, e.g., Greece, Italy, Spain, Portugal and Ireland, where high taxes and austerity measures are already in place, are more pointed examples. In the case of Greece, which has descended into an economic depression, the natural market outcome would have been a Greek default and an exit from the European Monetary Union (EMU) accompanied by losses for European banks and quite probably a number of European bank failures, along with the systemic impact of associated OTC derivatives, such as Credit Default Swaps (CDS). To prevent bank losses and failures, however, policy decisions replaced market outcomes. The normalization of market interventions, direct government control over the economy and ongoing monetization by central banks represented a transition from a market based status quo to a policy based status quo which maintained or increased otherwise unworkable government debt levels. Maintaining the status quo, however, requires financial repression.

Like the emergency measures that preceded it, financial repression has become a fixture in a new economic paradigm, but it is no more likely to provide a permanent solution. Financial repression will remain in place as long as bank failures and sovereign defaults continue to be prevented, e.g., through bailouts, asset purchases or debt monetization by central banks. Overall economic conditions in Western countries can, therefore, be expected to remain stagnant or to deteriorate. The continued debasement of major currencies, such as the U.S. dollar and the euro, will reduce the real value of debts, but monetary inflation cannot create a genuine economic recovery as long as bank balance sheets and government finances remain impaired. Without robust economic growth, however, both the banking system and the finances of Western governments certainly will remain impaired. In other words, financial repression in the U.S. and in Europe is set to remain in place indefinitely.

Under an ongoing regime of financial repression:

- savings,

- jobs,

- economic opportunity and

- living standards

will all suffer

In addition,

- the middle class will be reduced as generations of socioeconomic progress are gradually reversed,

- younger people, mired in stagflation, will be left behind in terms of income and economic opportunity, which will have a long-term negative impact,

- income disparity and the concentration of wealth will increase since U.S. banks stand to profit from financial repression. The destructive forces set in motion by financial repression will greatly increase the burden on government social welfare programs.

Conclusion

Financial repression will fail to alleviate government debt unless tax increases and austerity measures follow which could turn the United States into another Greece.

- Taxmageddon: 2013 Will be a Disaster Regardless of Who Wins! Here’s Why

- Financial Repression: How Sneaky Governments Steal Your Money

- The U.S. and Greece are Frighteningly Similar! Here’s Why

In theory, financial repression, together with other measures, can liquidate government debt but, in practice, it is a destructive and highly destabilizing approach that will result in a net loss of wealth to society.

*http://www.heraresearch.com/image/HRN_20121114_Why_Financial_Repression_Will_Fail.pdf

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. “This Time is Different: Eight Centuries of Financial Folly” – A Book by Reinhart and Rogoff

Highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked. Words: 1264

2. “Financial Repression” May Soon Become Our Worst Nightmare! Here’s Why

A new financial policy initiative known by the label “Financial Repression” may soon become our worst nightmare. ‘Repression’ rhymes with ‘depression’ which could be what we have to look forward to as rampant price inflation and permanently lower living standards take hold. Get ready to be conscripted into a citizen army assembled for the greater cause of saving the nation from being swamped by a tsunami of debt. Let me explain. Words: 1585

3. Taxmageddon: 2013 Will be a Disaster Regardless of Who Wins! Here’s Why

“Regardless of whether or not you feel taxes need to be raised, a big set of tax hikes is scheduled to happen. To be sure, some of those hikes will be undone in compromises, but many if not most will sneak through.” [Let me explain.]

4. Financial Repression: How Sneaky Governments Steal Your Money

One of the things that’s being lost in the welter of rhetoric around the debt crises of sovereign nations is that these are not normal debtors, and government debt is not the same as personal debt. If you or I are in debt we are obliged to fulfil the terms of our repayment obligations or to go bankrupt or to pretend to die and go off and live on the life insurance. A country in the same situation has a range of other measures available to it…[Let’s explore their options and what their implications would be for the country and its citizens.] Words: 1145

5. Stealth Taxation in the Form of Financial Repression is Coming! Here’s Why – and How

Financial Repression is a form of wealth confiscation and redistribution that is in some ways as effective as taxation – but the government never directly calls it that. It never appears in the budget (directly), and while it is dependent on a comprehensive network of laws and regulations – none of those go through the legislature with a stated intention of creating Financial Repression. So while the economic net effects are similar to a huge and comprehensive set of investor taxes being used to pay down the national debt, the “taxes” are never a campaign issue because voters and investors don’t understand what is happening – they only feel the results. [In this article I lay out for you what is slowly developing and expected to escalate dramatically in the next few years.] Words: 5800

6. John Hathaway: Financial Repression to Continue Even Under the Most Optimistic Scenarios

“In our view, monetary policy has been boxed in by previous actions, election year politics (and even more broadly by the dynamics of the contemporary state of democracy), and the slowdown in global forex accumulation. The result, we expect, will be a continuation of financial repression under the most optimistic of scenarios. At the very least, returns on liquid capital could remain negative for many years to come. Under such circumstances, demand for the protection offered by gold should remain strong. Should the presumed economic recovery falter, we anticipate that the calls for renewed QE will be deafening.”

7. Internationalize to Keep Your Assets Safe From Your Out-of-control Government – Here’s How

The politicians will do whatever they find convenient, because there is no longer anything to stop them – not an electorate that is jealous of its freedoms and certainly not the Constitution, which is now just a playhouse for judicial imagineering. No one can know what’s coming next from the government and the financial system it has fostered, but for many of us there is an awful suspicion that we are not going to like it. Most Americans still have yet to stick a single financial toe across the border, but more and more are considering it [and in this article I outline 10 ways to internationalize your assets to provide you with some much needed protection as the future unfolds.] Words: 392

8. The U.S. and Greece are Frighteningly Similar! Here’s Why

The inability [of Congress] to reduce spending and tax its citizenry represents a competitive disadvantage for the U.S.. It is the mark of a country that cannot keep its fiscal house in order, does not care about repaying its debts and, [as such, it] may well be heading for collapse. Words: 978

9. Get Ready to be Financially Conscripted – and Face a Lower Standard of Living!

Get ready to be financially conscripted into a citizen army assembled for the greater cause of saving America from being swamped by a tsunami of debt as a new policy initiative known as “financial repression” takes hold. ‘Repression’ rhymes with ‘depression’ and that is what we may have to look forward to as rampant price inflation and permanently lower living standards take hold as a result. Let me explain. Words: 1797

10. U.S. “Deficit Disorder” Means Broken Promises + Even More QE! Here’s Why

11. Monumental Change is Coming for Most Americans – Here’s Why

A monumental change is coming, and for most Americans, it will be painful—especially for the unprepared. [Let me explain just what is happening, why it can not go on as is and what we can likely expect in the future.] Words: 1144

12. Attention America! Your Surging Debt Will Eventually Suffocate You

Our empirical research ( Growth in a Time of Debt) on the history of financial crises and the relationship between growth and public liabilities shows that burdens above 90% are associated with 1% lower median growth – and the United States’ debt level is currently hovering around 90% on a gross basis and 60% netting out assets. Politicians like to argue that their country will expand its way out of debt but our historical research suggests that growth alone is rarely enough to achieve that…[given] the debt levels we are experiencing today…[As such,] we need to be cautious about surrendering to the “this-time-is-different” syndrome and decreeing that surging government debt isn’t as significant a problem in the present as it was in the past. [Let us explain why.] Words: 1175

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I think, “Financial Repression” actually describes the current Financial Civil War that exists between the Wealthy that control the Government and the “new poor” that are being controlled by them. Those in Power want to stay in Power and to do so without taxing themselves, they must put the squeeze on the rest of the US (no pun intended). This simple concept describes perfectly what is happening today and I challenge anyone to offer a different interpretation of the following examples:

1. Saying the current COLA is 1.7% is a sham because it is about one quarter to one-fifth of the current increase that most are now paying for their basic necessities.

2. Seniors cannot ReFi their own homes because they have no job income (because they are retired) and are being prevented from cutting their mortgages in half, which locks them into they’re existing mortgages.

3. Big Banks are getting Fed money at almost zero interest, yet home ReFi rates are still close to 3% or more, which is outrageous, since the Banks themselves are paying almost no interest on savings accounts!

4. Since Social Security + Medicare, + Medicaid COMBINED are ONLY 6% of the 2013 Recommended Discretionary Spending, while the DHS budget is now a bit less than 4.5% and the Military budget is OVER 60% (and that does not add in all the secret or “Black” programs)! Attacking Social Security, Medicare and Medicaid are nothing but a cheap shot at all those that have the least ability to defend themselves.

Until our Leaders realize that they not the “masses” are the cause of this Fiscal War against the “New Poor,” we will continue to wallow in ever more massive debt which only makes things worse for the 99%.

Since most of our Leaders are beholden to those Wealthy supporter that got them elected, I see the only two things that can create real change in the USA, and it may even end up being both; they are:

1. National Referendums to:

A. Dramatically increase the tax on the Ultra Wealthy.

B. Repeal the SCOTUS decision allowing Corporations to donate

massive amounts of money, which has “punked” our Political

system.

C. Eliminate all “off shore” tax havens for the rich.

D. Change tax code so that the Gov’t can “look back” and penalize.

2. One or more Wars, so the military Complex can justify itself to all the people that must support their huge percentage of “our” Budget.

Expect to see massive “Fiscal Flight” as those who are Ultra Wealthy relocate to Countries that will tend to better protect them and their holding from taxation, leaving behind nothing but debt and joblessness.