The closing of the gold window back in August 1971 has led governments  worldwide to create endless amounts of worthless paper money and the resulting credit bubble has created a world debt exposure of over US$ 1 quadrillion (including derivatives). It has also created perceived wealth for big parts of the world’s population – a wealth which is only backed by promises to pay and by grossly inflated assets. Few people realise that this wealth is totally illusory and will implode considerably faster than the time it took to create it. [Let me explain.] Words: 890

worldwide to create endless amounts of worthless paper money and the resulting credit bubble has created a world debt exposure of over US$ 1 quadrillion (including derivatives). It has also created perceived wealth for big parts of the world’s population – a wealth which is only backed by promises to pay and by grossly inflated assets. Few people realise that this wealth is totally illusory and will implode considerably faster than the time it took to create it. [Let me explain.] Words: 890

So says Egon von Greyerz (www.goldswitzerland.com) in edited excerpts from his original article* entitled Gold & Silver Off to the Races.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

von Greyerz goes on to say, in part:

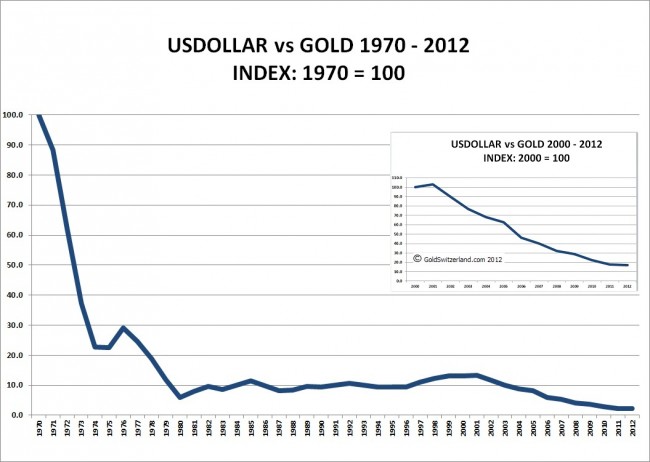

Gold reveals governments’ deceitful actions in destroying the value of paper money and the wealth of nations. Western governments dislike gold because gold tells the truth and the truth is that since August 1971 the US dollar has declined 98% in real terms [as can be seen in the graph below].

Before this debt cycle comes to an end in the next few years, the dollar and most major currencies are likely to finish their move down against gold and lose 100% of their value. Since 98 % has already been lost in the last forty-one years, there is really not far to go.

The final fall of currencies will be as a result of the unlimited money printing that governments will embark upon in the next few months in order to endeavour to “save” the world economy. Money printing, however, does not save anything, it just exacerbates the situation. You can never become debt free by issuing more debt and you cannot create prosperity with worthless pieces of paper.

The system is bankrupt

There has never before been a time in history when most sovereign nations are bankrupt and when the financial system only survives due to false accounting (banks are allowed to value worthless toxic debt at maturity value rather than market value) so, sadly, we are now likely to start the next phase in the world economy which is a hyperinflationary depression.

Hyperinflation arises as a result of money printing which leads to the currency collapsing. Whilst the price of most goods and services go up dramatically with hyperinflation, most of the assets that were financed by the credit bubble like stocks, bonds and property will collapse in real terms i.e. against gold.

Europe vs the USA

For the last couple of years, all the focus has been on the travails of the Eurozone countries. The Eurozone individual members’ dilemma is that, unlike the USA, they cannot print money. German political pressure stops that country from printing money for the Greeks to retire at 55 or to support the Spanish banks from collapsing. Germany is in a massive dilemma because if they contribute to the Eurozone’s money printing, they will increase their exposure and throw good money after bad. Also, it would be unacceptable politically. If they don’t print, however, the German government and banks are likely to lose in excess of €1 trillion which is their total exposure to the weaker European economies. Thus a virtual lose – lose dilemma for Germany awaits.

The focus on the Eurozone countries will soon move West across the pond. Virtually every important economic figure in the USA is worse than in Europe:

-

Both US debt to GDP and budget deficit to GDP are worse than Spain’s – and Spain is seen as a basket case.

-

Real US unemployment (23%) is also much worse than in most European countries.

-

Also, if toxic debt and derivatives are included, US bank balance sheets are looking very sick. JP Morgan alone has a $100 trillion derivative exposure. And we know how quickly derivatives become worthless with JPM’s latest $6 billion write off.

-

In addition, the US annual federal deficit is likely to remain in the trillions for many, many years to come.

These amounts dwarf anything happening in Europe.

Shangri-La or Ponzi Scheme

As the focus shifts to the USA during the autumn:

-

there will be pressure on the US dollar which eventually will put strong upward pressure on interest rates. The free money bonanza with zero interest rates will come to an end with US rates (and others) soon starting their journey to double figures.

Governments and central bankers must have thought that they had invented a financial Perpetuum Mobile. First you set interest rates at zero and then you print and borrow unlimited amounts of money since it is all free. This way we can all experience Shangri-la. But sadly, governments have not reinvented paradise but only been busy creating a fraudulent Ponzi scheme and, like all Ponzi schemes, this one will also collapse creating worldwide social and economic misery for many generations to come.

Gold and Silver breaking out

Physical precious metals, as well as PM stocks, will continue to reflect the destruction of paper money…Gold and silver have now started a major move to the upside. This move will be relentless with only minor corrections before we reach $4,500 to $5,000 in gold and substantially over $100 in silver.

Conclusion

Investors now have a last chance to invest in gold and silver at prices which will never be seen again. For wealth preservation purposes, however, it must be physical metals and it must be stored outside the fragile banking system.

*https://goldswitzerland.com/gold-silver-off-to-the-races

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. von Greyerz: Gold Going to $3,500-$5,000 in 12-18 Months – and $10,000 Within 3 Years!

There will be a catalyst coming soon, probably some concerted action of money printing between the Fed, IMF and the ECB. That will happen as a result of the economies, worldwide, collapsing….The catalyst could come from anywhere but the money printing will be part of the next move in gold, that’s for certain….[and it] will lead to collapsing currencies, and investors buying gold at any price…I see gold reaching $3,500 to $5,000 in the next 12 to 18 months. Within 3 years, I see the gold price reaching at least $10,000

The Western world is going to need even more easing, more money. All of this is incredibly bullish for gold longer-term. I do think you have to navigate the end of the euro before the next massive move in gold, but that’s coming. It’s possible that gold may get hit initially as the euro fails, but you have to buy it if it does.

3. Goldrunner: Price Target of $10,000 to $12,000 for Gold Still Holds

My Fractal Gold chart work is a direct comparison of Gold, today, to the late 70’s Gold Parabola. Thus, “timing” is taken directly from the late 70’s cycle, with price targets created from a combination of the late 70’s Gold price and different technical analysis techniques. We developed a price target back in 2006/ 2007 for Gold to reach the $10,000 to $12,000 range during this Gold Bull and we still stand by that forecast. Let me explain where we are at this point in time.

4. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

5. 50+ Analysts Project Gold to Reach $5,000 – $6,000 by Late 2014 or Early 2015

More than 50 analysts have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 600

6. Alf Field: Gold STILL Targeted to Reach $4,500 – Preceded By Violent Upside Action

We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085

7. Goldrunner: Silver to Rocket to $60 – $68 and Then Much Higher

Personally, based on the fundamentals at hand and the fact that Gold doubled its log channel around this point in the cycle; I expect Silver to bust up out of its log channel in 2013. Initially, I look for Silver to reach the $60 to $68 level, first and hold open the possibility for Silver to do much more on the upside as the 70’s Silver Chart reflects.

8. Alf Field Sees Silver Reaching $158.34 Based on His $4,500 Gold Projection!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money