Europe is heading into a full-scale disaster [because,] you see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The European banking system’s leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing. This is not a question of “if,” it is a question of “when” and it will very likely happen before the end of 2012. Words: 750

problems in Europe are not simply related to Greece. They are SYSTEMIC. The European banking system’s leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing. This is not a question of “if,” it is a question of “when” and it will very likely happen before the end of 2012. Words: 750

So says Graham Summers (www.gainspainscapital.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Summers goes on to say, in part:

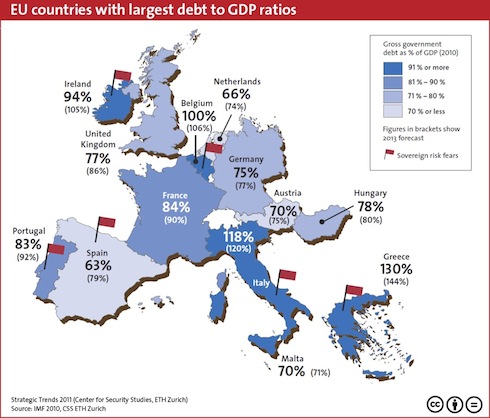

The chart below shows the official Debt-to-GDP ratios for the major players in Europe and, as you can see, even the more “solvent” countries like Germany and France are sporting Debt-to-GDP ratios of 75% and 84% respectively. These numbers, while bad, don’t account for unfunded liabilities – and Europe is nothing if not steeped in unfunded liabilities.

Let’s consider Germany: According to Axel Weber, the head of Germany’s Central Bank, Germany is, in fact, sitting on a REAL Debt-to-GDP ratio of over 200%. This is Germany – with unfunded liabilities equal to over TWO times its current GDP. (To put the insanity of this into perspective, Weber’s claim is akin to Ben Bernanke going on national TV and saying that the U.S. actually owes more than $30 trillion and that the debt ceiling is in fact a joke.)

What’s truly frightening about…[the situation in Germany] is that Weber is most likely being conservative here. Jagadeesh Gokhale of the Cato Institute published a paper for EuroStat in 2009 claiming Germany’s unfunded liabilities are in fact closer to 418%!

…Germany has yet to recapitalize its banks….[and, by] the German Institute for Economic Research’s OWN admission, German banks need 147 billion Euros’ worth of new capital. To put [that] into perspective the TOTAL EQUITY at the top three banks in Germany is less than 100 billion Euros – and this is GERMANY we’re talking about: the supposed rock-solid balance sheet of Europe. How bad do you think the other, less fiscally conservative EU members are? Think BAD, as in systemic collapse bad.

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

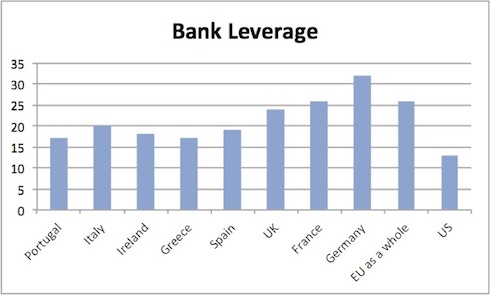

Indeed, let’s consider TOTAL debt sitting on Financial Institutions’ balance sheets in Europe. The below chart shows this number for financial institutions in several major EU members relative to their country’s 2010 GDP.

As you can see, financial institutions in Germany, France, Italy, Spain, the UK, and Ireland are all ticking time bombs. Indeed, taken as a whole, European financial institutions have more debt than Europe’s ENTIRE GDP.

Let’s compare the situation…[in Europe] to that in the U.S. banking system:

- Taken as a whole, the U.S. banking system is leveraged at 13 to 1….

- The European banking system is leveraged…at over 26 to 1. That’s the ENTIRE European Banking system leveraged at near Lehman levels (Lehman was 30 to 1 when it collapsed).

To put this into perspective:

- with a leverage level of 26 to 1, you only need a 4% drop in asset prices to wipe out ALL capital.

- What are the odds that European bank assets fall 4% in value in the near future as the PIIGS continue to collapse?

- These leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers.

- Again, I’m talking about Europe’s ENTIRE banking system collapsing.

- This is not a question of “if,” it is a question of “when” and

- it will very likely happen before the end of 2012.

- [Why? Because there] is a HUGE percentage of European bank debt that needs to be rolled over by the end of 2012 [as can be seen in the graph below].

I trust at this point you are beginning to see why any expansion of the EFSF or additional European bailouts is ultimately pointless: Europe’s ENTIRE BANKING SYSTEM as a whole is insolvent. Even a 4-10% drop in asset prices would wipe out ALL equity at many European banks.

Conclusion

On that note I believe we have at most a month or two and possibly even as little as a few weeks to prepare for the next round of the EU Crisis.

*http://gainspainscapital.com/?p=1829 (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Americans Take Note: European Crisis is Adversely Affecting U.S. in MAJOR Way – Here’s Proof

Americans, don’t think for one moment that the crises in Europe are irrelevant! This past April the U.S had the largest monthly decline in exports to Europe in the past 7.5 years and this trend will only get worse – much worse – as the crises spread and linger. Exports to Europe are now down 2.7% from April 2011, the first yearly decline since February 2010. The chart below says it all.

2. The Eurozone Crisis: A Quick Guide to Key Dates, Developments and Investment Implications

Follow the eurozone crisis as it unfolds with this quick guide to key dates, developments, and investment implications.

3. IMF’s Lagarde Warns: European Leaders Have 3 Months to Save the Euro!

As the focus of the euro crisis shifts to Italy, IMF head Christine Lagarde has warned that European leaders have less than three months to save the euro. Meanwhile top economist Nouriel Roubini has called on Berlin to drop its obsession with austerity, proposing that the German government give every household a 1,000 euro [$1,250 US equivalent] voucher to spend on a vacation in Southern Europe. Words: 990

4. PMI Data From Europe Shows Business Activity at Lowest level Since 2008/9 – What’s Next?

The Markit PMI data from Europe shows still more deterioration led by France, Italy, and Spain. Let’s take a look at a few countries.

5. European Union Will Collapse Before the End of 2012: This is NOT Doom & Gloom – This IS Reality!

[The European Union] will collapse before the end of the year and very likely before the end of the summer. When this crisis hits it will be worse than 2008 and the world Central Banks will not be able to control the damage. What makes this time different are several items: [Let me explain]. Words: 14006. The Euro System is Doomed and the End Will Look Like This

In every economic crisis there comes a moment of clarity. In Europe soon, millions of people will wake up to realize that the euro-as-we-know-it is gone. Economic chaos awaits them. [Let us explain why that is the case and how it will come about.] Words: 680

7. Here’s the “No BS” Situation with Europe – and Its BAD!

The media is rife with misrepresentations and analysis of the EU. Here’s the real deal, no BS situation with Europe – and its BAD! Words: 900

8. Why & How the Euro Came About and What the Future Holds

Introduction: “The crisis in the eurozone is the result of France’s persistent pursuit of the “European project,” the goal of political unification that began after World War II [with the hope] that a political union, a United States of Europe similar to America’s, would…prevent the types of conflict that had caused three major European wars…[and] also make Europe a power comparable to the United States, and thereby give France, with its sophisticated foreign service, an important role in European and world affairs.” [What went wrong and what does the future hold?]

9. Simone Foxman: “The Eurozone Crisis For Dummies”

Worries about an economic catastrophe in Europe are heating up again, and dramatic forecasts about doom are popping up everywhere. What’s important? How did we get here? Let’s put this all in perspective. Words: 2356

10. Nigel Farage: The Only Way to Avoid a Depression Is a Break Up of the European Union

We still don’t have many political voices [in the European Union] that have the courage to say, ‘We’re headed for the rocks, and before we hit the rocks, let’s take a different course. Let’s try to break this thing up peaceably, before it ends in disaster….The establishment always supports the status quo…but actually, I think the only way we can avoid a depression is to break this (the EU) up.

11. Graham Summers: Collapse of Europe is Guaranteed! Here’s Why

I continue to see articles in the media claiming that Europe’s problems are solved. Either the folks writing these articles can’t do simple math, or they don’t bother actually reading any of the political news coming out of Europe [so let me present 3 data points that guarantee Europe will collapse at some point in the near future]. Words: 722

12. Kunstler: Wake up, Sleepyheads! Things are Heating Up

Europe may soon be choking on that plat du jour of government a la Hollandaise with the side of chopped Greek salad. The whole world, in fact, has got something like a giant hairball stuck in its craw. The hairball is composed of filaments of lies wound over a core of supernatural indebtedness. The lies are promises that the debt will be paid back. Words: 710

13. Germany Could Initiate the Collapse of the European Union Within Months – Here’s Why

As many of you know, my primary forecast regarding Europe is that the EU will be broken up and/or collapse within the coming months. The reasons for this are financial, monetary and political in nature [with much of the latter dependant on what happens in Germany. Let me explain.] Words: 516

14. Europe is Heading Off a Financial Cliff! Here’s Why & How to Protect Your Portfolio

Europe is heading off a cliff! From one end of the continent to the other, the numbers suggest a double-dip recession is striking with brutal force…and with the world as interconnected as it is these days, what happens in Europe WILL impact our companies and markets here so now is the time to position your portfolio to weather the storm. Words: 900

15. This Picture of European Economic Reality is Worth 26,911 Words – Take a Look

The European economic situation is explained very simply in the illustration below. Take a look.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money