Part of being a good contrarian investor is constantly looking beyond your investment “comfort zone” and trying to find less-followed opportunities… [and the Canadian stock market represents just such an] opportunity. Here’s why. Words: 465

investment “comfort zone” and trying to find less-followed opportunities… [and the Canadian stock market represents just such an] opportunity. Here’s why. Words: 465

So says Tom Essaye (www.moneyandmarkets.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Essaye goes on to say, in part:

Canada has often been overshadowed by its much larger neighbor, the United States, yet things in the land to our north have quietly been picking up. Let me give you three reasons why …

#1 — Strong banks

Canadian banks are some of the best run and well capitalized in the whole world. The banking crisis that hit the U.S. and just recently Europe never hit the Canadian banks! So from a safety standpoint, Canada is one of the best investment destinations in the world.

#2 — Strengthening economy

From an economic growth perspective, the Canadian economy has recently been showing signs of strength — as evidenced by the fact that just two weeks ago, at the Bank of Canada interest rate decision meeting, Governor Mark Carney said that the Canadian economy is doing better than expected, so good in fact that the Bank of Canada (BOC) may have to become the first major central bank to begin raising interest rates later this year. That screams bullish opportunity for the contrarian investor!

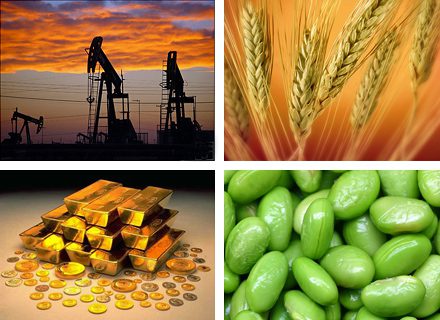

#3 — Abundant resources

Much of Canada’s economy is focused on natural resource demand and, with oil, gold, and silver prices all solidly positive for the year, and economic demand inching higher in the U.S., there are bullish prospects for the Canadian economy. They have even increased trade relations with China this year [Read: Chinese Trade Agreement Bullish for Canadian Mining & Energy Companies – Here’s Why], opening up a potentially huge market for energy, uranium and base metal export.

With all this bullishness, you’d think the Canadian stock market would be soaring year-to-date but as you can see in the chart below, it’s quite the opposite …

As of the end of April, the Canadian market was up less than 4 percent, not even half of the U.S. markets performance….I think this weakness in the Canadian market presents an opportunity!

Automatic Delivery Available! If you enjoy this site and would like every article sent to you automatically then go HERE and sign up to receive FREE Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

One way to take advantage of this opportunity in Canada is through the iShares MSCI Canada Index ETF (EWC). This exchange traded fund gives you broad, diversified exposure to some of the largest Canadian companies on the market.

Conclusion

Remember, being a contrarian investor requires that you always keep one eye on what the market is focused on, and one eye on areas the market is ignoring. That’s a virtual sure-fire strategy to get you ahead of the crowd and positioned for big potential opportunities.

*http://www.moneyandmarkets.com/attention-contrarian-investors-canada%e2%80%99s-screaming-opportunity-49569 (To access the articles please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Chinese Trade Agreement Bullish for Canadian Mining & Energy Companies – Here’s Why

While the world has been consumed watching the geo-political events unfolding in Europe and the Middle East, China and Canada have entered into a major trade agreement which should be long-term bullish for Canadian mining, energy and transportation companies. [Let me explain what is unfolding.] Words: 585

2. Why You Should Invest in These Three “Super Currencies” of Tomorrow – and How

There is a trio of currencies that you must include in your portfolio today because they operate on an entirely different playing field than the U.S. dollar and the euro and, as such, are set to undergo huge revaluations in the coming months. Without further ado… Words: 855

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money