With most of the world’s major economies as well as the financial system bankrupt…most people will rely on governments and central banks to save us but how can anyone possibly believe that totally incompetent and clueless politicians and central bankers could solve the problem they created in the first place… The main objective of governments is to stay in power and thus to buy votes, therefore they are incapable of taking the right decisions and the opposition, aspiring to power, is even less suitable since they will lie through their teeth and promise the earth in order to be elected. So what is the solution? Read on! Words: 2391

central banks to save us but how can anyone possibly believe that totally incompetent and clueless politicians and central bankers could solve the problem they created in the first place… The main objective of governments is to stay in power and thus to buy votes, therefore they are incapable of taking the right decisions and the opposition, aspiring to power, is even less suitable since they will lie through their teeth and promise the earth in order to be elected. So what is the solution? Read on! Words: 2391

So says Egon von Greyerz (www.goldswitzerland.com) in edited excerpts from his original article* Deus ex Machina.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The report’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

von Greyerz goes on to say, in part:

Ludwig von Mises said,

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final or total catastrophe of the currency system involved.”

and he was absolutely correct: “There is no means of avoiding a final collapse of a boom brought about by credit expansion”. Whatever politicians, bankers, economists or others experts say, there is no solution to this crisis. We have reached the end of the road and are now staring into the abyss.

The credit manufacturing system that started in 1913 when the Fed was founded, began its terminal phase in 1971 when Nixon abolished gold backing of the dollar. It has been clear to us for at least 20 years that the outcome was inevitable. It was never a question of “if” but only “when” it would happen. It is now clear to us that the false prosperity that the world has experienced by printing unlimited amounts of money will very soon come to an end. Thus the “if” and “when” conditions are now satisfied so the remaining question is HOW?

To try to answer this let’s return to Mises: “The alternative is only whether the crisis should come sooner as a result of voluntary abandonment of further credit expansion.” To stop the money printing and credit creation would be the only sensible way of ending the failed quasi-capitalist, socialist experiment which is in the process of destroying the structure of the Western world.

For almost 100 years we have lived on a system based on debt which has created a false prosperity as well as false values. The transfer of capital from private enterprise to government by massive taxation is approaching 50% in many countries (see table below). The average for 18 industrialised countries is almost 40%. This means that on average 40% of the productive economy is transferred to a non-producing entity (government) which wastes most of the money in the process of redistribution. Not only that but, since the state has taken over up to 50% of the economy in these countries, the desire to work, to strive, to take risk and to invent has been taken away from a major part of the population.

For a great many people it is now totally natural to rely on the state for their needs rather than on themselves – and the state needs to borrow/print ever increasing amounts to perpetuate this economy based on an illusion. This situation is totally untenable. Since any additional money printing will only exacerbate the crisis and make the final collapse so much greater, the swiftest solution would be let the financial system implode now. We need to reset the world to a level which is sustainable.

The consequences of this implosion would be a collapse of the financial system and a reset of debt to zero. Although this is unthinkable to any government or politician, it would be by far the quickest way to get the world back on its feet with no major debts, minimal government interference, and no central bank that can print money. It would be like a forest fire getting rid of all the dead wood. Out of that would rise masses of green shoots in the form of strong unchequered growth. The transition will of course be traumatic and the current generation will experience enormous hardship but not voluntarily abandoning the money printing now will just delay the inevitable and the consequences will be dramatically greater and affect many future generations.

Anyone who has followed my articles will know my view that governments worldwide are totally incapable of stopping the money printing. This is their only means of staying in power and buying votes. Not only that, this is the only method they know. This has been their patent solution to all economic problems in the last decades. Not that this is new in history. Most empires have resorted to diluting the value of money by reducing the gold/silver content of coins or printing paper money. But as far as I know it has never before been done by so many countries simultaneously to such an extent.

www.munKNEE.com

is for sale!

Become the editor/publisher of your very own financial site quickly, easily and inexpensively

Contact: Editor [at] munKNEE.com for details

Since there won’t be any voluntary abandonment of credit creation what will the likely outcome be? Again let’s use Mises words: “…… a final or total catastrophe of the currency system involved”. The problem this time is that we are not talking about one currency or one country. No, we are talking about most of the world’s major currencies.

We have been used to measuring currencies and economies on a relative basis i.e. against each other, but this is a total fallacy since all major currencies have been in a race to the bottom for the last 100 years. Most currencies have lost between 97% and 99% against real money – GOLD – since 1913. Since most currencies have lost 80% or more against gold since 1999, paper money has been a very poor measure of wealth in the last 100 years. Governments are creating credit and paper money and consequently, through their fraudulent actions, “stealing” from the people whilst at the same time increasing the people’s dependence on the state…The people [do] not understand that the value of paper money is declining continuously… but gold reveals [it clearly]. This is why governments do not like gold and try to suppress the gold price.

How will the currency system collapse? The answer to this question is very simple – through endless money printing. There will be no lasting austerity programmes in any country that can print money. Governments are incapable of sticking to austerity measures since in the end that is a guaranteed way of losing power. As power is the main purpose of all governments, they will use any method to retain it. Within the Eurozone, individual countries can…not print money but the ECB and the IMF will take care of that. So whilst world leaders are procrastinating and bickering in G8, G20 and all other “summit” meetings, it is absolutely guaranteed that the final outcome will be one QE package after the next. Governments and central banks know that without limitless money printing there would be a deflationary collapse of the banking system and world economy.

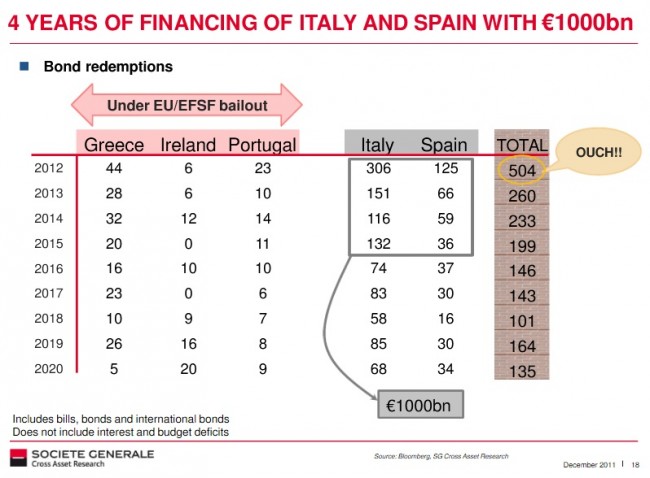

The table below shows the financing requirements of the PIGS countries in the next few years. Just Italy and Spain will require €1 trillion in the next 4 years and, of that, 1/2 trillion Euros in 2012 [alone]. Only printed money will take care of that.

For many years it has been absolutely crystal clear to some of us (sadly a very small minority) that many major sovereign nations are bankrupt as well as the world financial system. Banks are only surviving because they, with the blessing of governments, are allowed to value trillions of dollars of toxic and worthless assets at full value. On top of that, there are more than $1 quadrillion outstanding in derivatives. These are outside the banks’ balance sheets and there are virtually no reserves against them. The banks are netting the value down to virtually nothing and then applying a miniscule reserve against this net amount.

- The netting is only valid when the counterparty pays. When there is a counterparty failure, which is very likely in the coming financial collapse, gross remains gross and the $1 quadrillion remains $1 quadrillion.

- A major part of the derivatives are worthless or not protecting the investors as we have seen with, for example, Freddie Mac, Fannie Mae, Lehmans and, lately, MF Global. MF Global had bought CDs to hedge their investment in Greek debt but they hadn’t understood what they had bought and it turned out it offered no protection at all.

Hyperinflation

The “final or total catastrophe of the currency system” will occur as a result of the QE or unlimited money printing that will very soon start in the EU, USA, UK, Japan and many more countries…[which] will lead to hyperinflation as I have stated for many years. Throughout history, substantial government deficits leading to money creation or printing have always been the cause of hyperinflation because hyperinflation is always the result of a collapsing currency and not of excess demand.

To any thinking individual, it is totally incomprehensible that governments and central banks believe that an insolvent world can be saved by debt issued by bankrupt nations and then bought by the issuers themselves as there is no other buyer. This is the perfect recipe for self-destruction and “total catastrophe of the system.” I don’t think that even Mises envisaged at the time that this could involve a major part of the world rather than just one country. This is why this catastrophe will be unprecedented in world history and have consequences that will affect the world economically, socially and geopolitically for a very long time.

Wealth Preservation – Gold

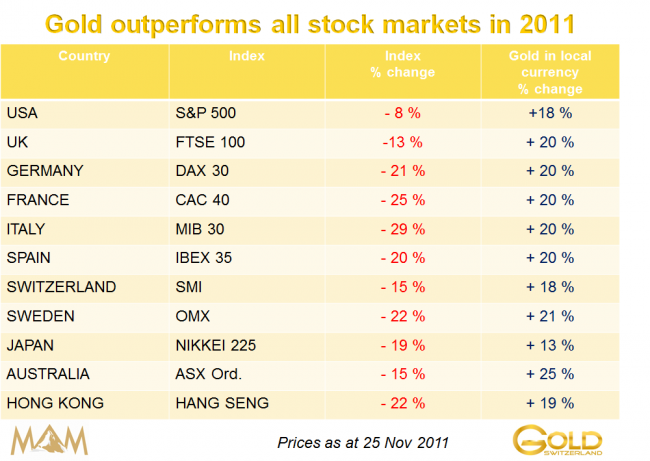

Since 2002 we have advised investors to put up to 50% of their assets into physical gold, stored outside the banking system. [As the table below shows] gold has appreciated between 15% and 20% per annum since 2002 depending on the base currency [while] most stock markets have declined 70-85% against gold in the last ten years. In fact, whilst stock markets are down between 1% and 24% in 2011, gold is up more than 20% against all major currencies. In spite of this most major investor groups (institutional, funds, asset managers or individuals) own no gold…

Stock markets will benefit temporarily from QE but it is still our view that they will fall another 90% against gold in the next few years. The correction in the precious metals [will] likely [soon] be over and we should see the metals going to new highs in 2012.

I had the pleasure of becoming acquainted with Alf Field at the recent Gold Symposium in Sydney where we were both speakers together with Eric Sprott, John Embry and Ben Davies amongst others. Alf is one of the few in the world, if not the only one, who knows how to apply the Elliott Wave principle successfully to gold. Alf’s next intermediate target is at least $4,500 [see my recent edit of said speech in 2 parts entitled Update of Alf Field’s Elliott Wave Theory Based Analysis of the Future Price of Gold and Alf Field is Back! The “Moses” Generation and the Future of Gold] and the ascent to this target could be rapid. That would probably mean a silver price of $150 [see my article entitled History Says Silver Could Become the Next 10-Bagger Investment! Here’s Why on the historical gold:silver ratios and what that means for the future price of silver]. These technical forecasts certainly confirm the fundamentals as outlined in this article.

Conclusion

The world is in a total mess and there is absolutely no solution to this unprecedented crisis. The hyperinflationary depression that we will experience in the next few years will totally destroy the majority of the credit based wealth that has been created in the last few decades. As such, in order to preserve wealth and keep capital intact, it is critical to keep a major part of investment assets in precious metals held outside the banking system…

*http://goldswitzerland.com/index.php/deus-ex-machina-egonvongreyerz/

Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast

Related Articles:

1. Update of Alf Field’s Elliott Wave Theory Based Analysis of the Future Price of Gold

If you concur with the 159 analysts (see below) that maintain that physical gold is going to go parabolic in price in the next few years to $3,000, $5,000 or even $10,000 or more then you should seriously consider buying physical silver. Why? Because the historical gold:silver ratio is so way out of wack that silver should appreciate much more than gold as it goes parabolic in the years to come. Indeed, silver could easily reach $100 – $200 per troy ounce, maybe even $300 and conceivably in excess of $400 depending on how high gold goes. The aforementioned may be hard to believe but an analysis below of the historical price relationship between silver and gold suggests that such will most likely occur if gold does, indeed, go parabolic. Take a look. Words: 1423

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money