The Surprising Truth About the Volatility of Gold and Silver Mining Stocks

The commercial investment industry [- from Wall Street to your personal financial advisor/planner -] is more interested in milking its clients for fees and spreading lies, deception and propaganda than in actually acting to preserve and build their clients’ wealth. In my opinion, “safe diversification” and “less volatile” strategies are nothing but pure absolute rubbish invented by and regurgitated from the mouths of such consultants. [Let me explain and show you some graphs to make my case.] Words: 1680

So says J.S.Kim (http://www.smartknowledgeu.com/) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Kim goes on to say:

The periodic volatility that afflicts gold and silver every year [is based on] two emotions – fear and greed. Financial consultants appeal to clients’ greed to deceive their clients into believing that overvalued stock markets…are really undervalued…[They appeal to their] fear… to keep them out of volatile but profitable asset classes such as gold and silver by selling them on the erroneous principles of beta and by convincing them that increased volatility means increased risk. [As such, they] are able to convince clients to engage in behavior that is a winning proposition for their companies but a losing proposition for their clients.

Global Investment Myths Exposed

1. The Strategy of Diversification

Diversification is nothing but a sales strategy designed by commercial investment firms to arm legions of clueless, incompetent financial consultants with a strategy that helps them pry hundreds of millions of dollars of fees from the checkbooks of wealthy clients. I’ll prove that diversification is nothing more than a sales scam and not an intelligent investment strategy with some cold hard facts at the end of this article.

The belief that volatility is directly correlated with risk seems, on the surface level, like a logical conclusion to draw from volatile assets. If assets rise and fall within several standard deviations of the norm, then massive speculation must be occurring within these asset classes and investors must not be investing in such asset classes based upon fundamental values.

Right? Not necessarily. With gold, and silver in particular, most investors do not consider another possibility behind the volatility that affects these two precious metals – banker manipulation and illegal banker fraud. If one understood that banker manipulation was the largest singular factor responsible for the volatility that afflicts gold and silver every year, then the perception of gold and silver as not only solid investments but as the only acceptable forms of money would gain serious momentum versus its perception among the masses as barbarous volatile relics to be avoided.

Who in the world is currently reading this article along with you? Click here to find out.

In any event, once the investment industry knew that their propaganda campaign of equating volatility with risk had successfully injected this belief into the psyche of investors worldwide, bankers merely began introducing periodic steep bouts of volatility into gold and silver prices as their weapon to convince investors not to purchase precious metals, and instead, to purchase much riskier stocks that traded on the major global stock market indexes.

The fact is that the first necessary step one must take on the road to building wealth is to shed oneself of all the investment beliefs one has learned in school and from the commercial investment industry…

The Gap Between Reality and Perception

While the gap between reality and perception about precious metal markets has closed significantly, a large gap still exists in regard to gold and silver mining stocks due to the decades of misinformation deliberately spread by bankers all over the world…It is my strong belief that Central Bankers that are so preoccupied with trying to suppress the price of gold and silver would not ignore the opportunity to illegally intervene and suppress the price of precious metal mining stocks as well. For example, Central Banks have enlisted the aid of corrupt commercial banks to invent gold and silver derivative products and therefore create massive paper supplies of gold and silver at the same time physical supplies are becoming increasingly scarce. [See here (1) for an article by Sprott on the subject.]

In the chart below we can clearly see the recent underperformance of [ the 16 large-cap] gold and silver mining stock [constituents of the Philadelphia Gold & Silver Index (XAU)] that has led the financial media to inundate the public with declarations that mining stocks, as an asset class, are dead weight and should be avoided at all costs.

However, if you remove the emotion of “fear” from this conclusion and inject the explanation of deliberate banker price suppression schemes executed against mining stocks you might just conclude that the “best in class” mining stocks are grossly undervalued and a great buy this summer season [see here (2), here (3), here (4), here (5), here (6), here (7) and here (8) for other articles on the subject] whether or not the bottom has been put in for the summer, versus the commercial investment industry conclusion that they are dead weight.

[As noted above, the XAU was at] the same level…in mid-June as it was in mid-September of 2010 [yet] despite its flat performance silver had risen 74% higher than its mid-September 2010 $20.44 an ounce price and gold had risen nearly 20% higher than its mid-September 2010 $1,270 an ounce price.

To illustrate that investing in volatile mining stocks need not subject an investor to an emotional roller coaster ride, note the several points [in the chart above] in which I point out that mining stocks were undervalued and in which I point out that they were likely to be hit by the bankers to the downside again…

In conclusion, I hope to impress upon you the following. Bankers deliberately manipulate and introduce volatility into gold and silver mining stocks specifically to:

- Keep people out of these stocks and out of anything gold and silver as they know people equate volatility with risk.

- Induce people to panic sell out of mining stocks during rapid downward volatile periods they create as a mechanism to support their immoral fiat currency banking system.

- Keep people invested in general stock market indexes so they can continue to collect fees even if they end up destroying the wealth of their clients.

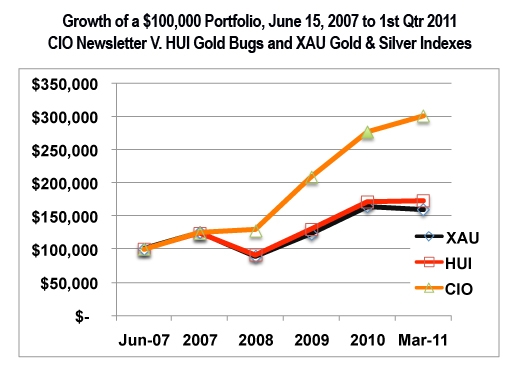

You can also see from the chart below that the volatility of the mining stocks necessitates the use of an active management style – the antithesis of widely accepted and adopted diversification strategies – to optimally benefit from being invested in this asset class. From mid-June 2007 until the end of the first quarter 2011, if one had invested in the HUI Gold Bugs Index or the XAU [read this article (9) for the different bias of each] and had elected to ride out every scary bout of volatility in the past four years, one still would have been rewarded with cumulative returns of 73.18% and +59.71%, respectively, as compared to returns of 13.53%, -10.90% and -22.70% for the S&P 500, the ASX200 and the FTSE100, respectively… [So much for volatility! Indeed, without knowing ] the facts, one might have believed that gold and silver mining stocks had massively underperformed, instead of massively outperformed, the major global stock market indexes in recent years.

Furthermore, incorporate a keen understanding of banker manipulation schemes and the understanding of when to enter and exit gold and silver assets and when it is necessary to ride out volatile periods without panic exiting, and one can easily add a great deal of “extra” performance to even the stellar returns of the HUI and XAU indexes. [For example, the recommendations in my subscription Crisis Investment Opportunities (CIO) newsletter shows above] returned a cumulative +200.96% return (in a tax-deferred account) versus the +59.71 and +73.18% return of the XAU index and the HUI gold miners index, respectively. [For even greater returns than that of the CIO go here (10) to read about the major returns made by long-term gold and silver company warrants over the years.]

Conclusion

If you trust financial consultants with your family’s financial future then continue holding fiat currencies and heeding their propaganda. However, if you lack confidence that the pound, yen, euro and the U.S. dollar will fail to hold their purchasing power over the next decade – a feat that they have failed to accomplish since they were conceived of by Central Bankers – then it’s far beyond the time when you should have started investing in physical gold, physical silver, and best-in-class gold and silver mining stocks [and their associated long-term warrants where available].

I admit that commercial investment industry employees have an amazing capacity to cry wolf for years on end and still maintain the trust of their clients. However, armed with the knowledge of this article, it’s time we all stopped falling victim to their misinformation campaigns.

*http://seekingalpha.com/article/277967-the-surprising-truth-about-the-volatility-of-gold-and-silver-mining-stocks

Titles and Links to Articles Referenced Above:

- Sprott: Shocking Shenanigans in Paper vs. Physical Silver Market https://gos.ixm.mybluehost.me/2011/07/sprott-shocking-shenanigans-in-paper-vs-physical-silver-market/

- It’s Not Time to Buy the Gold Miners – Yet https://gos.ixm.mybluehost.me/2011/06/its-not-time-to-buy-the-gold-miners-yet/

-

Negative Sentiment Suggests Buying Gold & Silver Stocks NOW https://gos.ixm.mybluehost.me/2011/06/negative-sentiment-suggests-buying-gold-silver-stocks-now/

-

NOW is the Best Time to Buy Gold Stocks! Here’s Why https://gos.ixm.mybluehost.me/2011/06/now-is-the-best-time-to-buy-gold-stocks-heres-why/

-

Gold Mining Stocks Are CHEAP Compared to Price of Gold https://gos.ixm.mybluehost.me/2011/06/gold-mining-stocks-are-cheap-compared-to-price-of-gold/

-

July Breach of Gold’s 150-Day MA Would Suggest 22% Rise by Year End https://gos.ixm.mybluehost.me/2011/07/july-breach-of-golds-150-day-ma-would-suggest-22-rise-by-year-end/

-

Gold’s Recent Price Action Suggests Ultimate Top of $5,000/ozt. https://gos.ixm.mybluehost.me/2011/06/golds-recent-price-action-suggests-ultimate-top-of-5000ozt/

-

Gold to Repeat? https://gos.ixm.mybluehost.me/2011/07/gold-to-repeat/

-

Which Index is the Best to Use: the HUI, XAU or the GDX? https://gos.ixm.mybluehost.me/2011/06/which-index-is-the-best-to-use-the-hui-xau-or-the-gdx/

-

Gold & Silver Warrants Index (GSWI) Update https://gos.ixm.mybluehost.me/2011/06/gold-silver-warrants-index-gswi-update/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

Gold

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money