Gold should be soaring with red-hot inflation raging but, instead, it is breaking down..[but] gold’s bizarre decoupling, driven by a parabolic USD surge fueling unsustainable heavy gold-futures selling,…is an extreme anomaly that will prove short-lived…

This version of the original article by Adam Hamilton (zeallc.com) has been edited ([ ]) and abridged (…) by 53% (from 2780 to 1294 words) for the sake of clarity and brevity to provide the reader with a faster and easier read.

As a professional speculator and financial-newsletter writer for the past 23 years, I’m deeply immersed in the markets. I eat, breathe, and sleep trading, watching and analyzing market action all day every day. In such a long span of time, I’ve seen plenty of irrational episodes where prices temporarily disconnect from reality but recent months’ serious gold weakness may take the cake as the most absurd I’ve witnessed!

The Normal Gold-Inflation Dynamic

For millennia, gold has proven the greatest investment in inflationary times of monetary debasement. Its supply growth from mining is very-slow, constrained naturally by the rarity of economic gold deposits and the decade-plus timelines necessary to bring them to production so when governments irresponsibly expand their money supplies at excessive rates, gold prices surge to reflect those depreciating currencies.

Relatively way more money is suddenly available to compete for relatively much less gold, bidding up its price levels and the higher gold powers, the more investors want to chase it accelerating its upside. This logical gold-inflation dynamic has fueled legendary gains during past inflation super-spikes…[For example:]

- from June 1972 to December 1974, headline year-over-year US Consumer Price Index inflation soared from 2.7% to 12.3%. During that 30-month span, conservative monthly-average gold prices blasted up an amazing 196.6%!

- from November 1976 to March 1980, the YoY CPI prints skyrocketed from 4.9% to 14.8%…[and,] over that 40-month inflation super-spike, gold shot parabolic with a stupendous 322.4% gain in monthly-average-price terms from trough to peak CPI!

As the world’s aboveground gold supply is way bigger now than during the 1970s, gold probably won’t nearly triple or more than quadruple again in this first inflation super-spike since then, but surely it ought to at least double with red-hot inflation raging out of control.

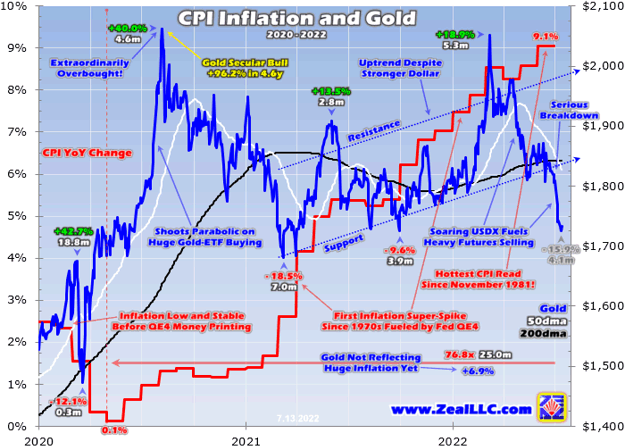

Today’s…[inflation] – the result of the Federal Reserve flooding the world with a colossal deluge of new US dollars in recent years…to compete for, and bid up, the prices on far-slower-growing goods and services – is soaring. Just this week the latest June CPI print blasted up 9.1% YoY, its hottest since November 1981 but monthly-average gold prices have only climbed a pathetic 6.9% in that span!…Clearly gold is not yet reflecting this first inflation super-spike since the 1970s.

CPI Inflation and Gold 2020 – 2022 (ZealLLC.com)

…This current raging inflation is literally unlike anything witnessed since the 1970s…yet gold is acting like the Fed never doubled the US dollars in circulation, like this latest inflation super-spike doesn’t even exist! That’s exceedingly-frustrating for contrarian speculators and investors, as well as students of market history.

Gold’s vexing disconnect from this red-hot inflation is fairly-new though, mostly emerging over just the last several months. During the initial year between March 2021 when the headline CPI first surged over the Fed’s 2% inflation target to March 2022, gold powered 22.0% higher. That way-more-normal behavior for mounting inflationary pressures was a good start. Gold marched higher like it should have in a solid uptrend.

The Impact Of the USD

Gold would’ve fared better in that span, but the US dollar was also strengthening. During that first real year of this inflation super-spike, the leading benchmark US Dollar Index climbed 7.2%. That is counter-intuitive, as inflationary debasement of currencies eroding their purchasing power eventually forces them lower, but the US dollar was bid higher on an increasingly-likely new Fed-rate-hike cycle to fight raging inflation…[and, in addition,] in early May they detailed how they would start unwinding that epic money-supply growth…

Together, that ultra-aggressive rate-hike cycle and big QT made for the most-hawkish Fed pivot by far in its entire century-plus history so currency traders stampeded into the US dollar, further motivated by the weaker euro…Crazy-leveraged currency traders love chasing momentum, so they increasingly piled into the soaring US dollar while dumping the cratering euro. That dynamic triggered gold’s inflation disconnect, which merely started three months ago in mid-April. Gold was still trading way up at $1,977 before the USDX rocketed parabolic and the euro collapsed. Their huge moves since then have been extraordinary and unsustainable.

As of this Monday the USDX had skyrocketed 8.3% in just 2.9 months, an exceedingly-extreme move for the world’s reserve currency. Epic Fed hawkishness fueled that, while helping the competing euro crater a brutal 7.7% in that same span. By major-currency standards, the dollar’s massive rally compressed into such a short timeframe was parabolic. It catapulted the USDX way up to an incredible 19.7-year secular high!

Such an anomalous surge attracted huge capital inflows, leaving the US dollar extremely-overbought and wildly-overcrowded. It also generated mania-like universal bullishness, leaving herd psychology for the USDX overwhelmingly-greedy. It was that euphoric dollar that slammed gold, as I analyzed in depth in last week’s essay. Gold’s apparent inflation disconnect resulted from an exceedingly-extreme dollar rally…[but] this unsustainable USDX parabolic rally is doomed to reverse hard soon.

Exceptionally-big-and-fast surges to lofty heights inevitably generate overwhelming herd greed. Traders rush to chase the upside momentum, which temporarily becomes self-feeding, but that soon sucks in all-available near-term buyers, leaving only sellers so vertical rallies soon peak with sentiment growing universally-bullish, then quickly fail in symmetrical plunges. Selling begets selling, accelerating the downside.

Any day now, the radically-overbought US dollar and equally-oversold euro could start violently mean reverting in the opposite directions. The catalyst could prove unexpected economic data out of the US or Europe…or it might be central-bank officials changing their jawboning, implying slower tightening in the US or faster tightening over in Europe. Regardless of news flows, however, vertical parabolic rallies resulting in mania-like exuberance never last long…

The mighty dollar’s blistering 8.3% parabolic spike since mid-April should be symmetrically unwound over a few months. That would work wonders for gold, as that extraordinary dollar surge is the sole reason gold plunged since mid-April. That’s because the gold-futures speculators who dominate gold’s short-term price action watch the US dollar’s fortunes for their primary trading cues. [Editor’s note: A large portion of the original article is focused on gold futures so if that is of interest to you please go there for the details.]

Fortunes are won in the markets by buying low then selling high. The former requires betting on sectors when they are deeply-out-of-favor, like gold and its miners’ stocks today. It is never easy maintaining a contrarian worldview and fighting the herd, which is always wrong at price extremes but market history has long proven that’s the best way to generate life-changing wealth. This anomalous gold selloff is a gift.

The radically-overbought euphoric US dollar is soon going to roll over hard, as the wildly-oversold euro rebounds. That dollar weakness will drive gold higher, forcing gold-futures specs to quickly buy to cover their shorts or face catastrophic leveraged losses. That will accelerate gold’s gains, attracting back long-side gold-futures buyers then later investors with their vastly-larger pools of capital. Gold will soar on all that!

Gold Miners’ Stocks

The biggest beneficiaries of higher gold prices are gold miners’ stocks, which are far-more-oversold than their metal. The larger gold stocks of GDX tend to amplify gold upleg gains by 2x to 3x, while the smaller fundamentally-superior mid-tiers and juniors well outperform even that! Before this inflation super-spike runs its course and gold fully reconnects, the better smaller gold stocks should see order-of-magnitude gains.

The Bottom Line

The bottom line is today’s apparent gold-inflation disconnect is a temporary unsustainable anomaly…The extraordinarily-overbought, euphoric, and wildly-overcrowded long-dollar trade is overdue to reverse sharply. And speculators’ capital firepower to sell gold futures is largely tapped-out based on multi-year trends. So when the USDX inevitably rolls over on a less-hawkish Fed or more-hawkish ECB, gold will soar on massive mean-reversion gold-futures buying. That will attract back investors, accelerating the upside.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money