This article gives you an example of how to create your own silver miner portfolio. It is broken into categories and allocations and includes an overview of how each section was constructed and any additional information that may apply.

@$$4$Physical Silver (8%)

This is my largest holding, with a cost basis of 8% (of my total investment portfolio). It includes 100 oz. and 10 oz. bars, plus 1 oz. coins and US junk silver (90% silver pre-1965). My average cost basis is $19 an ounce. You won’t be able to buy silver that cheap, but finding bars with a 15% premium is still possible.

Use these sources to find the lowest prices or available inventory: APMEX.com, SD Bullion, JM Bullion, Provident Metals, or Miles Franklin. Some of these companies occasionally have special sale prices, so get on their email list.

Two good alternatives to physical silver ownership are the ETF PSLV offered by Sprott in Canada, and BullionVault.com. These are good alternatives if you don’t want to store your own silver. I own PSLV and consider it one of the best physical alternatives.

My favorite bar is 10 oz. because 100 oz. bars won’t be as easy to sell when silver reaches $100 ($10,000 per bar). If you live in a country on the metric system, the kilo bar is probably the way to go. Valcambi Swiss kilo bars tend to have low premiums, if you can find them.

The reason why my physical allocation is high (at 8%) is because the risk-reward was compelling for the long term when I was stacking. The odds of silver prices rising well above $19 (my average cost basis) is very good. You will likely be buying silver at higher prices, so you might decrease your allocation. I don’t know if I would use an 8% allocation today if my average cost basis was $30 or higher. At $30, a 300% pre-tax return would require $120 silver.

Miner ETFs (5%)

There are two silver miner ETFs: SIL and SILJ. I own both, with a combined cost basis position of 5%. Use these (if they are available in your country) if you want to increase your silver allocation without incurring substantial risk. This was a good alternative for me, because I don’t want to have an allocation higher than 2% for a single stock. Conversely, I don’t mind a 3% to 5% allocation in an ETF.

(If you are going to invest less than $100,000 in silver and are content with a 200% to 300% return, then you can focus on only physical silver and silver miner ETFs (if they are available in your country). Those will be sufficient to get you exposure for the returns you seek. However, if you want to go after larger returns, then let’s continue.)

Large Producers (1% to 2% per stock)

There are not many large silver producers ($1 billion market cap or larger), and I own most of them. Here are the stocks I own. I only allocate 1% to 2% of my total cost basis for this category. One benefit of large producers is they generally pay dividends. The second benefit is they have less risk than other silver mining stocks, thereby creating a way to limit overall risk in your portfolio. Goldstockdata.com

Goldstockdata.com

Mid-Tier Producers (1% to 2% per stock)

There are not many mid-tier silver producers ($100 million to $1 billion market cap), and I own most of them. Here are the stocks I own. I only allocate 1% to 2% of my total cost basis for this category. These stocks are what I consider the sweet spot for risk-reward. They are generally growth stocks and tend to have somewhat moderate risk and excellent upside potential. These are the most important stocks to achieve my investment goals. Why? Because when silver rises, so will they. It’s a correlation you can depend on. If silver goes to $50, then these are the stocks that will be dependable performers. Goldstockdata.com

Goldstockdata.com

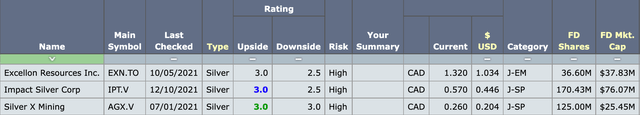

Small Producers (.25 to .5%)

There are not many small silver producers (< $100 million market cap), and I own most of them. Here are the stocks I own. I only allocate about .5% (usually less) of my total cost basis for this category. I keep my allocations low for this category because these stocks usually do not have much production growth potential but I don’t ignore them, because you never know who is going to be a good performer. Goldstockdata.com

Goldstockdata.com

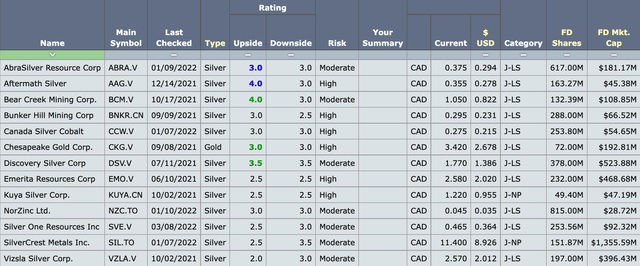

Development (.35% to 1%)

A development stock is a company that is not currently producing, but is developing a project with the intent to be a producer.

Once you get to the development category, the risk level jumps significantly. In fact, it has been my experience that only about 20% of development stocks pay off big (even when I pick the best ones). You can expect to lose money on many of your development plays. Why? Mostly because of share dilution. It takes a long time to develop mines, and during that period they only spend money. Another reason is from the myriad of things that can go wrong, such as permit issues, ramp-up issues, or lack of funding for the capex. Many of you are probably nodding your head and saying been-there-done-that.

To decrease your risk, try to only invest in development plays with a path to production within three years. Also, make sure that insiders own at least 25%, so that they are not sitting ducks for low-ball takeover attempts.

Goldstockdata.com

Goldstockdata.com

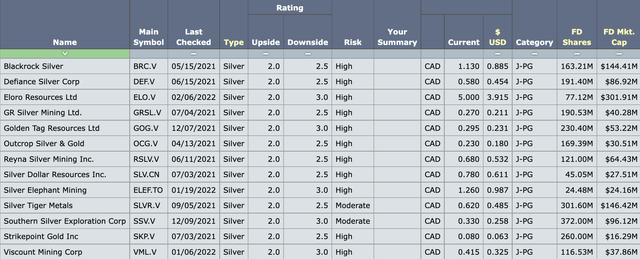

Exploration (.25% to .50%)

An exploration stock is a company that has no intention of becoming a producer. On my website, I call them project generators, because that’s their mission. They are trying to find projects that a developer/producer can turn into a mine. I often call these drill stories, because you make your money on future drill results. Although, some of them are optionality plays with large resources already in the ground.

For a drill story, I prefer to keep my allocation very low at around .25% of my total cost basis. These are often lottery picks, and the risk-reward is not great. For a good optionality play, I will allocate more, perhaps up to .5%.

I am always looking for big upside, big alpha. That can come from a producer, but generally, you need to have an excellent entry price for a producer to explode in value so most of your big returns are going to come from development and exploration plays. For this reason, you will need significant exposure to give yourself a good chance at finding some. This is why I own several exploration and development plays, even though I know the risk-reward is not great. You can expect many of your exploration plays to be poor performers, and a few to be rocket ships. Goldstockdata.com

Goldstockdata.com

My portfolio gives you an example (and some ideas) of how to get exposure to this coming breakout. Note that silver mining stocks are one of the riskiest investments. It is a highly volatile sector, with many stocks dropping 10% in a day and 50% in a week. It is not a recommended investment if you are risk-averse. You have to accept that silver and silver mine companies are speculative investments. This is for investors who are chasing alpha and accept the associated risk. Conversely, if your goal is to hedge, then gold is a much better alternative.

Conclusion

We have experienced a 7-year basing from 2013 to 2020, and then a 17-month correction since August 2020 for silver. Now it is on the precipice of breaking out. I think there is a good chance that silver could run from $30 to $50 in 3-6 months this year. If that happens, then the silver miners will fly.

The above version of the original article by Don Durrett (goldstockdata.com) was edited [ ] and abridged (…) to provide you with a faster and easier read. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

One comment

Pingback: Which of These 7 Silver ETFs Is Right For You? - munKNEE.com