There are no get rich quick schemes, but sometimes wealth just seems to lie on the street, waiting to be picked up by a patient buyer. This may well be one of those times with the gold to silver ratio over 82 and silver nearing a 21 year low in terms of gold so, regardless [of] whether [or not] precious metals fall or raise in the near term, the likelihood that silver will outperform gold is historically very high over the next few years.

lie on the street, waiting to be picked up by a patient buyer. This may well be one of those times with the gold to silver ratio over 82 and silver nearing a 21 year low in terms of gold so, regardless [of] whether [or not] precious metals fall or raise in the near term, the likelihood that silver will outperform gold is historically very high over the next few years.

This post is an enhanced (not duplicate) version of the original by Gregor Gregersen in that it has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide you with a fast and easy read. Enjoy!

to provide you with a fast and easy read. Enjoy!

Throughout most of our history, silver and gold were interchangeable at a ratio of 15 to 1 – the value of a [troy] ounce of gold…being equivalent to 15 [troy] ounces of silver. This ratio roughly mirrored the natural occurrence of silver to gold as mined from the earth.

It was only in the 20th century with the widespread introduction of fiat currencies and the abandoning of silver as backing for currency, that this ratio skyrocketed and started to fluctuate dramatically. Throughout the 20th century the gold to silver ratio averaged 47 and spiked to an all-time high of over 100 in 1991.

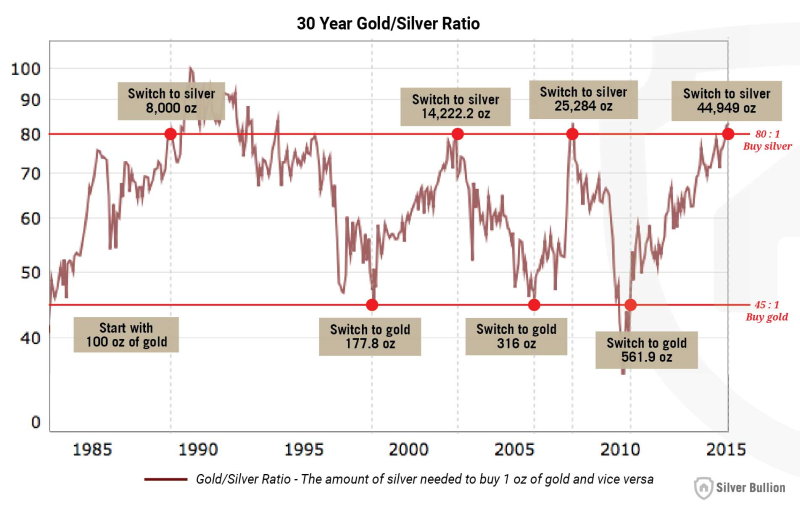

For the last 30 years the ratio has consistently ping-ponged within a wide range, characterized by rough lows of 40 to 45 and rough highs of 80 to 85. A simple strategy of converting silver ounces to gold when the ratio was 45 and swapping those silver ounces for gold at 80 would have resulted in 100 ounces of gold to become 562 ounces in 30 years. Yes, $665,000 US worth of gold rather than $122,000 US!

The 45 and 80 gold to silver ratio (GSR) rule would have required just 7 transactions in the last 30 years, so it is neither difficult nor expensive to implement. There is no need to time trades to a given day or try to guess tops or bottoms… simply buy gold when it is cheap relative to silver (around 45), wait, and a few years later buy silver when it is cheap relative to gold (around 80).

Example:

- Start with 100 ozt of gold.

- In late 1989 when the ratio is at 80, convert the 100 ozt of gold to 8,000 ozt of silver.

- In mid 1998 when the ratio is at 45, convert 8,000 ozt of silver to 177.8 ozt of gold.

- In late 2003 when the ratio is at 80, convert 177.8 ozt of gold to 14,222 ozt of silver.

- In mid 2006 when the ratio is at 45, convert 14,222 ozt of silver to 316 ozt of gold.

- In late 2008 when the ratio is at 80, convert 316 ozt of gold to 25,284 ozt of silver.

- In mid 2011 when the ratio is at 45, convert 25,284 ozt of silver to 561.9 ozt of gold.

- In early 2016 when the ratio is around 80, convert 561.9 ozt of gold to 44,949 ozt of silver.

An increasing number of customer have already switched from gold into silver or prioritized silver purchases over gold, as they wait for the ratio to fall and eventually switch back to gold. A similar argument to be made for platinum, which used to be valued at twice the price of gold but is currently selling at prices 25% below gold…

Want more such articles? “Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner of page).

Get engaged: Have your say regarding the above article in the Comment section at the bottom of the page.

Wanted! Contributors of original articles & links to other informative articles that deserve a wider read. Send to editor(at)munKNEE(dot)com.

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

Related Articles from the munKNEE Vault:

1. Apply Gold:Silver Ratio Ups & Downs to Greatly Increase Your PM Holdings – Here’s How

Should you buy & hold your gold or silver or switch back and forth depending on the gold/silver ratio? This article examines 3 scenarios and identifies certain rules that should be followed to make the most of the ups and downs of the gold/silver ratio to substantially increase your holdings over time.

2. Now’s the Time To Trade In Your Gold For Silver – Here’s Why

If you’re a speculator in precious metals, now may be a good time to consider trading in some gold for silver. Here’s why.

3. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher!

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691

4. Gold Bullion: What’s the Difference Between 1 Troy Ounce and 1 Regular Ounce?

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? Let me explain

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money