The average annual equity return for individual investors has been 60-65% less ( 6-7 percentage points less), over a 20 year period, than the performance of the indices that everyone assumes reflect investor returns! In spite of such a dramatic under-performance that fact is being ignored because it is not useful to academics or investment companies – but I would think it is of interest to YOU! Words: 729

So says Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A $ite for sore eyes and inquisitive mind$) and www.munKNEE.com (Your Key to Making Money!). Please note that this complete paragraph, and a link back to the original article*, must be included in any article posting or re-posting to avoid copyright infringement.

Eric Falkenstein conveys in paraphrased excerpts from an article* that:

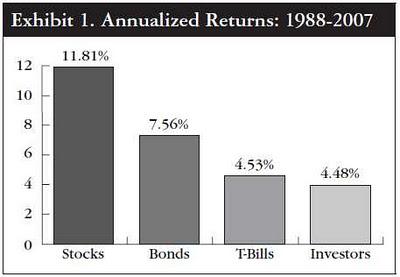

N. Scott Pritchard, relying on the annual Dalbar study which consolidates data from the Investment Company Institute, looked at data from 401(k) plans from 1988 through 2007, and found that (see chart below), while the S&P 500 returned 11.81% annually and Treasury bills returned 4.53%, the average investor achieved a return of only 4.48% [a 62.07% underperformance or 7.33 percentage points].

Indeed, more recent research has shown that over the twenty years ending in 12/31/2010, the S&P500 was up 9.14% while the average annual equity return for investors was only 3.27% [a 64.22% underperformance or 5.87 percentage points].

According to Ted Cadsby, in his book The Power of Index Funds – Canada’s Best-kept Investment Secret:

Indexing is the best way to maximize your long-term returns…and is relevant for every single investor, without exception…Every investor, no matter what stage of life they have reached and no matter how much they have to invest, should hold index products as the foundation of a diversified, long-term investment portfolio…

While an index fund aspires to do no better, and no worse, than the index it is tracking, it will, however, be destined to always do a little worse, since the [modest] fee of the fund will prevent it from generating the exact return of the index…

The index is a hard benchmark to beat in [almost] all markets…[Whether you manage your own portfolio or have it managed on your behalf the fact is that] the [vast] majority of active individual investors have underperformed the index in most years. The ones that are able to beat the index don’t beat it by much and the majority that underperform the index tend to underperform it by a lot…

Indexing outperforms most individual investors because of:

- the lower fees and brokerage commissions charged by indexed products;

- the lower trading costs of the buy-and-hold strategy inherent in indexing;

- the deferred capital gains tax that results from less portfolio trading;

- the lower cash holdings (which otherwise drag down performance over the longer term) in index funds;

- the difficulties active individual investors face in trying to rationally keep ahead of the consensus view of market prices and

- the purity of indexing which allows a more effective management of asset mix, which is the most important part of the investment process…

Index funds are the best method of indexing for most individual investors. Thet are easy to buy. there is no commission for purchasing or selling them. the tax consequences are straightforward and beneficial in terms of capital gains. Dividends and capital gains distributions are reinvested automatically into the fund so your money keeps working for you…

The beauty of index funds is that you can pretty much forget about them once you have invested in them. Just check once a year to see how the tracking error is against the index that the fund is following and make sure that the management expense ratio has not been increased…

Indexing is an investment strategy that is strongly favoured by probabilities – more so than any other investment strategy – so I ask you: No matter what your net worth, or how sophisticated your investment knowledge, why wouldn’t you want to have investment probabilities working for you, instead of against you?

Conclusion

Yes, why wouldn’t you invest in a broad index fund when research shows that you that, in spite of your prior misconceptions and your financial advisors self-serving, or just erroneous, advice you will likely be 60+% further ahead in doing so!!

*http://falkenblog.blogspot.com/2011/10/real-investors-lag-indices-by-6.html

Related Articles:

1. Is the “Halloween Indicator” a Good Way to Time the Market?

Seasonality tells us that statistically the months from the end of October through the end of April are in fact the best months of the year for investing while the six months from May through October (the “sell in May and go away” strategy), are the worst but is there any validity to what’s sometimes known as “the Halloween indicator?” [Let’s take a look.] Words: 460

2. Why U.S. Stocks are Still in a Bear Market and How to Determine When They are Not

There is more than enough reason to believe that U.S. stocks are in a bear market regardless of what percentage drop has taken place. [Let’s take a look at stock momentum, various moving averages, volatility and certain technical indicators to see what they have to say in this regard.] Words: 700

3. “Presidential Cycle” Suggests the S&P 500 Will Soar Before the End of 2011 – Here’s Why

Despite the outlook for relatively weak economic growth in the near future, the S&P 500… [should rise dramatically during the next 75 days] based on historical precedent – namely, the “Presidential Cycle.” [Let’s take a look at the specifics.] Words: 405

4. Now’s the Time to be Contrarian and Invest in the Stock Market – Here’s Why

Can markets find the road back to positive territory? [There are] three reasons investors should consider [before deciding whether to] remain in equities or…sit on the sidelines, [namely that:] investor sentiment is signaling the market is over-extended to the downside, stocks are trading well below historical valuation trends and the S&P 500 dividend yields are higher than the 10-year Treasury yield. [Let’s take a look at each of the three to help you come to a decision. Words: 960

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money