Benjamin Graham, the “godfather of value investing” created an equation to calculate the maximum fair value for a stock, referred to as the Graham Number and any stock trading at a significant discount to this number would appear undervalued. [Here are the names of 18 such stocks.] Words: 1707

So says an article* at www.kapitall.com which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. The article goes on to say:

The Graham Number only requires two data points: current earnings per share and current book value per share. The Graham Number = Square Root of (22.5) x (TTM Earnings per Share) x (MRQ Book Value per Share). This equation assumes that a stock is overvalued if P/E is over 15 or P/BV is over 1.5.

We used the Graham Number to screen for potentially undervalued stocks among the universe of low-debt stocks that are also trading at significant discounts to target price.

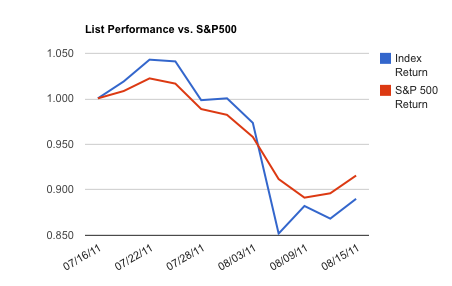

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month.

Do you think these stocks are undervalued? Use this list, sorted by potential upside implied by the Graham number, as a starting-off point for your own analysis.

1. Provident Financial Services, Inc. (PFS): Savings & Loans Industry. Market cap of $744.87M.

- MRQ total debt to assets at 0.00.

- Target price at $15.60 vs. current price at $12.32 (implies a potential upside of 26.62%).

- TTM diluted EPS at $0.92,

- MRQ book value per share at $16.51,

- Graham number at $18.49 (vs. current price at $12.10, implies a potential upside of 52.78%).

- The stock is a short squeeze candidate, with a short float at 5.93% (equivalent to 10.62 days of average volume).

- The stock has performed poorly over the last month, losing 13.42%.

2. Curtiss-Wright Corp. (CW): Aerospace/Defense Products & Services Industry. Market cap of $1.33B.

- MRQ total debt to assets at 0.19.

- Target price at $38.14 vs. current price at $28.55 (implies a potential upside of 33.60%).

- TTM diluted EPS at $2.59,

- MRQ book value per share at $26.76,

- Graham number at $39.49 (vs. current price at $28.31, implies a potential upside of 39.49%).

- The stock has performed poorly over the last month, losing 10.5%.

3. M&T Bank Corp. (MTB): Regional Banks Industry. Market cap of $9.39B.

- MRQ total debt to assets at 0.10.

- Target price at $96.20 vs. current price at $74.80 (implies a potential upside of 28.61%).

- TTM diluted EPS at $7.10,

- MRQ book value per share at $66.73,

- Graham number at $103.25 (vs. current price at $74.03, implies a potential upside of 39.47%).

- The stock has performed poorly over the last month, losing 12.58%.

4. Harte-Hanks Inc. (HHS): Marketing Services Industry. Market cap of $507.34M.

- MRQ total debt to assets at 0.19.

- Target price at $10.20 vs. current price at $8.08 (implies a potential upside of 26.24%).

- TTM diluted EPS at $0.73,

- MRQ book value per share at $7.04,

- Graham number at $10.75 (vs. current price at $7.81, implies a potential upside of 37.69%).

- The stock has lost 17.8% over the last year.

5. The Babcock & Wilcox Company (BWC): Diversified Machinery Industry. Market cap of $2.68B.

- MRQ total debt to assets at 0.00.

- Target price at $31.33 vs. current price at $22.78 (implies a potential upside of 37.55%).

- TTM diluted EPS at $2.78,

- MRQ book value per share at $15.40,

- Graham number at $31.04 (vs. current price at $22.79, implies a potential upside of 36.19%).

- The stock has had a couple of great days, gaining 10.64% over the last week.

6. F.N.B. Corporation (FNB): Regional Banks Industry. Market cap of $1.16B.

- MRQ total debt to assets at 0.12.

- Target price at $11.28 vs. current price at $9.16 (implies a potential upside of 23.16%).

- TTM diluted EPS at $0.68,

- MRQ book value per share at $9.59,

- Graham number at $12.11 (vs. current price at $9.02, implies a potential upside of 34.29%).

- The stock is a short squeeze candidate, with a short float at 12.19% (equivalent to 12.12 days of average volume).

- The stock has had a couple of great days, gaining 9.57% over the last week.

7. Western Digital Corp. (WDC): Data Storage Devices Industry. Market cap of $7.31B.

- MRQ total debt to assets at 0.04.

- Target price at $44.00 vs. current price at $31.47 (implies a potential upside of 39.82%).

- TTM diluted EPS at $3.09,

- MRQ book value per share at $23.55,

- Graham number at $40.46 (vs. current price at $31.25, implies a potential upside of 29.48%).

- The stock has had a couple of great days, gaining 8.11% over the last week.

- The stock has performed poorly over the last month, losing 15.56%.

8. NYSE Euronext, Inc. (NYX): Diversified Investments Industry. Market cap of $7.59B.

- MRQ total debt to assets at 0.16.

- Target price at $40.16 vs. current price at $28.97 (implies a potential upside of 38.62%).

- TTM diluted EPS at $2.17, MRQ book value per share at $27.32,

- Graham number at $36.52 (vs. current price at $28.44, implies a potential upside of 28.42%).

- The stock has had a couple of great days, gaining 14.14% over the last week.

- The stock has performed poorly over the last month, losing 15.66%.

9. NTT DOCOMO, Inc. (DCM): Wireless Communications Industry. Market cap of $80.67B.

- MRQ total debt to assets at 0.06.

- Target price at $22.30 vs. current price at $18.49 (implies a potential upside of 20.60%).

- TTM diluted EPS at $1.59,

- MRQ book value per share at $15.42,

- Graham number at $23.49 (vs. current price at $18.52, implies a potential upside of 26.82%).

- The stock has had a couple of great days, gaining 7.69% over the last week.

10. AGCO Corporation (AGCO): Farm & Construction Machinery Industry. Market cap of $3.94B.

- MRQ total debt to assets at 0.12.

- Target price at $55.12 vs. current price at $40.84 (implies a potential upside of 34.97%).

- TTM diluted EPS at $3.70,

- MRQ book value per share at $32.24,

- Graham number at $51.81 (vs. current price at $40.86, implies a potential upside of 26.79%).

- The stock has had a couple of great days, gaining 14.08% over the last week.

- The stock has performed poorly over the last month, losing 15.58%.

11. Cytec Industries Inc. (CYT): Specialty Chemicals Industry. Market cap of $2.37B.

- MRQ total debt to assets at 0.17.

- Target price at $62.17 vs. current price at $47.75 (implies a potential upside of 30.19%).

- TTM diluted EPS at $4.06,

- MRQ book value per share at $38.54,

- Graham number at $59.33 (vs. current price at $48.02, implies a potential upside of 23.56%).

- The stock is a short squeeze candidate, with a short float at 5.35% (equivalent to 5.81 days of average volume).

- The stock has had a couple of great days, gaining 8.23% over the last week. The stock has performed poorly over the last month, losing 14.59%.

12. City National Corp. (CYN): Regional Industry. Market cap of $2.33B.

- MRQ total debt to assets at 0.04.

- Target price at $58.34 vs. current price at $43.82 (implies a potential upside of 33.14%).

- TTM diluted EPS at $3.02,

- MRQ book value per share at $39.24,

- Graham number at $51.64 (vs. current price at $42.90, implies a potential upside of 20.37%).

- The stock has performed poorly over the last month, losing 16.5%.

13. U.S. Bancorp (USB): Regional Banks Industry. Market cap of $43.66B.

- MRQ total debt to assets at 0.19.

- Target price at $30.72 vs. current price at $22.73 (implies a potential upside of 35.17%).

- TTM diluted EPS at $2.06,

- MRQ book value per share at $15.50,

- Graham number at $26.80 (vs. current price at $22.45, implies a potential upside of 19.39%).

- The stock has had a couple of great days, gaining 5.28% over the last week.

14. CVS Caremark Corporation (CVS): Drug Stores Industry. Market cap of $45.72B.

- MRQ total debt to assets at 0.17.

- Target price at $43.06 vs. current price at $34.00 (implies a potential upside of 26.64%).

- TTM diluted EPS at $2.46,

- MRQ book value per share at $28.41,

- Graham number at $39.65 (vs. current price at $33.78, implies a potential upside of 17.39%).

- The stock has had a couple of great days, gaining 5.23% over the last week.

15. UniFirst Corp. (UNF): Textile Clothing Industry. Market cap of $1.0B.

- MRQ total debt to assets at 0.15.

- Target price at $63.00 vs. current price at $50.46 (implies a potential upside of 24.85%).

- TTM diluted EPS at $3.81,

- MRQ book value per share at $39.22,

- Graham number at $57.98 (vs. current price at $49.77, implies a potential upside of 16.50%).

- The stock has had a couple of great days, gaining 6.21% over the last week.

- The stock has performed poorly over the last month, losing 13.01%.

16. Raymond James Financial Inc. (RJF): Investment Brokerage Industry. Market cap of $3.53B.

- MRQ total debt to assets at 0.05.

- Target price at $37.29 vs. current price at $27.89 (implies a potential upside of 33.69%).

- TTM diluted EPS at $2.20,

- MRQ book value per share at $20.22,

- Graham number at $31.64 (vs. current price at $27.50, implies a potential upside of 15.04%).

- The stock has had a couple of great days, gaining 6.65% over the last week.

- The stock has performed poorly over the last month, losing 10.92%.

17. Tyco International Ltd. (TYC): Diversified Machinery Industry. Market cap of $19.23B.

- MRQ total debt to assets at 0.16.

- Target price at $53.47 vs. current price at $41.41 (implies a potential upside of 29.12%).

- TTM diluted EPS at $3.30,

- MRQ book value per share at $30.55,

- Graham number at $47.63 (vs. current price at $41.58, implies a potential upside of 14.54%).

- The stock has had a couple of great days, gaining 9.52% over the last week.

- The stock has performed poorly over the last month, losing 12.34%.

18. Nokia Corporation (NOK): Communication Equipment Industry. Market cap of $24.02B.

- MRQ total debt to assets at 0.16.

- Target price at $7.74 vs. current price at $6.29 (implies a potential upside of 23.02%).

- TTM diluted EPS at $0.47,

- MRQ book value per share at $4.74,

- Graham number at $7.08 (vs. current price at $6.22, implies a potential upside of 13.83%).

- The stock has recently rebounded, and is currently trading 12.24% above its SMA20 and 5.78% above its SMA50.

- However, the stock still trades 24.11% below its SMA200.

- The stock has had a couple of great days, gaining 28.89% over the last week.

Data Source: Target price data sourced from Screener.co, EPS and BVPS data sourced from Yahoo! Finance, all other data sourced from Finviz.

*http://seekingalpha.com/article/288051-18-low-debt-stocks-undervalued-by-target-price-and-the-graham-number?source=email_portfolio

Related Articles:

- 7 Agricultural Stock Buying Opportunities

- Don’t Fight the Fed: Buy Some of These 20 Blue Chip Stocks Instead!

- Now’s the Time to Buy Quality Dividend Stocks – Consider These 11

- These are the Top 10 Stocks Based on Yield and Payout Ratio

- Corporate Insiders On a Buying Binge! What are the Implications?

- Forget Warren Buffett: Invest Like Jim Cramer – and Win Big!

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money