It’s up to the concerned and critical-thinking among us to look at the math, the hard data underlying the headlines, and construct what we can best calculate to be true [about our current personal financial level of (un)readiness for the future] and here’s the truth: The big picture numbers just don’t add up. A nation that’s in hock…needs to seriously face the fact that it cannot make good on its current promises, let alone entertain making them larger.

hard data underlying the headlines, and construct what we can best calculate to be true [about our current personal financial level of (un)readiness for the future] and here’s the truth: The big picture numbers just don’t add up. A nation that’s in hock…needs to seriously face the fact that it cannot make good on its current promises, let alone entertain making them larger.

The three adult generations in the U.S. are suffering, and their burdens are likely to increase with time. Each is experiencing a squeeze that is making it harder to create value, save capital, and pursue happiness than at any point since WWII….[Let’s]…walk through the numbers.

So writes Adam Taggart (www.peakprosperity.com) in edited excerpts from his original article* entitled Let’s Stop Fooling Ourselves: Americans Can’t Afford the Future.

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Taggart goes on to say in further edited excerpts:

…The American spirit is rooted in the belief of a better tomorrow. Its success has been due to generations of men and women who toiled, through both hardship and boom times, to make that dream a reality, but at some point over the past several decades, that hope for a better tomorrow became an expectation or, perhaps, a perceived entitlement. It became assumed that the future would be more prosperous than today, irrespective of the actual steps being taken in the here and now.

For a prolonged time – characterized by plentiful and cheap energy, accelerating globalization, technical innovation, and the financialization of the economy – it seemed like…[the above] assumption was a certain bet but these wonderful tailwinds that America has been enjoying for so many decades are sputtering out.

Americans, who had the luxury of abandoning savings and sacrifice for consumerism and credit financing are now on a collision course with the reality of experiencing the forces of resource scarcity, debt saturation, price inflation, and physical limits that will impact their way of life dramatically more going forward than living generations have experienced to date. Like the grasshopper in Aesop’s fable, they have partied away the fair seasons and winter is now on the way, which they are not prepared for.

Group #1 – The Seniors: Woefully Unprepared for Retirement

In the late 1970s, the 401k emerged as a new retirement vehicle. Among its touted benefits was the ability of the individual to save as much as s/he thought prudent for his/her financial future. Companies loved the new private savings plans because they gave them a way out of putting aside mandatory savings for worker pensions. For a long time, everyone thought this was a big step forward.

Three decades later, what we’re realizing is that this shift from dedicated-contribution pension plans to voluntary private savings was a grand experiment with no assurances. Corporations definitely benefited, as they could redeploy capital to expansion or bottom line profits. But employees? The data certainly seems to show that the experiment did not take human nature into account enough – specifically, the fact that just because people have the option to save money for later use doesn’t mean that they actually will [and they are, in fact saving less and less as the table below shows].

- Not every American worker (by far) is offered a 401k or similar retirement plan through work but of those that are, 21% choose not to participate.

- 25% of those aged 45-64 have NO retirement savings

- 22% of those 65+ have $0 in retirement savings.

- 49% of American adults of all ages are saving nothing for retirement.

- 54% of retirees with retirement savings have less than $25,000.

- 71% of retirees with retirement savings have less than $100,000 and

- 83% of retirees with retirement savings have less than $250,000

…[yet] Medicare out-of-pocket costs alone are expected to be between $240,000 and $430,000 over retirement for a 65-year-old couple retiring today.

Read: Secure Your Golden Years – Now! Here’s How

(Source)

(Source)

The gap between retirement savings and living costs in one’s later years is pretty staggering:

- As the table above shows, nearly 83% of retired households have less saved than Medicare costs alone will consume.

- 33% of retired households are entirely dependent on Social Security. On average, that’s only $1,230 per month – a hard income to live on.

- 34% of older Americans depend on credit cards to pay for basic living expenses such as mortgage payments, groceries, and utilities.

The denial being shown by baby boomers entering retirement is frightening.

- Many simply plan to work longer before retiring, with a growing percentage saying they plan to work “forever”. The data shows, however, that 50% of current retirees had to leave the work force sooner than desired due to health problems, disability, or layoffs according to years of surveys by the Employment Benefit Research Institute.

- Add to this the nefarious impact of the Federal Reserve’s prolonged 0% interest rate policy, which makes it extremely hard for retirees with fixed-income investments to generate a meaningful income from them.

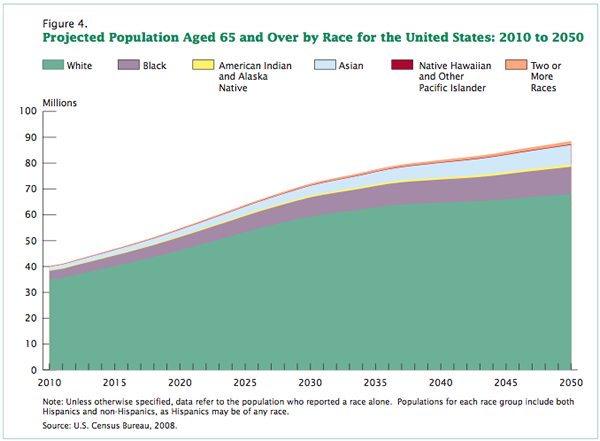

The number of Americans aged 65 years and older is projected to more than double in the next 40 years:

Read: AARP Survey: Golden Years Appear Grim to Aspiring Retirees

Will the remaining body of active workers be able to support this tsunami of underfunded seniors? Don’t bet on it.

Group #2 – The Workers: Taxes & Inflation Sucking Them Dry

To borrow from another fable, U.S. policy is doing its best to kill the goose that lays the golden eggs. Bottlenecked between retirees and the younger “millennial” generation is the current “productive peak” working class. As government, mired in debt and budget deficits, grows desperate to boost tax receipts and keep interest rates on its debt manageable, it is increasingly both siphoning capital and stealing purchasing power from those generating income.

History shows that the above cannot continue indefinitely. Eventually you exhaust the incentive for working and your productive class goes on strike. How close are we to that breaking point? It’s not hard to find a litany of articles on the Internet these days warning that it’s coming soon:

- “If we put all of this together we can see a picture of the average American. The chart below shows the annual change in personal incomes combined with the annual change in personal expenditures. What is clear is that consumption has been supported by rising transfer receipts (welfare) and a drop in the personal savings rate which is now at the lowest level since just prior to the last recession. The consumer is clearly struggling to maintain their current standard of living and all indications are that they are going to lose this battle.”

- “Is ‘discretionary income’ rapidly becoming a thing of the past for most American families? Right now, there are a lot of signs that we are on the verge of a nightmarish consumer spending drought. Incomes are down, taxes are up, many large retail chains are deeply struggling because of the lack of customers, and at this point nearly a quarter of all Americans have more credit card debt than money in the bank. Considering the fact that consumer spending is such a large percentage of the U.S. economy, that is very bad news. How will we ever have a sustained economic recovery if consumers don’t have much money to spend? Well, the truth is that we aren’t ever going to have a sustained economic recovery. In fact, this debt-fueled bubble of false hope that we are experiencing right now is as good as things are going to get. Things are going to go downhill from here, and if you think that consumer spending is bad now, just wait until you see what happens over the next several years…

Looking from a bird’s-eye view, real wages have been falling in the U.S. for decades. The chart below includes numbers based on the officially reported Consumer Price Index (or CPI, the methodology of which has been changed many times to make the output “kinder and gentler”), as well as those from ShadowStats, (which applies a standardized and less fuzzy methodology to try to get to a truer picture). You can see that according to ShadowStats (the dark blue line), real wages have been plummeting in recent years as the Federal Reserve has been running the money-printing machines at full tilt:

Meanwhile, the cost of living has soared as the Fed’s liquidity has found its way into the commodities markets and driven prices of essentials higher [as seen in the chart below] so today’s worker is enjoying paying for substantially costlier goods with a materially devalued income – that is, if they are fortunate enough to have an income:

Don’t Even Think About It – Touching Your 401(k) That Is!

Unemployment in the U.S. is still painfully high. Even the recently-celebrated declines are due to a jump in part-time jobs as workers take on multiple jobs to simply get by. Full-time jobs are actually on the decline.

At the same time, in pursuit of greater efficiencies, U.S. corporations are investing more than ever in automation. Many of the less-skilled jobs lost during the Great Recession are simply not coming back, as human labor is increasingly replaced by robots and intelligent machines.

Read: Unemployed? Under-employed? Bored? Check Out These 10 High-growth Jobs

[Moreover], while the stock market is up nicely in the past year, the wealth gains from this are hyper-concentrated within the top 10% – really the top 1%, as this excellent video visualizes. [16,575,000 views to date!] The mean U.S. household currently only has about $50k in savings (and that average is skewed upwards by the super-rich).These workers have also been whipsawed over the past decade by several asset bubbles blown by central banks that have knee-capped their efforts to amass wealth. The S&P 500 stock index has just returned to price territory last seen in 2001 and 2007, and housing prices are only slowly beginning to rise again in the aftermath of the vicious correction begun in 2007. Sadly, it seems that new bubbles in stocks, bonds and housing are being inflated once again – sure to take a large swath of wealth from these workers when they burst.

Perhaps the arriving cohort of younger workers will be able to support their elders once they hit their peak earning years. We can hope but, again, the prospects do not look encouraging.

Group #3 – The Millennials: At Risk of Becoming a Lost Generation

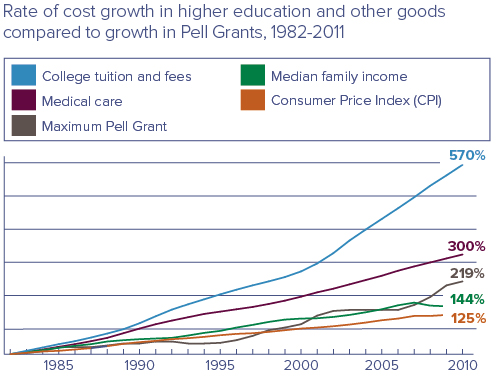

Pity the recent college graduate. The cost of higher education has been far outstripping inflation for years…

Read: The Surprising Side Effects of Rising College Costs

Most colleges have no exposure to their students’ ability to repay their loans so they actually have an incentive to continue to raise tuition and other fees as high as the market will possibly bear.

Read: The Millennial Cohort: A Look at Their Present Predicament, Their Future Economic Prospects

The average graduate student has a student loan balance of over $27,000 (not including credit-card or other types of debt that many students also have). This puts them into a hole early in their adult lives that delays their ability to create families, buy a first home, or start businesses.

Read: American Grads: Here’s a Great Guide to Personal Finance

The challenge to capital formation is compounded by the frighteningly high unemployment rate of approximately 12% for those under 30. Not only are companies still hiring conservatively, but given the factors mentioned above, younger workers find themselves competing with older ones for entry-level positions to an extent not seen in living memory.

Read: These Degrees Are the Ticket to the 10 Top Paying Careers

It’s no wonder there’s a growing perception that going deep into debt for a college diploma isn’t a smart trade-off. A number of today’s graduates will be finally paying off their balances around the same time their own children are heading off to college. [

Read: Which U.S. Universities & Fields of Study Generate the Highest ROI?

Along with the joys of debt-serfdom, younger workers are realizing they can’t count on:

- loyalty from the companies they work for

- a national infrastructure that is the envy of the world

- low oil prices

- affordable healthcare

- affordable home prices

- easy access to credit

- Social Security

and a number of other elements of the “American promise” that preceding generations were able to take for granted. It’s no surprise that millions of young workers are giving up on searching for work.

The big danger for this generation’s members is that the longer they go without work experience, the less appealing they become to employers when hiring does begin to pick back up. Tomorrow’s new college graduates will be hired for entry-level positions, leaving many of today’s unskilled seekers “unemployable” – a lost generation.

Let’s Stop Fooling Ourselves

By forcing the stock market higher, the Fed has simply made a small minority of the country better off. By funneling endless amounts of free money to the biggest banks, the Fed has enriched the banking system. The Fed truly seems to believe that this is the right course of action: that a stable and profitable banking system coupled to rising stock prices will somehow generate the necessary confidence within the middle class required for them to once again go on a borrowing binge.

That’s what the system has devolved into, for better or worse: our economy is founded on credit and borrowing, not earnings and savings…

The big picture numbers just don’t add up. A nation that’s in hock…needs to seriously face the fact that it cannot make good on its current promises, let alone entertain making them larger.

Here we are, [however,] with every outlet of the current power structure vigorously promoting that “all is well” while minimizing or completely ignoring those who would seek to open a dialog about the wisdom, or lack thereof, of ramming asset prices higher and supporting historically ruinous levels of deficit spending by printing money out of thin air.

In summary, if we’re being honest with ourselves, the current narrative of recovery being pushed by Wall Street and the mainstream media doesn’t make any sense.

The American experience of rising standards of living and general prosperity have always rested upon a deep and healthy middle class. That middle class, by almost any available economic or financial measure, is steadily losing ground as a direct consequence of Fed and DC policies.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.peakprosperity.com/blog/81190/lets-stop-fooling-ourselves-americans-cant-afford-future

Disagree? Concur? Have your say on the subject via:

We’d like to know what you have to say.

Related Articles:

1. Guess What % of Americans STILL Have More Credit Card Debt Than Savings

The economy is slowly hobbling back to health but for many Americans the rainy day fund is still looking a little dry, the credit card bill is still looking a little scary [Unfortunately, the liklihood is that,] as the economy strengthens further, many Americans will…spend their new found extra cash rather than save it. Words: 474

2. U.S.A.: United States of Addiction – Our Insatiable Appetite for Debt

16 point 7 trillion dollars. That is our current national debt. 12 point 8 trillion dollars. That is the amount households carry in mortgage and consumer debt. We are now addicted to debt to lubricate the wheels of our financial system. There is nothing wrong with debt per se, but it is safe to say that too much debt relative to how much revenue is being produced is a sign of economic problems. At the core of our current financial mess is how we use debt as a parachute for any problem. [Unfortunately,] addictions are never easily cured and we have yet to come to terms with our insatiable appetite for debt. Words: 850

3. 75% of Americans are in Deep _ _ _t!

Rising education and medical costs, on-going credit card interest payments, well used personal lines of credit and large mortgage debt and home equity loans – most a penchant for living beyond their means – is keeping 75% of American households in some degree of debt. Take a look and then pass it on to your friends, neighbors and co-workers.

4. Secure Your Golden Years – Now! Here’s How

Americans spend more time planning their vacations than their retirement and this is the reason why 1 out 7 baby boomers are going bankrupt. With people living longer and spending as much as 30 years in retirement, if you want to maintain a moderate standard of living, it is essential to plan your retirement well in advance to secure your golden years.This article outlines 6 ways to do just that. Words: 665

5. Which U.S. Universities & Fields of Study Generate the Highest ROI?

Recent research by PayScale has revealed that the average ROI for U.S. university graduates (693 schools surveyed) is $387,501 over a 30-year period. 6 of the universities generated a return on investment for its graduates in excess of $1.6 million.

6. American Grads: Here’s a Great Guide to Personal Finance

Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don’t need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out.

7. AARP Survey: Golden Years Appear Grim to Aspiring Retirees

An AARP survey of over 5,000 American workers aged 50 or older has confirmed…that the Great Recession has radically changed the financial situation for many aspiring retirees and that the outlook for their golden years now looks grim. It seems that counting on their home equity to finance a life of leisure didn’t exactly work out as planned. [Let’s review the survey’s findings.] Words: 400

More than 25% of American workers (33% of those in their 40s) with 401(k) and other retirement savings accounts use them to pay current expenses, new data show, [which is] undermining already shaky retirement security for millions of Americans. With federal policymakers eyeing cuts to Social Security benefits and Medicare to rein in soaring federal deficits, and traditional pensions in a long decline, retirement savings experts say the drain from the accounts has dire implications for future retirees. Words: 890

9. Don’t Even Think About It – Touching Your 401(k) That Is!

Look, if you’re absolutely stuck right now, then you’ve got to do what’s necessary but, in my opinion, you should avoid 401(k) hardship withdrawals at all costs … and think long and hard before you consider borrowing against your future retirement. With so many people nearing retirement already grossly underfunded [such actions are] going to prove catastrophic down the line. Words: 1043

10. Is Your Household One of the 51% Projected to be at Risk in Retirement?

Many Americans are reacting to the economic downturn not by resolving to save more but by no longer actively planning for retirement. “That’s exactly the opposite of what they should be doing,’’ said Paul Ballew, senior vice president at Nationwide Insurance. Words: 369

Visit wsj.com – HERE – to find their calculator which shows where your household income stands compared to others in the U.S.. $506,000 puts you in the top 1%; the much talked about $250,00 in the top 6%; $200,000 in the top 10% while an annual salary of $43,000 puts you in the top/bottom 50%. Where do you stand?

If you’re reading this and under 30, let me be absolutely clear about one indubitable point: your government is going to sacrifice your future in order to pay for its own mistakes from the past. [If that kind of future does not sit well with you] then get out of Dodge. Stop playing by the same rules of the game that used to work in the past because the old playbook of “go to school, get a good job, work your way up the ladder” simply doesn’t apply anymore. [This article outlines what is being laid out as your future unless you take independent action and, in conclusion, outlines suggestions on how to make a better life for yourself. Feel free to share this article with one and all!] Words: 1058

13.These Degrees Are the Ticket to the 10 Top Paying Careers

Staying in school has always been seen as the way to get ahead. Post-secondary education, especially a university degree, is often the ticket to the big pay cheque but not all degrees are created equally when it comes to earning potential. Which programs lead to the best paying jobs? Check out our list of the top earning degrees. Words: 775

14. Unemployed? Under-employed? Bored? Check Out These 10 High-growth Jobs

Though unemployment has been wide-reaching across industries…[some] jobs, against all odds, are on the rise – a steep rise…So if you’re sick of your job and craving a new profession, now might be the time to head back to school and get that secondary degree in one of these 10 specializations.

15. The Surprising Side Effects of Rising College Costs

The rising cost of college tuition translates into many students re-evaluating higher education, their future professional careers as well as other major life decisions. Find out more in our very enlightening infographic on The Surprising Side Effects of Rising College Costs.

16. The Millennial Cohort: A Look at Their Present Predicament, Their Future Economic Prospects

Though considered the most educated generation in history, the Millennial generation – young adults between the age of 18 and 29 who make up 25% of America’s population – is also living through one of the worst economic crises. From a weak job market to the global economic downturn, are the Millennials cut out for this market? [A look at the infographic below tells the story.] Words: 345

17. Want a Secure & Enjoyable Retirement? Here’s Exactly What to Do

Retirement planning is more intimidating for most than any other personal finance topic. We know we should be saving but not how much. We know it’s important to use a tax-deferred account but not which one. Most devastatingly, we often leave saving itself completely up to chance trusting that we will have enough willpower to set money aside for 30-50 years. Luckily, finding a secure and enjoyable retirement need not be mysterious. Here’s exactly what to do.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money