“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers)

Gold investors often fail to watch the Federal Reserve with enough attention to detail and can miss buying opportunities like the present one, as a result. The case for gold is as strong as ever and I outline in this article why with details you’re unlikely to see anywhere else. Words: 775; Charts: 6

attention to detail and can miss buying opportunities like the present one, as a result. The case for gold is as strong as ever and I outline in this article why with details you’re unlikely to see anywhere else. Words: 775; Charts: 6

So writes Adam Rabie (www.gold.net) in edited excerpts from an article* posted on Seeking Alpha under the title Fed To Help Gold Soar Off 6-Month Low.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Rabie goes on to say in further edited excerpts:

Why Gold Has Suffered So Far

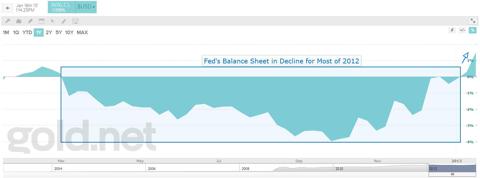

Gold prices suffered in 2012…[because] the Federal Reserve’s balance sheet flat-lined over the last 12 months [as can be seen in the chart below]:

Gold Prices Correlate with the Fed’s Printing

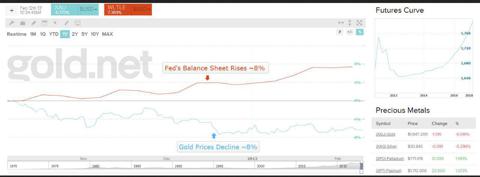

The correlation between the price of gold and the amount of assets purchased by the Federal Reserve is much higher than many realize [as can be seen in the chart below]:

A proactive Fed is an obvious driver of the price of gold and, in particular, quantitative easing measures seem to have some of the largest effects, albeit with a lag.

Over the last year, despite no net balance sheet growth, the Fed engaged in a heavy qualitative easing, aka “Operation Twist,” a measure to increase the average maturity of the Fed’s holdings, by swapping relatively safe short-term assets, with riskier, longer-maturing assets. These measures, along with negative real interest rates, have helped sustain gold prices but do not seem capable of lifting the precious metal to new highs on their own.

No More Room to Twist, Infinite Room to Grow

While the Fed has indicated they will continue their maturity expansion, the fact is they have run out of room, having sold almost all of their short-term assets [as can be seen in the chart below]:

The Fed’s agency holdings have almost run out as well [see below]:

QE Is Back in Action

Given the de facto end of the Fed’s qualitative easing, the one measure they can engage with their balance sheet – that can never dry – is more quantitative easing and this is exactly what is happening. The Fed’s balance sheet so far this year has risen at an annualized pace of 21%, its first real…[advance] in more than a year…[but,] interestingly, [the price of] gold has not…[caught] on to the trend [as of yet].

The gold price today…[is down approx. 8% from 6 months ago and,] interestingly, this decline nearly perfectly mimics the growth in the Fed’s balance sheet over the same period [as can be clearly seen in the chart below]:

(click to enlarge)

Broken Correlations or Golden Discounts?

While these facts seem to indicate that gold does not follow the Fed’s expansionary efforts, it is important to realize that gold price trends historically tend to react to the Fed’s action with a lag. If this is the case, gold prices may prove to be heavily discounted at present...

A forward look at the Fed as well may help solidify which direction the yellow metal will head because, despite some internal dissent in the Fed, the overwhelming direction of monetary policy seems to indicate stimulus will remain or increase.

Federal Reserve Leadership Is United

It is important to focus on who matters at the Fed at least as much as the information that is coming from representatives of the central bank. While the media and markets have been flooded with quasi-hawkish comments from St Louis Fed President James Bullard, his voting action and conviction do not seem to align with his vocal sentiment, as he heeds to the direction of his voting board’s leaders.

The main directors of the Federal Reserve include its Chairman, Ben Bernanke, the vice-chair, Janet Yellen and the President of the New York Fed, Bill Dudley. These three Fed leaders have not voiced any qualms over present stimulus measures and rather the sentiment is quite the opposite, with Janet Yellen just…[recently] reminding the public that stimulus measures may even remain once unemployment guidelines are hit.

The macro environment they are facing also seems to corroborate their stance, with the 10-year yield close to 2% [which is] an implicit target of the Fed, and America’s outstanding debt continually growing to record levels. A desire to lift off the downward pressure on borrowing costs does not even seem considerable.

Gold Prices May Be Set to Rise

If this analysis of the Fed is correct, the rising ratio of the Fed’s balance sheet priced in gold while the gold price declines, indicates a potentially lucrative buying opportunity for gold investors.

The Fed is currently set to purchase about $85 billion in net assets a month, which implies a more than 30% annual growth in the Fed’s balance sheet, and could spell 2013 glitters for gold investors who just suffered a rough year….

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/1177791-fed-to-help-gold-soar-off-6-month-low

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

Only the “best-of-the-best” financial, economic and investment articles posted

Edited excerpts format provides brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

Recipients restricted to only 1,000 active subscribers!

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Startling Relationship Between Gold Price & U.S. Gov’t Debt Suggests What Price for Gold in 2017?

The price of gold, on a quarterly basis, is 86% correlated – yes, 86%! – to total government debt going back to 1975… and a shocking 98% over the past 15 years! [As such,] it would seem like a no-brainer investment thesis to buy gold… as a proxy for the not-otherwise-investable thesis that US total government debt will increase in the future. [But there is more – and it is disappointment for gold bugs – read on!]

The U.S. is one of the worst debt ‘offenders’ in the world [and, as such, unless] dramatic spending cuts and tax increases [are undertaken within the next 5 years,] America’s debt/GDP ratio will continue to rise, the Fed will print money to pay for the deficiency, inflation will follow, the dollar will inevitably decline, bonds will be burned to a crisp, and only gold and real assets will thrive. [Here’s why.] Words: 674

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I’d love to read a similar article about SILVER, so PM investors could compare the two!