“Follow the munKNEE” via twitter & Facebook

‘Tis the annual forecasting season. Every economist with a model is publishing detailed forecasts for the U.S. and world economies for 2013. I have no model, and my degrees are in history and law but the signs now are clearer than they have been in some time: 2013-2015 should see beneficial growth of the American economy and that will translate into good results for some companies and good returns for some stocks. [Let me explain my conclusions.] Words: 902 ; Charts: 1

publishing detailed forecasts for the U.S. and world economies for 2013. I have no model, and my degrees are in history and law but the signs now are clearer than they have been in some time: 2013-2015 should see beneficial growth of the American economy and that will translate into good results for some companies and good returns for some stocks. [Let me explain my conclusions.] Words: 902 ; Charts: 1

So writes Martin Lowy in edited excerpts from his recent post* on Seeking Alpha entitled Bullish On The Economy For 2013-2015.

This article is presented by www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Lowry goes on to say, in part:

1. Consumer Spending on the Rise

The Fiscal Cliff, like the Millennial computer bug, will prove a dud. The U.S. economy runs on final demand, which primarily means consumer spending. Government spending also is part of demand, but it has to come either from taxes or from borrowing. Neither is as good as good consumer spending. Good consumer spending is spending based on increased income, not borrowing. On that front, recent news is encouraging.

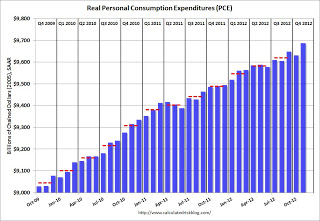

Below is a graph from…Bill McBride at Calculated Risk …[which] illustrates how consumer spending is getting healthier:

McBride reported on December 21, 2012, that “Personal income increased $85.8 billion, or 0.6 percent … in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $41.3 billion, or 0.4 percent.”

2. Household Formation is Picking Up

[The above] means that the growth in consumer spending was healthy, being based on growth of personal income, and…[should] continue because household formation is picking up. Don’t fight the Fed and don’t fight the Demographics. Household formation is, in many ways, the key to the American economy because it results in spending on so many forms of goods and services. People starting a household need everything from homes to refrigerators to paint jobs to pots and pans.Over the last five years, household formation has been at historic lows compared with increases in population,…[according to] a recent Credit Suisse research note…[with] depressed household formation during the 2008-2012 period. That anomaly means that not only do we have the usual forces propelling household formation; we also have pent-up household formation that gradually, over the next few years, should make for robust demand for everything a household needs….

3. Demand for New Homes Should Increase

Household formation also, of course, will tend to drive the market for new homes and will tend to promote the emerging increases in house prices. These events will be part of a virtuous cycle in which increasing house prices will make it possible for aging boomers to sell their houses, move to warmer climes, and add to the household formation boom by engaging in their own redecorating and home improvement. Home building has traditionally led of the economy out of recessions. It has been held back in the last four years by the overhang of foreclosed properties and the lack of household formation….

4. Industry Will Become More Competitive Internationally

I would add to…[the above] economic tailwind the benefits of more abundant oil and gas. Over the next few years, the prices of these commodities are likely to stay in check. That will give American manufacturing businesses a leg up on foreign competition that should lead to increased sales and new jobs.

5. Growth in Jobs & Economic Activity Will Increase Tax Revenues

This growth in jobs and economic activity will increase tax revenues as well, thereby bringing down the U.S. fiscal deficit and easing the concerns about the ability of the U.S. to fund its debt….

Where to Invest?

[Personally,]…I like stocks of companies with sound balance sheets that make or sell the kinds of stuff that household formation causes people to buy…. For an investor with a lot of money on the sidelines and little time or inclination to do much research, I think probably this is not a bad time to buy a broad index fund, such as SPDR S&P 500 ETF (SPY), as long as the investor understands that the market in general goes up and down, often in ways unrelated to fundamental values and that global events often derail expectations for periods of time. We have had almost four years of market recovery. We should not expect big upsides over the next few years because the market already has priced in much of the good economy that I and others are forecasting. Nevertheless, I believe that stocks will bring greater returns than other financial assets.A 3-year Process

The process that I am describing is about a three-year process that should take us through 2015. I cannot quantify the progress that this process will create. As I said at the outset, I do not have a model.

My forecast for 2013 is more optimistic than the forecasts of many of the economists that I respect the most, but it is in line with their expectations for 2014-2015. The only substantial difference is that I think the first half of 2013 will not be as weak as they forecast….

[ABOUT Martin Lowy: Trained as a lawyer and practiced in the fields of corporate law and bank regulation in large U.S. firms for 20 years…[He is now]…retired from active business and a full-time writer, mostly on economic subjects. His books include: High Rollers: Inside the S&L Debacle (1991); Debt Spiral: How Credit Failed Capitalism (2009); Practical Handbook for Bank Directors (1995), second edition due 2012; Corporate Governance for Public Company Directors (2003)]

*http://seekingalpha.com/article/1082391-bullish-on-the-economy-for-2013-2015

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- FREE

- The “best of the best” financial, economic and investment articles to be found on the internet

- An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you!

- Sign up HERE and begin receiving your newsletter starting tomorrow

- You can also “follow the munKNEE” via twitter & Facebook

Related Articles:

1. The Most Important Questions (and Answers) Regarding What the Futures Hold for 2013

Since 2012 is rapidly coming to a close, I’m fielding questions about what the future holds for 2013. My hope? That my answers will be both informative and instructive, and ultimately profitable, of course. Words: 1588; Charts: 2

2. 2013 Forecasts: Do These 10 Analysts Know Something We Don’t?

Barron’s have just come out with the forecasts of 10 top analysts and ALL their forecasts are positive. There is not a single forecaster who expects the S&P 500 to fall in 2013 and there is only one forecaster who expects the 10 year bond yield to fall from its current level of 1.7% and he only sees a 10 bps decline to 1.6%. [Look at the average forecasts for each item at the end of the post.]

3. Goldman Sachs’ Thoughts, Outlooks, Strategies & Picks for 2013

Goldman Sachs has been out with a number of reports in recent weeks highlighting their positioning for 2013. While it’s important to keep in mind that these kinds of reports are no holy grail… it is always good for brain storming and, after all, it’s not like Goldman Sachs is a bunch of dummies.

While Treasuries are said to have no default risk as the Federal Reserve can always print money to pay off the debt, hidden risks might be lurking. As oxymoronic as it may sound, the biggest risk to the economy and the U.S. dollar might be, well, economic growth! Let us explain. Words: 2065; Charts: 1

5. Lack of Economic Growth Expected to Continue Until 1 of 2 Things Change – Here They Are

Saving rates continue to fall. As full-time employment remains elusive, the average American continues to resort to debt, and governmental support, to fill the gap between waning real incomes and their expected standard of living….[This] will continue to impede economic growth until such time as either debt returns to levels that are conducive for higher levels of personal savings or incomes rise. [Words: 1322; Charts: 7]

6. 2013 Will Not Be A “Happy New Year” For Most Americans

[As the New Year approaches it is becoming more and more imperative that we] find our internal inner joy…[and] maintain our positive perspective…while the external world around us deteriorates thanks (actually that should read “no thanks”) to all those…who caused or enabled the current financial and economic trauma. We must face up to the fact that the current financial path of the United States is unsustainable and will probably not result in a “Happy New Year” for most Americans in 2013. As such, we must do something utterly different. Words: 620

Until policymakers see the light, it’s very slow and steady as she goes, with a chance of higher inflation on the horizon. This is not necessarily bad for the stock market, however, since I continue to believe that both stocks and bonds are priced to the expectation that growth will be very weak or even negative in the years to come. Words: 696

We are in for a tough time for the next four years if the chart below, showing a big dive in economic development expectations, is any indication – ahd here is probably why that is the case. (Words: 200; Chart: 1)

9. Fiscal Cliff: 1 Step Backward – Then 2 Steps Forward

…Fiscal policy, both in the U.S. and in Europe, has already been a drag on economic growth, and it’s extremely likely to continue to be one as politicians begin addressing concerns about long-term debt burdens. The debate about the fiscal cliff deal might revolve around the preferred paths to reducing the nation’s long-term debt, but it also will determine just how much fiscal policy will limit growth over the coming months and years. What’s really at stake, in the near term at least, is the answer to two important and interrelated questions: How dysfunctional is our political leadership and how bad is our economy going to be next year? Words: 610

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money