“Follow the munKNEE” via twitter & Facebook

Gold just can’t seem to get any traction any more. The Feds announce QEternity, and gold moves down. Fiscal cliff talks fall apart, and gold still stagnates. Why is this the case? I think weak Indian demand is the culprit. [This article explains why that is the case and why that could be exacerbated in 2013.] Words: 1100

QEternity, and gold moves down. Fiscal cliff talks fall apart, and gold still stagnates. Why is this the case? I think weak Indian demand is the culprit. [This article explains why that is the case and why that could be exacerbated in 2013.] Words: 1100

This article is presented by www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

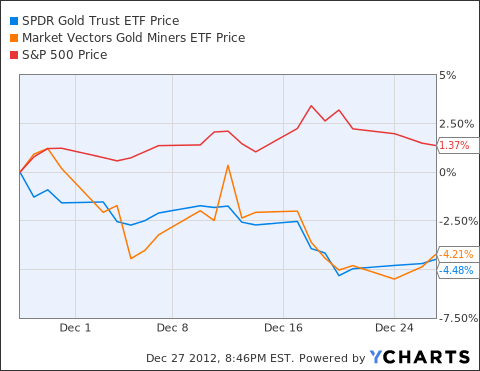

[The chart below shows]…how the yellow metal and the miners have done in the past month. Both are down about 4%. In the meantime, the S&P is up about 1.4%.…I keep seeing articles stating that 2013 will be the year for gold but, unfortunately, Indian gold merchants disagree. India, just for the record, is the world’s largest consumer of gold. If the Indian gold merchants expect prices to be flat, then probably it is going to be flat. These guys know well where the demand (or lack thereof) is. Reports the Economic Times:

According to analysts, gold prices are likely to settle around Rs 29,000 to Rs 32,000 per 10 grams in the near term …

Gold prices in the capital fell by Rs 220 to Rs 31,000 per 10 grams on Wednesday, so there we have it. Gold per 10 grams to go up nominally by at most ~3%, from Rs 31,000 to Rs 32,000, with a good chance of falling by ~6% to Rs 29,000 as well. This, mind you, is a nominal price increase. Inflation in India runs at around 8% per year, so whichever way you cut it, investors in India are expecting a drop in the price of gold in real terms.

[An expected drop in the price of gold] is not surprising, as the Indian government has been trying its level best to curb gold consumption by Indians [as I discussed in a previous posting** on Seeking Alpha entitled Can Gold Survive Lack Of Demand In India? in which I said the following:India consumes about 25% of the world gold demand, and these days it is buying less and less of the yellow metal.

India has historically been the country that drove world gold demand even when there was no rush to gold in the Western world. Indians have strong cultural and economic reasons to buy gold.

- The economic reason is straightforward. Inflation in India has been high for a long time, in the 5-8% range. Gold is therefore seen as a store of value.

- There are also strong cultural reasons, in that Indian brides are supposed to be gifted gold jewelery.

- Coupled with the fact that in rural India there are very few financial institutions (though that is changing) and hence fewer opportunities for alternative investments, gold has for a long time been the store of value for Indian families, especially from the rural regions – and India is still, by and large, a rural country.

However, this level of gold consumption puts the Indian government in a sticky situation. India produces very little gold locally. It imports most of its gold and in the 2011/12 fiscal year…[that] amounted to $58B…[or] about 3% of the Indian GDP….To add to the problem, India has a persistent current account deficit…[at]around 4% of GDP per quarter, or about $17B.

Naturally, the Indian government doesn’t like this, so it has taken some steps to stop the gold import.

- It raised import taxes to 10%, which means now a gold investor has to wait for more than a year at current inflation rates for the investment to make sense.

- More importantly, it banned banks from issuing loans for the purpose of buying gold.

So, gold demand has promptly collapsed in India. In 2011, India imported about 1000 tonnes of gold. The 2012 numbers are looking like 800 tonne. and in 2013? Well, the projections are 550 tonnes, a whopping 45% decline from 2011 levels….

When the entity that buys 25% of global demand decides to slim that down by 45%, I posit prices will follow suit.]

Jewelers are expecting higher sales during the Pongal festival but Reuters reports that retail demand remains weak….and the culprit, according to Wall Street Journal reports… is that investors eye stronger gains from equities.

Here is the trouble:

- If equities return more than gold, Indians will buy less gold.

- That will push pressure on gold demand and hence price, and make equities look even better in comparison to gold.

- This cycle will feed on itself as gold keeps getting more and more out of favor.

- Historically, Indians didn’t have too many places to invest outside of gold but that is not true any more.

With the economy forecast to do better in 2013, equities will likely boom, and smart Indian investors are making the bet.

Conclusion

Given the above, I continue to urge caution to gold investors…. I believe both physical gold and gold mining stocks will continue to struggle in 2013 as Indians turn away from gold. However, I also know how the gold market goes – it is not in any way based on fundamentals, it is all about sentiment – so I am not about to short gold, but I must say I am sorely tempted. That said, I believe gold investors can still make upwards of 50% this year. I explained that in my article Make a 153-174% Return – With 95% Confidence – IF Gold Goes Up Just 10% in 2013! Here’s How [and silver investors too – Read: If You Think Silver Is Going To Increase In 2013 Here’s How to Best Maximize Your Return].

Happy investing.

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- FREE

- The “best of the best” financial, economic and investment articles to be found on the internet

- An “edited excerpts” format to provide brevity & clarity to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you!

- Sign up HERE and begin receiving your newsletter starting tomorrow

- You can also “follow the munKNEE” via twitter & Facebook

*http://seekingalpha.com/article/1085551-gold-cannot-seem-to-make-a-move-even-with-fiscal-cliff

**http://seekingalpha.com/article/1065141-can-gold-survive-lack-of-demand-in-india

Related Articles:

1. Make a 153-174% Return – With 95% Confidence – IF Gold Goes Up Just 10% in 2013! Here’s How

I am not a big fan of gold [and believe that the best we can expect for 2013 is that it will go sideways.] That said, [however,] I believe that there is still substantial money to be made from a such a sideways movement [and much, much more should it actually increase somewhat in price. This article explains exactly how.] Words: 691; Charts: 2

2. If You Think Silver Is Going To Increase In 2013 Here’s How to Best Maximize Your Return

I am not normally a big fan of precious metals but in 2013 I am an unabashed fan of silver. If SLV were to return 15% next year there is a 95% probability that a ProShares Ultrashort Silver ETF (ZSL) put option on SLV would return 80%+! [Let me explain how I have come to that conclusion.] Words: 985

3. What’s Going On With Gold & Silver?

It would seem logical that the precious metals should be moving a lot higher after the FOMC announced its latest QE program. How is it possible that the market is dumping like this, in conjunction with a concomitant decline in the dollar? [Let me] explain from a technical perspective what is happening. Words: 700; Charts: 3

4. The Reason Gold Has Been Declining Is Simply This…

There have been many motives offered for the recent and ongoing plunge in gold and silver prices since the start of October from sentiment to a supposed trade against the Euro, etc, etc. but the true reason is a lot more prosaic. It’s old fashioned liquidation. Let me explain. Words: 257

5. Goldbugs, Here’s Why Gold’s Long Bull Run Could Be Over

Gold is sought after and saved when its price is rising in anticipation of rising inflation, or on concerns created by the collapse of currencies and in the final stage of long bull markets in any asset, prices often continue to rise further for no other reason than that they have been rising so dramatically for so long, making investors confident they can extend expectations for more gains in a straight line into the future, rather than thinking cycles. [That begs the question no gold bug wants to contemplate “Could gold’s long bull run be over?” Let’s try and answer that question.] Words: 814; Charts: 3

6. Is Gold’s 13 Year Run Almost Over?

[While] the price of gold has gone up for 12 straight years, and is on pace to make it 13 when this year comes to a close, it seems that despite all of the gold bugs calling for the metal to surge to unbelievable highs, major financial institutions are calling for the gold bubble to finally burst in the coming months. [Let’s examine what they and others have to say.] Words: 450

Gold’s loss of momentum in the past months has predictably brought out calls to short gold. [This article offers] a brief guide to whether you should consider or ignore these [suggestions]. Words: 1184; Charts: 1

8. It’s Time to Seriously Consider SHORTING Gold – Here’s Why

I view the current market weakness in gold, coupled with the pullback in trader positions, as a shorting opportunity which is strong in terms of reward vs. risk. I have come to that conclusion by questioning the assumptions that many make about it, isolating its fundamental drivers and providing a trading recommendation as to where I believe the price is headed in the future. Let me share my analyses with you. (Words: 1440; Charts: 4; Tables: 1)

9. 7 Indications That Gold & Silver Bearishness Most Likely Will Continue

This article looks at 7 reasons why gold and silver should experience further weakness over the days/weeks ahead. (Words: 206; Charts: 5)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money