Until policymakers see the light, it’s very slow and steady as she goes, with a chance of higher inflation on the horizon. This is not necessarily bad for the stock market, however, since I continue to believe that both stocks and bonds are priced to the expectation that growth will be very weak or even negative in the years to come. [Let me explain more fully.] Words: 696

chance of higher inflation on the horizon. This is not necessarily bad for the stock market, however, since I continue to believe that both stocks and bonds are priced to the expectation that growth will be very weak or even negative in the years to come. [Let me explain more fully.] Words: 696

So says Scott Grannis (http://scottgrannis.blogspot.ca) in edited excerpts from his article* entitled simply Inflation update.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

Grannis goes on to say, in part:

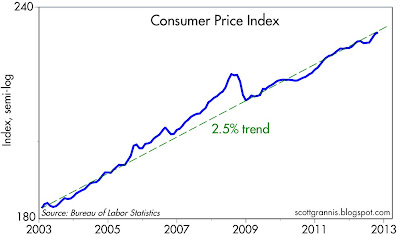

October CPI report was unsurprising, showing inflation at the consumer level running at just over 2%. However, from a long-term perspective, inflation is averaging about 2.5% a year. That’s not particularly troubling, until you realize that the Fed has been trying as hard as possible to push inflation higher.

The above chart plots the consumer price index on a semi-log scale. As the dotted line shows, the index has been rising at a 2.5% annualized rate over the past 10 years, with occasional periods of above- and below-trend growth. (A similar chart using the core CPI would show that inflation has averaged about 2.1%.) The Fed’s inflation target is 1-2% growth in the core Personal Consumption Deflator, and that measure of inflation tends to run about 0.5 percentage points below the CPI so what the Fed has accomplished in the past decade is to deliver inflation at the upper end of its target range.

Who in the world is currently reading this article along with you? Click here

There is absolutely no sign here of any deflation, and that is very significant given the prevailing belief at the Fed that weak economic growth poses a risk of deflation. We’ve had the weakest recovery ever in the past several years, with the economy slipping well below its potential and well below its long-term growth path. The chart below documents this:

In fact, this recovery has effectively shattered three long-cherished beliefs shared by many economists (though not by supply-siders):

- that increased government spending can stimulate growth;

- that accommodative monetary policy can stimulate growth, and

- that weak and below-trend growth is deflationary.

Government is not as all-powerful as statists would have us believe. The Fed can’t pull its monetary levels and fine tune growth, and Congress can’t borrow and spend and expect that to create jobs.

If there’s any mystery here, it is that inflation has not proven to be much higher given the degree of monetary stimulus that has been applied already by the Fed. (I’ve explained why that is the case here.) We haven’t seen worrisome inflation yet, but that’s not to say it won’t happen going forward.

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- It’s FREE

- It contains the “best of the best” financial, economic and investment articles to be found on the internet

- It’s presented in an “edited excerpts” format to provide brevity & clarity of content to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you and bring them to you each day!

- Sign up HERE and begin receiving your newsletter starting tomorrow

There is a large degree of monetary uncertainty in the world, and that helps explain why gold is still trading in the stratosphere and the dollar is very close to its weakest level ever. Moreover, it’s a testament to the inherent dynamism of the U.S. economy that it has managed to grow 2% a year for the past three years in spite of huge monetary uncertainty and in spite of the threat of a massive hike in future tax burdens (courtesy of four years of trillion-dollar deficits).

The above musing beg the question:

- if fiscal stimulus doesn’t work (and it most likely hurts rather than helps the economy), and

- if monetary stimulus doesn’t work (since it only adds to the uncertainties),

- then why does Congress want to keep the pedal to the metal on fiscal policy, and

- why does the Fed want to add even more monetary stimulus?

I’m reminded of the definition of insanity: doing the same thing over and over and expecting different results. Questions such as these are a big reason why economic growth remains lackluster.

A more enlightened fiscal policy would focus on reducing, rather than increasing, government spending, and a more enlightened monetary policy would focus on reducing, rather than increasing, monetary stimulus.

Until policymakers see the light, it’s very slow and steady as she goes, with a chance of higher inflation on the horizon. This is not necessarily bad for the stock market, however, since I continue to believe that both stocks and bonds are priced to the expectation that growth will be very weak or even negative in the years to come.

*http://scottgrannis.blogspot.ca/2012/11/inflation-update.html

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Prepare to Be Nickled & Dimed to Death in the Stock Market Until 2015! Here’s Why

The Dow Jones Industrial Average composite (DJIA) hitting a five year high early last month does not bode well for the bulls. Frankly, I am predicting that the recent five year high…(October 5th) will prove to be the cyclical high in an ongoing secular bear market that has not yet hit its bear market low for this secular bear and that…it will not get to an all-time new high until 2015 at the earliest. Prepare to be nickled and dimed in the meantime! Words: 995

2. Goldman Sachs: The Fiscal Cliff Is a Real & Present Danger to Future Level of S&P 500 – Here’s Why

“Portfolio managers have been swayed by hope over experience” when it comes to anticipating the effects the fiscal cliff will have on markets. Investors aren’t giving as much attention to the fiscal cliff as they should be, and that may be helping to set the markets up for a repeat of last year, when the debt ceiling negotiations sent stocks plummeting.

3. These 6 Factors Suggest Avoiding Equities in the Foreseeable Future

The six factors discussed in this article suggest a near-term peak for equity markets, avoiding fresh exposure to equities at these levels and selling some of one’s equity holdings. Long-term investors can still ignore the volatility and buy quality stocks, however, it would make more sense to buy the same stocks after the markets decline 10%-15% than buying it at current levels. [Let me explain more fully.] Words: 665

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money