In an environment of ultra expansionary monetary policies…the long-term trend for gold is higher and as inflation surges, gold will go ballistic resulting in the Dow-Gold ratio touching one. [Let me explain why that will indeed be the case.] Words: 760

trend for gold is higher and as inflation surges, gold will go ballistic resulting in the Dow-Gold ratio touching one. [Let me explain why that will indeed be the case.] Words: 760

So says the Economics Fanatic (www.economicsfanatic.com) in edited excerpts from an article* posted on Seeking Alpha entitled Is The Dow-Gold Ratio Heading Towards One?

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

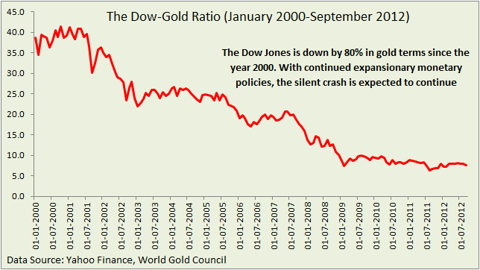

The word crash might be an understatement here, as the equity markets in the United States have slumped by 80% since the year 2000 in gold terms. Many investors will argue that in the period 1980-2000, equity markets trended higher in gold terms. The objective of this article is not to prove that gold is a superior investment and equities are an inferior investment. I just want to stress on the fact that all asset classes might underperform compared to hard assets (honest currencies) in a prolonged environment of expansionary monetary policies.

In the current scenario, interest rates are expected to remain at near-zero levels until mid-2015, budget deficits in the United States is expected to remain above USD1 trillion on an annual basis and the Euro zone crisis promises to be a prolonged one. All these factors combined ensure that governments will continue to print money and the Dow might continue to trend down in gold terms for another decade (if not more).

The chart below gives the Dow-Gold ratio from January 2000 to September 2012.

In January 2000, investors needed nearly 39 ounces of gold to buy one unit of the Dow Jones Index. Currently, investors just need 7.6 ounces of gold to buy one unit of the Dow Jones Index. This is what I call the silent crash in equity markets. In gold terms, the Dow Jones Index is already down by 80% in the last ten years. During this period, the government debt in the United States has nearly tripled and the total credit market debt outstanding has more than doubled. With debt being money in the current financial system, the enormous money creation has supported the equity index at higher levels. However, in terms of an honest currency, the index has slumped.

Who in the world is currently reading this article along with you? Click here

The discussion so far was just the story of the past. The key question before investors is – Will the Dow-Gold ratio continue to trend lower and ultimately reach 1?

I am of the opinion that the Dow-Gold ratio will trend lower over the next decade and there is a high probability of the ratio reaching 1. Again, there are two possible outcomes:

- the Dow Jones crashes and the Dow-Gold ratio reaches one and

- gold surges leading to the ratio touching one.

I believe that # 2 above is the likely outcome – gold will go ballistic at one point of time resulting in the ratio touching one.

Creating and maintaining asset market inflation is one of the primary objectives of central bankers. In order to create asset market inflation, central bankers will continue to flood the financial system with liquidity. This will be positive for the precious metal in the long-term.

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time.

Join the informed! 100,000 articles are read every month at munKNEE.com.

All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read.

Get newly posted articles delivered automatically to your inbox.

Sign up here.

Further, the CBO expects deficits of USD10 trillion over the next ten years for the United States. Funding these deficits would necessitate the creation of more money. At the same time, problems in the Euro zone promise to be prolonged and expansionary monetary policies of the ECB will also lend support to gold.

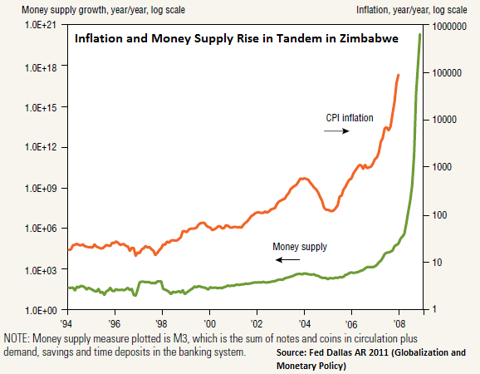

With a lagging effect, money creation does have an impact on inflation and as inflation surges on the back of higher energy and agricultural commodity prices, gold will also trend higher.

(click to enlarge)

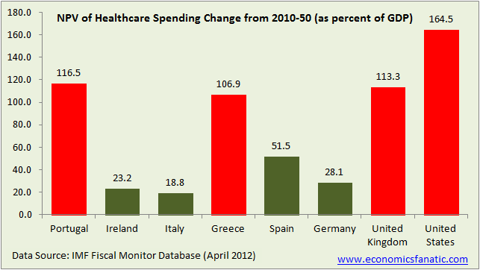

Talking about new money creation, it is extremely important to mention here that governments in the advanced economies have gigantic off-balance sheet liabilities. There is no source of funding these liabilities other than printing money.

The net present value of healthcare spending change (2010-2050) for some of the major advance economies is significant in terms of percentage of GDP.

(click to enlarge)

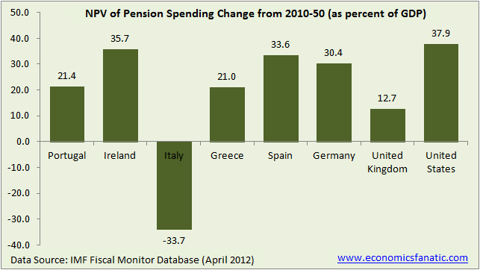

The net present value of pension spending change (2010-2050) for some major advance economies also deserves a mention and will contribute to pressure on government finances in the long term.

Conclusion

Given these factors, it is next to impossible to visualize a scenario where the current money creation exercise will end. Clearly, the long-term trend for gold is higher and as inflation surges, gold will go ballistic resulting in the Dow-Gold ratio touching one.

Of course, by this conclusion, I am not suggesting that one should invest all their savings in gold. Diversification is of paramount importance in the current financial and economic environment. However, having gold and silver along with industrial commodities is essential for every portfolio.

*Source of original article: http://seekingalpha.com/article/911211-is-the-dow-gold-ratio-heading-towards-one

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Asset Allocation: How Sound is the Foundation of Your Portfolio Pyramid?

Regardless of the size of your financial pyramid, without a core-holding foundation, you are building it on sand. Core holdings are for protection, not for profit. They function as insurance against a catastrophe. [Let me explain.] Words: 754

2. Physical Gold and Gold Stocks Should be in Your Portfolio – Here’s Why

Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren’t held in various forms of gold and silver, we…think your portfolio is at risk. Here’s why. Words: 625

3. Believe It or Not: Only 1 Fund Has Outperformed Physical Gold Since 2007!

Out of the 7,500 separate mutual funds available, and with 22,000 shares classes to choose from, only 1 fund – just ONE fund – actually managed to achieve a greater percentage return than gold bullion since the alarm bells rang out at the turn of 2007! [That being said, are you still one of the 99% of investors who, for whatever reason (are you foolishly listening to the “advice” provided by your stock broker/securities salesman going under the guise of a financial “advisor”), is still without any physical gold or silver?] Words: 395

4. What Does the Future Hold for the Dow:Gold Ratio?

The Dow:Gold ratio is defined as the ratio of the price of the Dow Jones Industrial Average divided by the price of gold [or] how many ounces of gold it takes to buy the 30-stock Dow. The current Dow:Gold ratio of 8.5 is up 21.1% from its 17-year March 6, 2009 low of 7.0 and 81% below its 1999 peak of 44.77. [What does the future hold? Higher gold prices, lower stock prices or vice versa?] Words: 400

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money