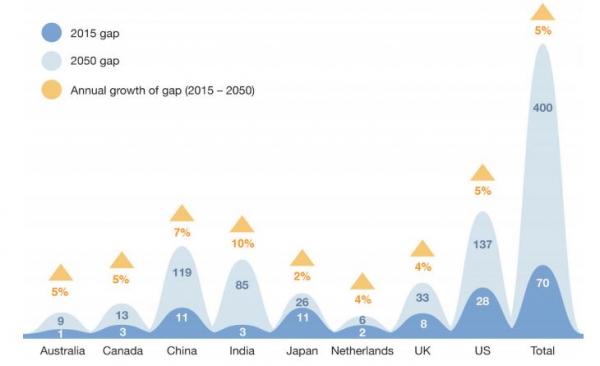

…The global pension outlook is looking bad and a large part of this stems from people living longer and simply not saving enough while they work…By 2050 global pension funds will be underfunded by $400 trillion. Does this sound sustainable?

and simply not saving enough while they work…By 2050 global pension funds will be underfunded by $400 trillion. Does this sound sustainable?

The global pension problem

There are some major reasons as to why this problem is occurring.

- For one, long-term growth has slowed and returns are simply not looking great. Many pension funds have optimistic return rates that are just unsustainable. We are in a lower return market.

- Another issue is that people simply do not save enough for retirement. In the U.S. half the country is living paycheck to paycheck. The recommended savings rate is 10 to 15% of annual salary but that just isn’t happening across the board. With the shift from defined benefits to 401k casinos, people are now left with virtually nothing for retirement (outside of Social Security).

Take a look at how underfunded global pensions are:

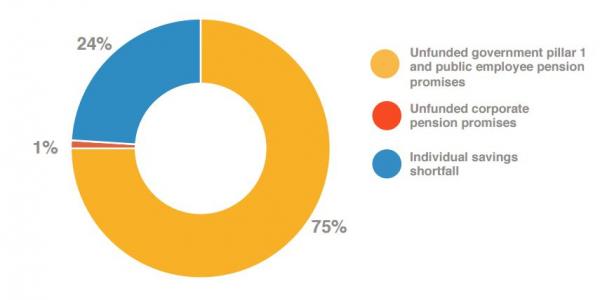

This problem is only going to get more pronounced. This of course has to do with people living longer and the fact that globally we are entering into a slower growth phase. You can see that by 2050 pension obligations are going to balloon to dramatic levels and it comes from this:

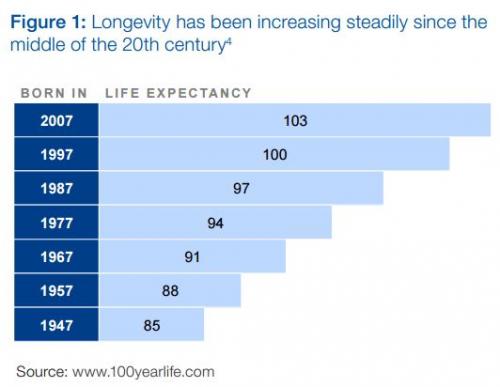

What does this mean? For those with pensions expect lower payouts. For those without, you need to start saving if you are able to do so. Because overall people are living longer:

Is this a good thing? Sure if your quality of life is up to par, but we know that as we age the cost of healthcare just goes up as our biological bodies deteriorate. In the U.S. people are simply walking closer and closer to the financial edge and are gearing up to dive off it with no parachute.

The American pension system has slowly disappeared since the early 1980s and has been replaced with 401k style investment options. Now, nearly 40 years later, that change shows that the vast majority of people just don’t put money away on their own. Hence, nearly half of the U.S. elderly rely fully on Social Security as their primary source of retirement income.

We need to think about what this will mean when low wage jobs dominate the landscape and the middle class is in a minority. Are we ready to deal with a $400 trillion underfunded pension system globally – and this of course is assuming that we don’t hit any type of recessions or crisis in the next three decades? How likely is that?

The comments above are edited ([ ]) and abridged (…) excerpts from the original article by MyBudget360.com

Thanks for reading! If you want more articles like the one above visit our Facebook page (here) and “Like” any article so you can get future articles automatically delivered to your feed. You can also “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner).

Remember: munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money