The very nature of the question used to solicit rates from the contributing banks to establish the LIBOR (London Interbank Offered Rate),  tells you all you need to know. The banks are asked, in effect, “At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?” The bank is supposed to submit a rate where they think they could borrow, not where they actually borrowed, or where they would lend to other contributors…and, as such, LIBOR has always had an element of “gamesmanship” if not outright lying. [Here’s what you should know about what LIBOR is, how it is established and why you should really care.] Words: 1100

tells you all you need to know. The banks are asked, in effect, “At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?” The bank is supposed to submit a rate where they think they could borrow, not where they actually borrowed, or where they would lend to other contributors…and, as such, LIBOR has always had an element of “gamesmanship” if not outright lying. [Here’s what you should know about what LIBOR is, how it is established and why you should really care.] Words: 1100

So says Peter Tchir (www.MarketAdvisors.com) in paraphrased excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Tchir goes on to say, in part:

How is LIBOR calculated?

The BBA provides pretty detailed analysis of the process. The key here is what the rate is meant to be. The contributors, are supposed to submit a rate for each currency they contribute for overnight, one week, two week, and monthly out to a year….The bank is supposed to submit a rate where they think they could borrow, not where they actually borrowed or where they would lend to other contributors.

[Why should you and I care about any of this? Because LIBOR is used as the foundation for a host of other interest rates. Everyone is affected by LIBOR: it influences the payments made on mortgages and personal loans, and those received on investments and pensions.]Right from the start the question raises questions that have been discussed for years:

- How can a bank “know” where some other bank will lend them money?

- Can’t they use transactions?

- Can’t they get firm “offers” from other banks?

- Why not have the banks submit levels where they would lend to other banks?

The very nature of the question used to solicit rates tells you all you need to know. LIBOR has always had an element of “gamesmanship” if not outright lying.

In general, banks will tend to submit lower rates and attempt to artificially lower LIBOR. There are two reasons for this:

1. The Signaling Effect: Banks don’t want to say it would cost them more money to borrow than their peers because that would be admitting to weakness and may cause their lenders to pull back and create a financing freeze. Each contributor’s LIBOR indications are published so if a bank shows up with a particularly high estimate of what it would cost to borrow, it would attract unwanted attention. It may be the truth and should be evident in the CDS and bond markets, but for some reason banks remain concerned about the signaling impact and tended to skew LIBOR submissions lower than they should have been.

2. Risk and P&L Impact: The big banks always have a lot of risk associated with LIBOR. It will affect:

- their borrowing costs,

- what they receive on floating rate loans and

- the value of their interest rate derivative books.

It might have other secondary impacts, but those 3 areas are big.

It is probably safe to say that banks in general benefit from lower LIBOR, but that won’t be true for all banks and won’t be true for all days. There are occasions where banks may benefit from a higher LIBOR. If they have a disproportionately large amount of floating rate loans resetting on that day, they may benefit by having LIBOR higher that day, thus locking in slightly higher income for that period. Someone at the bank will know their exposure to the LIBOR setting on any day, and it would be hard to believe that on days when the exposure is large either direction, the group that submits it would be unaware of the potential P&L impact.

Take Note:

The above reasons are a dangerous concoction. The question they are asked (“At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?”) leaves a lot of wiggle room, and banks that may have strong incentives to use that “wiggle” room.

Controls and Actual Calculations

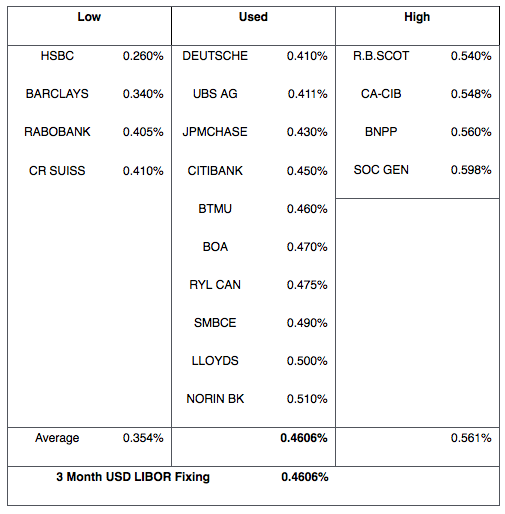

For me, the single most important rate is the 3 month USDLIBOR rate. It certainly impacts Americans more than any other rate calculated by the BBA. Here is yesterday’s submissions, and the calculation.

There are 18 banks that submit U.S. LIBOR. The 4 lowest rates and 4 highest rates are thrown out for purposes of the setting. Then LIBOR is set as the average of the remaining 10 rates.

You can see the wide discrepancy in rates. HSBC and Barclay’s clearly think they have easy access to money. SocGen and BNP seem to think it would cost them a lot of money relative to the others. There is no indication how much borrowing and lending is occurring in the interbank market, so there is no easy way for an outsider to tell if this reflects reality or not. JP seems conservative given that their 5 year CDS trades at 125 which is similar to HSBC’s 120 level. Barclay’s 5 year trading at 205 would indicate a possibly optimistic view of where they could get short term funding, and Citi and BAC barely behind JPM again seems a bit optimistic given their CDS trade at 235 and 250 respectively.

By throwing out the outliers, and using a relatively large pool to calculate the average, the BBA attempts to mitigate the risk of any one bank skewing the setting. The problem is that it doesn’t do much if multiple banks collude to manipulate the setting. If multiple banks have the same incentive to skew their own submission, and worse yet, communicate that to “friendly” banks, then the BBA methodology breaks down further. The problems with the BBA methodology is there is no confirmation that the rate submitted is reasonable, and nothing is done to protect against group rather than individual bias in their submissions….

Ultimately the LIBOR setting process will have to change. The current process is too vague. There have been some calls for an alternative to LIBOR, but with so many contracts outstanding, I think that is unlikely. It will be far easier to just amend the methodology and try to improve the existing LIBOR process rather than starting an entirely new rate series….

*http://advisoranalyst.com/glablog/2012/07/04/libor-everything-you-want-to-know-but-were-afraid-to-ask/#ixzz2034nPg5h (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

3. LIBOR: The Crime of the Century

4. LIBOR Was a Criminal Conspiracy From the Start

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money