The permabears are coming out the woodwork. Bad, scary articles and news seem to attract more attention and eyeballs than good news articles or those that offer a counterbalanced view. Whenever someone gets interviewed on US TV, it’s for someone proclaiming the end of the expansion – you never see them interviewing someone offering a counter view of a more positive nature. This article gives you a balanced, opposing view to the tiresome popular perma-bear consensus so that you can make your own balanced decision. [As for our own conclusion, we don’t see imminent recession. Here’s why.] Words: 1315

seem to attract more attention and eyeballs than good news articles or those that offer a counterbalanced view. Whenever someone gets interviewed on US TV, it’s for someone proclaiming the end of the expansion – you never see them interviewing someone offering a counter view of a more positive nature. This article gives you a balanced, opposing view to the tiresome popular perma-bear consensus so that you can make your own balanced decision. [As for our own conclusion, we don’t see imminent recession. Here’s why.] Words: 1315

So says Dwaine Van Vuuren (www.recessionalert.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Van Vuuren goes on to say, in part:

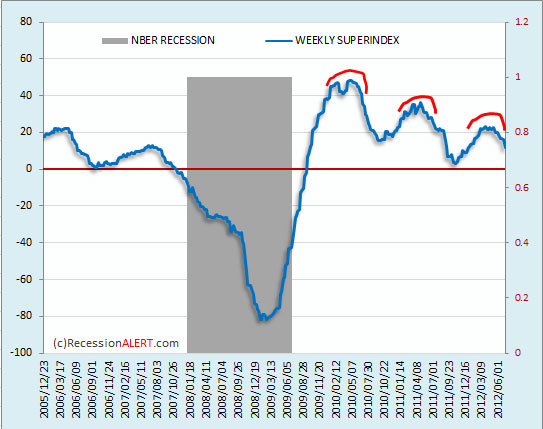

We find ourselves in the 3rd “summer slowdown scare”, just like 2010 and in August 2011. During this time the perma-bears crank up the alarm bells and we are bombarded with a cacophony of ill tidings that spell the doom of the U.S economy. As we saw in 2010 and 2011 the economic slowdowns turned out to be “soft landings”. Investors scared into the side-lines stared in disbelief as the U.S stock markets roared ahead leaving them behind. We may well be in the same position now.

I was so exasperated with the despair been painted in the U.S. that I penned an article…titled “U.S. Recession – an opposing view”…. and the models I presented in the January 2012 article are still far from recession territory [although, granted,] they are also far from full blown expansion. The U.S. economic growth remains tepid and sub-par, vulnerable to the slightest external shock. Risks are not negligible, but neither are they full-blown.

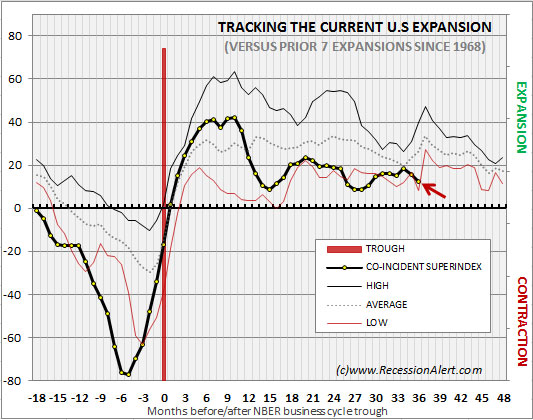

The track of the co-incident SuperIndex versus the last 7 business cycles [as shown below] aptly describes the tepid growth situation we find ourselves in – we are on the verge of printing a new historical low-watermark for growth after 36 months of expansion.

Looking at the Leading SuperIndex, I think we are a bit worse off than last summer and the summer before that. We just put in a leading SuperIndex peak…that is lower than the prior two peaks. This slowdown, if not checked in time, may well be the one that pushes us over the edge but that is still 2-3 months away using the SuperIndex recession-path projections in our regular weekly report.

I have a deep suspicion of any single indicator or even composite indicator as a single source of a recession call. Recession calls are “high stakes” events; the costs of being wrong are high. I prefer to use an ensemble approach (Recession Forecasting Ensemble or RFE for short) of 6 different and diversified leading, coincident and lagging systems, waiting for consensus vote confirmation before placing recession calls. The longer the lead a system offers the higher the likelihood of error. I do not use systems with 9-12 months leads because of this reason, but also because my firm’s research shows that any defensive stock market actions earlier than 5 months before recession is likely to be unproductive anyway (See “Recession – just how much warning is useful anyway?”)

Take Note:

We also do not advocate single “all or nothing” reaction to recession signals. Because no system is perfect or likely to continue being perfect and nobody has yet managed to perfectly model an economy and its likely behaviour, we prefer a staged-action approach with our RFE to adjust to increasing market risk. Typically the longer leading models in the RFE will flag recession first and the co-incident and lagging ones last. As more and more models in the RFE flag recession we move more and more into cash (or hedge more and more). Hopefully by the time the last coincident model flags recession we are mostly in cash or fully hedged.

None of the RFE models are flagging recession. Of the 9 SuperIndex components, only the ECRI WLI, Philly Fed Survey and the ISM PMI are nearing recession territory. Of course a couple more weeks’ bad data and things could change quickly.

If we look at the Philly Fed 50-state leading and co-incident indicators (which have a much shorter history than all the other models we use, hence we look at them separately) we are not in recession territory either. Not out the woods but not in the clutches of the fox either.

The NBER are the arbiters of recession dating. They take forever to proclaim specific starts and ends to expansions so all the revisions can “work their way through” and they can be dead accurate. Given these proclamation lags can take up to 12 months [and, as such,] their announcements are good for historical, academic and back-testing use only. Now, given that many reputable people are claiming we (1) are already in recession or (2) are about to enter one, let us put all our fancy models aside and look hard at what the NBER will be looking at. They will be examining 4 co-incident indicators:

- Industrial Production

- Real personal income less transfers deflated by personal consumption expenditure

- Non-farm payrolls

- Real retail sales deflated by consumer price index

You can track these together on nice monthly charts at the Federal Reserve Bank of St Louis which gives “some idea” about if we are in recession or not but is a bit difficult to determine how far from recession we are. The second determination is a bit more important to the stock market operator or fund manager than the first.

If we take real-time vintages (no revisions, just what the model would have observed in real time when data is published) of the above 4 components and build them into an economic index to appropriately describe NBER-defined recessions and expansions then we get the below chart:

Now the problem with this model is that is has an average 1 months lag to NBER recession (some are leads but most are 2 months lags). The real-time data set has components that represent the prior month and we also have a publish lag to consider, hence the 2-months lags. Considering you get to know if we are in recession at worst two months into recession, however, it is a hell of a lot better than the average 8-12 months lag from the NBER committee. Unlike the SuperIndex and the other RFE models we deploy, the purpose of hauling out this model is not to warn you of recession but (1) confirmation of last-resort if you are in recession and also (2) give you an idea how far we are from possible recession.

We note that some more damage is yet to come before we can declare a recession. Points in time where we were at current levels and then descended straight into recession are highlighted with red circles. Apart from December 1973 (when we were indeed in recession) there was an average 6 months before we entered recession with minimum 3 months and maximum 12 months. This means at worst we can fall into recession in September to December 2012 (assuming of course we are not in a December 1973 scenario which is historically probable 1 out of 7 times but unlikely.)

No model is infallible. Recession forecasting and dating is an art more than a science. We can try our best using the best models and adopt risk-adjusted stances to the market with our equity allocations. [As such,] it is neither impossible nor unfeasible that what the permabears are saying could come to light and we do indeed fall into recession sooner (or are already in one as many claim) but I think it unlikely according to the models and methods I prefer to use.

Are there elevated risks? Certainly! Do these quant models exclude external risks, black-swans and shocks? Absolutely! I do not claim perfection in an imperfect world.

In the end you have to make up your own mind- but at least this article gives you a balanced, opposing view to the tiresome popular perma-bear consensus so that you can make a balanced decision and not be blindsided by an unexpected or unconsidered result.

*http://recessionalert.com/here-we-go-again/ (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Probability of Global Recession Increasing – Here’s Why

This past week we received the latest PMI readings for the world as a whole (48.9), the eurozone (46.4), and for 30+ individual countries [Read: Telling It Like It Is: Latest PMIs Reveal Truth About the Global Economy]…and the latest numbers signal contraction and even more so when adjusted to reflect the concentration of GDP by countries/region. [Let me explain.] Words: 600

We are in a number of crises: the sovereign crisis, a banking crisis, an economic crisis and a social crisis. The first three crises together are guaranteed to bring down the world economy because they are not just in one country, they are worldwide….A social crisis will develop leading to even more social unrest. All of these factors are why this will ultimately lead to a hyperinflationary depression – the most serious depression the world has ever experienced – and why investors have to focus on protecting their wealth.

3. Campbell Comments On: “Is This 1931 All Over Again? Krugman, Roubini and Ferguson Think So!”

Why read: It is foolish not to consider the possibility of depression, particularly in the face of the preponderance of commentary over the past many months that rampant inflation is on the horizon. [Here I review, analyze and comment on one such article on that possibility.] Words: 697

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money