As I see it, worsening financial crises lead initially to lower gold prices which are followed by some form of government intervention to alleviate the crises and that action, in turn, eventually results in renewed appreciation in the price of gold. The basic steps in such a transition are really quite straightforward. Let me explain. Words: 686

So said Plan B Economics (www.planbeconomics.com) in edited comments from their original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

Why Does Gold Fall When a Financial Crisis Worsens?

Investors need to understand two things:

- gold is priced in US dollars meaning that as the dollar rises the price of gold falls, all things being equal. The dollar is quickly rising because it is a safe haven (US Treasuries are a safe haven that must be purchased in US dollars) and because asset liquidations around the world are gaining speed causing a growing shortage of dollars.

- gold…is a source of funding for margin calls made on declining assets. This means that gold is undergoing a degree of “forced selling.”

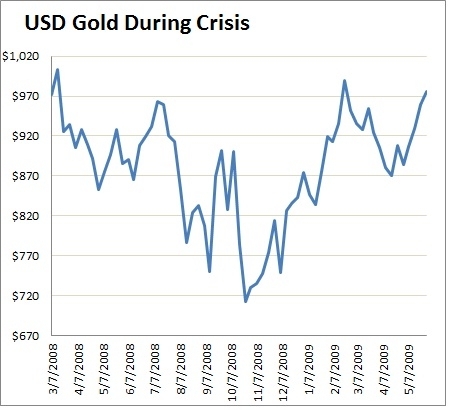

One only has to go back a couple years to see how gold reacts during a financial crisis. The chart below shows the price of gold during the financial crisis…in March 2008…During this time, gold prices fell by about 25% and subsequently recovered all losses. This was a scary ride for anyone holding gold at the time, but it’s an incomplete view of gold’s performance during the crisis.

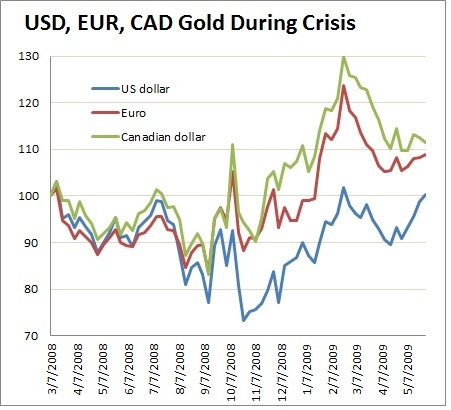

The second chart below shows gold during the same period priced in US dollars, euros and Canadian dollars (indexed to 100 for comparison purposes). During the 2008/2009 crisis…the US dollar was rising while the euro and Canadian dollar were falling and this is reflected in the different gold prices. Gold priced in Euros and Canadian dollars fell less and recovered faster than gold priced in US dollars. This is precisely because the US dollar was so strong during that period. However, as the monetary response began to unfold (QE1 announced December 2008) and trillions of US dollars were unleashed to backstop the financial system, gold in all currencies began to rally dramatically.

- Economic/financial crisis leads to asset liquidation and dollar shortage

- Dollar shortage leads to dollar appreciation and gold depreciation (in dollar terms)

- One form of asset liquidation – forced gold selling – leads to gold depreciation (in all currencies)

- Eventual monetary response creates surplus of dollars

- Surplus of dollars causes dollar depreciation and gold appreciation

Should I Buy, Hold or Sell?

For US investors, in my opinion, a crisis in which a skyrocketing dollar sends gold plummeting in US dollar terms could create a big gold buying opportunity, like it did in 2008…[although it] could take months to fully materialize…

For non-US investors that own gold, pay attention to the price of gold in your domestic currency because, unless you have hedged, your exposure is relative to your home currency, not US dollars.

*http://www.planbeconomics.com/2011/09/23/how-gold-performs-during-a-financial-crisis/

Sign-up for Automatic Receipt of Articles in your Inbox or via

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet edited for clarity and brevity to ensure you a fast an easy read.

Related Articles:

1. Gold: What the !@#$%^&* Is Going On!

Over the past few years, pretty much every investor has become familiar with gold. The shiny precious metal has surged in price and has managed to hold strong while broad indexes have slipped, highlighting its appeal as a diversification agent and safe haven investment. This has prompted many investors to ramp up their allocations to the space in order to take advantage of these favorable trends and lead their portfolios to broad gains…[but] there are a number of other issues that investors need to be aware of when considering allocating capital to the space, as there are several reasons to avoid the precious metal from an investment perspective. Below, we highlight seven reasons for why investors may want to temper their expectations for the metal and consider a more diversified approach that doesn’t include such a large allocation to the ‘barbaric relic’. Words: 2030

4. Hold On! It’s Far Too Early to Sell Your Gold and Silver

We are at an important crossroads in this commodities bull market,,,[where] even the most fearless bulls are tempted to give up – to sell out of their positions and consider themselves lucky that they were able to be along for the ride and to escape with any profits at all – but I have posted a chart below to help remind you of the real danger in “getting out” now. Words: 350

5. Why Have Gold & Silver Been Selling Off? Here’s the Simple Answer

What’s going on? If gold is the great anti-asset, the thing to hold when everything else is in collapse why is it now trading…[below $1,700 and] not $2,000? Words:1147

10. Gold as a Safe Haven is Worthless!

If there is one thing we’ve learned about gold in recent years – and recent days – it is this: gold is not a haven investment… There are many theories about gold’s correction. [Let’s take a look.] Words: 781

11. Aden Sisters: Buy Gold NOW as it Corrects on its Way to $2,000

When you just consider the downgrade of U.S. debt, the jobs problem, the housing situation, the European bank concerns and their debt crisis, the negative outlook for the global economy, not to mention that the Fed will likely seek new measures to help the economy, we just don’t see gold coming down any time soon, other than having a normal downward correction [as currently is the case. Let us show you why.] Words: 1102

12. Ian Campbell’s Commentary: Gold – The Safest Haven?

Is physical gold the best available ‘safe-haven’ or is it the U.S. dollar – or perhaps even U.S. Treasuries? Words: 793

13. How Low Will Gold Go in This Correction?

Gold is in the second phase of a Bump-and-Run Reversal Top pattern, which typically occurs when excessive speculation drives prices up steeply, and is now at a critical juncture where substantially lower prices could be realized. Let me explain. Words: 339

14. What Should a Prudent Gold Investor Do Now?

We are in an environment where gold bugs boldly proclaim that gold is going to the moon, and gold bears strongly protest that gold is in a bubble. At such a heated stage, this article attempts to answer the question, “What is a prudent investor to do now?” Words: 575

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money