The world is in an absolute mess, economically, financially, politically and morally… and this has been evident for at least 10-15 years. The only thing that is not clear is how long governments and central banks can deceive the people by kicking the can down the road in an endless creation of worthless pieces of paper that they call money…The world is now staring into the abyss and we are most likely entering the Dark Years which I wrote about two years ago. The consequences will almost certainly be unlimited money printing and a hyperinflationary depression [which will result in dramatic increases in the price of gold. Let me explain.] Words: 2004

So says Egon von Greyerz (www.matterhornassetmanagement.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. von Greyerz goes on to say:

In spite of a seven fold increase in the gold price over the last 10 years, only circa 1% of world financial assets are invested in gold…Major institutional investors not only do not own gold, but they don’t understand gold either…They don’t understand gold’s role as an investment class or the fact that measured in real money, i.e. in gold, their investments are declining precipitously. It must be unprecedented that an important asset class can go up for such a long period with so few investors participating. In my view this is the most bullish sign ever for gold.

The World Will See Unprecedented Money Printing

The mess the world is in will lead to unprecedented money printing in the U.S., EU, the UK and many more regions and gold will continue to reflect the destruction of paper money. In addition, investors will increasingly mistrust paper gold and invest in physical gold only. Due to the very limited availability of physical gold, the increase in demand can only be satisfied at substantially higher prices.

Sky is the Limit for Future Price of Gold

There are many ways to project how high the gold price can reach. Here are a few:

- $53,000/ozt.: Adjusting gold for real (not the published, manipulated) inflation the price would be circa $7,500. At the recent GATA conference, Adrian Douglas put forward a target of $53,000 an oz based on M3. He said that that out of every 33 oz of gold traded 32 oz are paper gold, which would lead to a price projection of $53,000 also, if all trading were backed by physical gold.

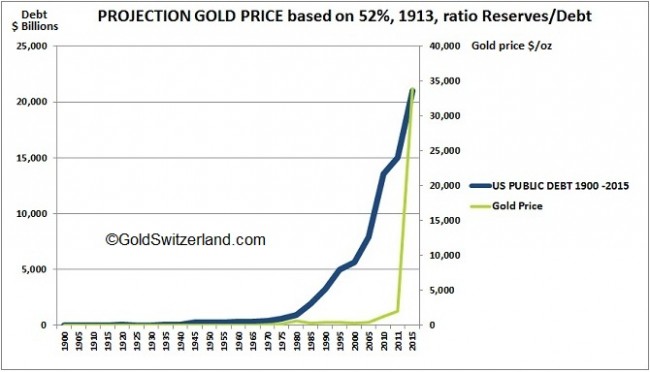

- $27,000/ozt.: If the U.S. gold reserves were at the same percentage (52%) of U.S. debt as in 1913 when the Fed was founded gold would be $27,000 today and going up to $33,000 in 2015 with a projected increase in debt of $ 6.5 trillion (6.5T).

The above projections are subjective and therefore somewhat arbitrary, however, whatever method is used, gold is undervalued on any measure. We are not just talking about a substantial undervaluation but more importantly that paper money is likely to be totally destroyed in the next few years with the gold price reflecting this obliteration. It is absolutely impossible to forecast how much money will be printed but the flood of paper could lead to many zeroes being added to the gold price just like in any hyperinflationary economy…Gold (and silver) is a critical asset to hold in order to preserve wealth against such a hyperinflationary destruction of paper money. [Go here to read von Greyerz’ personal projection for the future price of gold.]

What the Future Holds for Physical Gold

-

Circa 96% of all gold trading is paper. For anyone who demands delivery, there will be no gold to deliver.

-

Currency wars will lead to the U.S. government taking back (confiscating) whatever gold it has lent to bullion banks as well as gold it holds for other nations (most of Germany’s gold is said to be held in New York) according to Jim Rickards as well as

-

a potential 90% windfall tax on gold.

In a subsequent King World interview (click to listen), Eric King discussed with Rickards that the U.S. government has keys to Via Mat’s US vaults.

It is of course not possible to predict what desperate governments will do, nor is it possible to protect yourself against every eventuality. What is very clear, however, is that simple action [such as the following,] can and will give investors a better chance of preserving wealth:

- Only buy physical allocated gold/silver bars or coins

- Store the gold outside the country where you are resident.

- Store the gold in a country with a stable political system (like Switzerland)

- Store the gold outside the banking system in vaults with no US connection.

- Make sure you have personal access to your gold and/or silver

Gold Making New Highs Across the Board

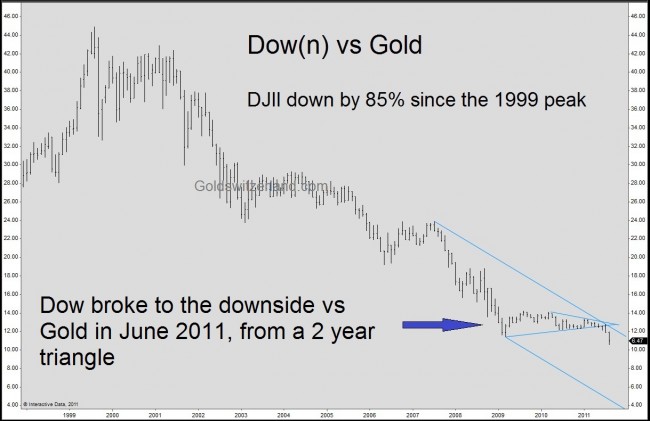

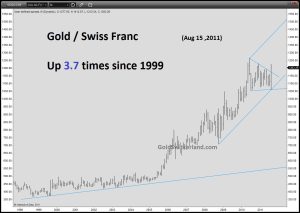

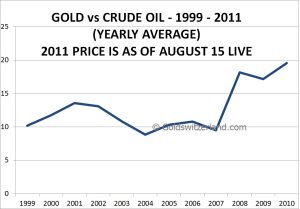

Gold has recently made new highs against most currencies. In addition, after longer consolidations, the Dow is breaking down against gold (down 85% in 12 years), and gold is breaking up against both oil and the Swiss franc [as shown in the graphs below].

These break outs are potentially very significant and will most probably lead to a strong up-move in the gold price in the next few months.

The Can is Getting Too Big to Kick Down the Road

Intellectually dishonest and corrupt politicians and bankers have devised a system which has created perceived, debt-based wealth for the people whilst buying votes and generating massive wealth for the bankers but this Ponzi scheme is now coming to an end. When printed money can only be repaid with more printed money and when there are no buyers for the worthless debt instruments created by governments except for the government itself, then we have reached the end of the road with a “can too big to kick” any more.

This Time IS Different

Throughout history there have been regular periods of credit creation and money printing resulting in a collapsing currency. This happened for example as the Roman Empire was disintegrating starting circa mid 200 AD. So destruction of money is not a new phenomenon as Voltaire said already back in 1729 “Paper money eventually returns to its intrinsic value – ZERO”. So far in history, however, these events have normally been limited to one country or region. Never before in history has there been a financial system which has made it possible for the whole world to simultaneously create unlimited amounts of debt.

Who in the world is currently reading this article along with you? Click here to find out.

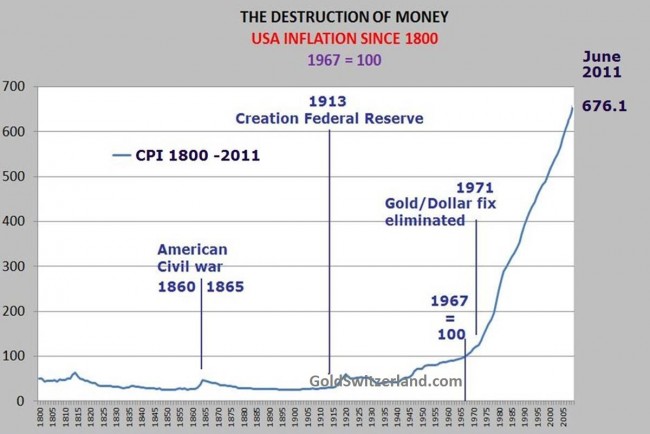

The graph below shows the effect of this money creation in the U.S. but the same applies for many other parts of the world as well. Between the early 19th century and the early 20th century there was virtually no inflation. A house cost the same in 1910 as in 1810 but then in 1913 the fraud in the financial system started. Private bankers in the U.S. created a private central bank owned by the bankers and for the benefit of the bankers. This was when the Federal Reserve Bank was created with ultimate power to print money and thus destroy the value of paper money. This was the most perfect way for private bankers to control financial markets with the total blessing of the government. Thus started a worldwide credit manufacturing scheme that eventually will lead to a collapse of the financial system.

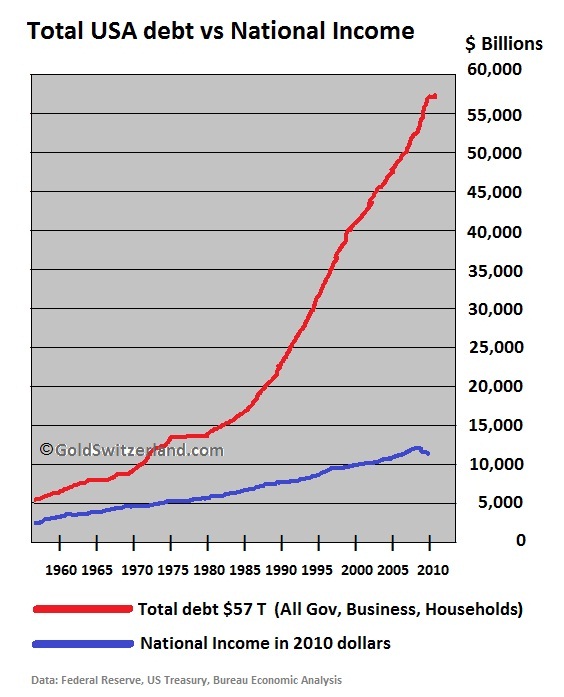

In order to inflate this bubble even faster, Nixon abolished gold backing of the dollar exactly 40 years ago on August 15 1971. Nixon should not have been impeached for Watergate but instead for destroying the world financial system and world economy for many generations. Since the closing of the gold window in 1971, total US Debt (private and public) has gone from $10 trillion to almost $60 TRILLION today.

The U.S. Debt Ceiling Debate Was Irrelevant

The debt ceiling debate in Washigton was totally irrelevant. US Federal debt has increased every year since 1961…and during that time the debt ceiling has been raised 79 times! The real issue is that the U.S. is bankrupt and raising the debt ceiling only exacerbated the gravity of the country’s problems. What they should have agreed instead is a substantial reduction of the debt ceiling – but that doesn’t buy any votes.

Another debt rise agreed of $2.4 trillion (in two stages) will probably last a year at best. Proposed spending cuts of $2.1 trillion will almost certainly never happen but if they do they will be after 2013 and probably mainly take place at the end of a 10 year period starting from now. In the meantime the debt is likely to increase by tens of trillions of dollars.

The U.S. Debt Situation is Unsalvageable

The exponential growth in debt in the last 100 years has created a false prosperity by mortgaging the future for many generations for the benefit of current consumption. Wealth based on credit does not only steal from future generations but creates the wrong values based on debt, greed and materialism. Values such as honesty, integrity, courteousness, righteousness, respect and kindness have totally disappeared in large groups of the population – and the family is no longer the kernel of society. Recent social unrest and riots in the UK is an inevitable consequence of this social decadence. With youth unemployment at 25% in many countries and as high as 50% in the major cities, this problem will become unmanageable in the next few years. Failing economies and empty stomachs will exacerbate the situation dramatically.

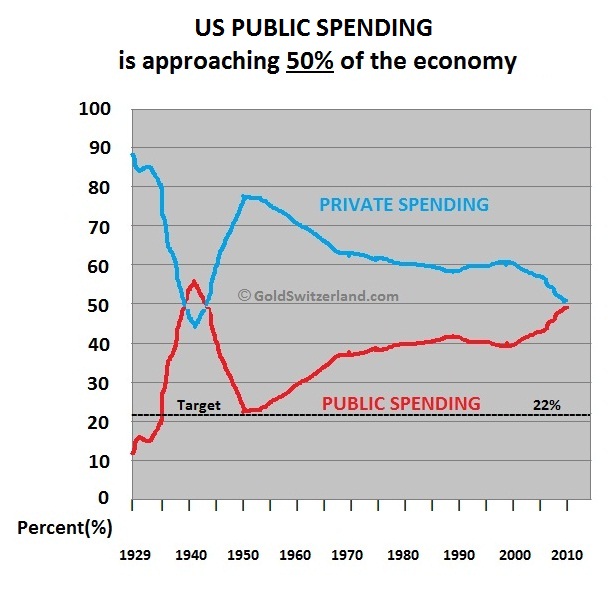

[Furthermore,] since government (and the bankers) control the system by creating money out of thin air, major resources in the economy are transferred from the productive and innovative private sector to the totally inefficient, unproductive and bureaucratic public sector. The public sector only consumes wealth and does not produce anything. By taking invaluable resources from the private sector, consuming most of what it takes and then giving the rest to the most unproductive part of society (the weak, sick, unemployed, work shy etc.), government perpetuates the worst part of the economy and destroys the ability of the nation to expand.The point I am making is that the last 100 years are exceptional in history because this period is based on an unprecedented worldwide debt creation and money printing but not on the natural laws of supply and demand or saving and investment. Exceptional things never last since the laws of nature can only be broken for a limited period…

The EU Will Eventually Break Up

Add to the U.S. debacle, the problems in Europe which are almost of the same severity. The European money markets are now starting to seize up as pressure mounts on the Italian, Spanish and French banking systems. It will be impossible for the milk cow of Europe to continue to support all the weak European countries. Initially the EU will accelerate the money printing because of political pride but like all grandiose political unions, the EU will eventually break up.

In Conclusion

The world is now staring into the abyss and we are most likely entering the Dark Years which I wrote about two years ago. The consequences will almost certainly be unlimited money printing and a hyperinflationary depression.

*http://goldswitzerland.com/index.php/too-late-to-jump-on-the-goldwagon-question/print/

Related Articles:

- Update: These 90 Analysts Believe Gold Will Go to $5,000/ozt. – or More!

- $325/ozt. Silver and $6,800 Gold Quite Possible – Here’s Why

- How Much Gold Should You have in Your Portfolio

- Gold Could Reach $25,000/ozt.! Here’s Why

- $1,700 – $1,800 Still Not Too Much to Pay for Gold! Here’s Why

- Gold is Not an Investment – Gold is Money – and Here’s Why

- Richard Russell: Get Prepared – A Gold Tsunami is Coming

- Gold to Repeat?

- Gold & Silver: the Ideal ‘Buy and Hold’ Investments – Here’s Why

Editor’s Note:

– The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

– Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money