…”We are now at the end of an era which has created unreal wealth for a few and massive debt for most of the world. As all the bubble markets in stocks, bonds, property and other financial assets implode, together with the debt that has fuelled it all, 100s of trillions of dollars will just vanish and never return. The consequences will be both shocking and devastating for most people…”

Prepared by Lorimer Wilson, editor of munKNEE.com – Your KEY To Making Money!

[Editor’s Note: The original article by Egon von Greyerz has been edited ([ ]), restructured and abridged (…) by 63% in this version* to provide a FASTER – and easier – read. Please note: This complete paragraph must be included in any re-posting to avoid copyright infringement.]

2007-9 SOON BACK WITH A VENGEANCE

“The continuation of the 2007-9 crisis is just around the corner.

Governments and bankers around the world have managed to postpone the inevitable for 10 years. That will result in a crisis of a much greater magnitude.

- This time around there is not much margin for lowering rates since they are already negative or very low in most countries

- and the coming money printing on a global scale is very unlikely to save the system.

- The fake financial system based on credit and printed money will soon be revealed.

- Finally, the world will soon realise that it has been living on a lie as printed money can never create wealth…

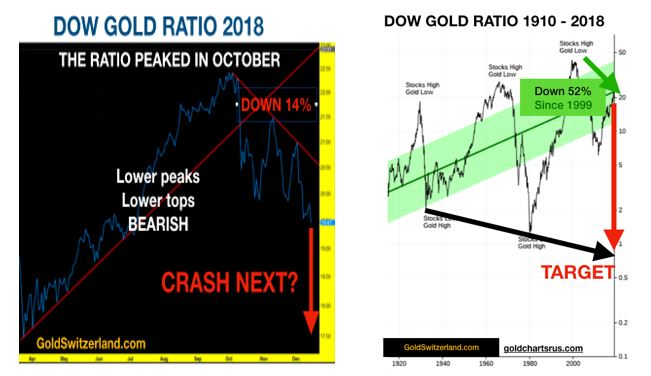

THE FALL OF THE DOW / GOLD RATIO – AN OMINOUS SIGN

The best illustration of what will happen in the next few years as wealth is destroyed is the chart of the Dow – Gold ratio.

- When this ratio goes up, it means that the Dow is going up against gold and when it goes down that gold is gaining against the Dow.

Stocks bottomed against gold in 1980 as the gold price reached $850. Subsequently stocks rose strongly as gold fell to $250 at the end of the 1990s. The Dow then fell 87% against gold from 2000 to 2011.

We have since 2009 seen a strong stock market and lower gold. In spite of that the Dow is still down 52% against gold since 1999. The correction now seems to be over and we have seen the ratio fall 14% since October 2018 as the Daily black chart below for 2018 shows.

The long term fall which started in 1999 is now likely to resume in earnest. A stock market crash is imminent.

- The ratio reached 1 in 1980 which means that the Dow and Gold were at the same level around 850.

- We are likely to at least reach the trend line which is at 0.75 but probably overshoot and see the ratio below 0.5. This means that the gold price will be at least twice as high as the Dow.

- Whether that is $20,000 gold and 10,000 Dow, time will tell.

- It could also be $50,000 gold and 25,000 Dow with hyperinflation.

It is, of course, impossible to forecast the exact level but what is clear is that stocks together with most assets will decline dramatically in real terms which means against gold.

Conclusion

Most people, clients or friends, we know who own gold, do not hold it in order to become wealthy. They do it because they see the unprecedented risks in the world, in markets and in the financial system. They see gold as the best form of insurance or wealth preservation against these risks.”… [What about you?]

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Scroll to very bottom of page & add your comments on this article. We want to share what you have to say!

Want your very own financial site? munKNEE.com is being GIVEN away – Check it out!A note from Lorimer Wilson, owner/editor of munKNEE.com – Your KEY to Making Money!:

“Illness necessitates that I spend less time on this unique & successful site so:

For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here).

If you enjoyed reading the above article please hit the “Like” button, and if you’d like to be notified of future articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Hey Lorimer Wilson,

Your word is right that some people kept gold to support their finance freedom, but they don’t know that by only storing gold can’t make millionaire. To become really wealthy we have to take risk with money.

It is very informative to read your post.

Thanks for sharing this post…