ShadowStat Alternative Inflation Figures Suggest Infation Adjusted Gold Price of $5,476!

Contrary to popular belief, Gold Prices have, in fact, tracked the true inflation rate very closely… and there is a very real possibility that we will have a short-term spike – a genuine investment bubble – in gold that takes us into the $5,000/oz to $8,000/oz range. Words: 748

So says Rob Marstrand in an article* at www.goldnews.bullionvault.com which has been reformatted and edited […] below by Lorimer Wilson, editor of www.munKNEE.com, for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Marstrand goes on to say:

CPI Adjusted Gold Price of $1,753

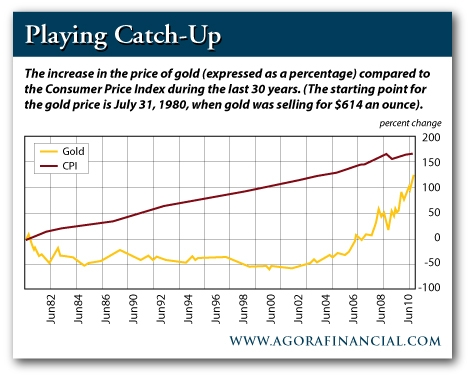

Let’s examine a brief history of the Gold Price relative to U.S. inflation. The Gold Price peaked in January 1980 at $850 per ounce but this peak was very brief… Probably a better reference point for the market top is the average price during 1980 as a whole. This was $615/oz. Since then, the Gold Price has increased only 125%. Over the same timespan, however, the government’s most widely quoted inflation gauge, the Consumer Price Index (CPI), has increased 185%. Therefore, if the Gold Price had increased as much as the CPI, it would be selling for $1753/oz today… but the official inflation figures might not be the real story.

ShadowStats Alternative Gold Price of $5,467 to $7,000

Using alternative inflation figures calculated by ShadowStats.com, consumer prices have soared an astounding 789% since 1980, which means that the inflation- adjusted Gold Price would be $5,467/oz.

Substantiation For ShadowStat Inflation Data

Interestingly, if we look at the market bottoms for gold – 1970 and 2001 – instead of the market tops, the ShadowStats data seem to provide a much more accurate inflation gauge than the CPI. For example, in January 1970 – before gold’s 10-year bull run – the price of gold was just $35/oz. Thirty-one years later – after soaring to more than $800 an ounce in 1980 – the big bear market in gold bottomed out at $256/oz. – and the average price for 2001 was $271/oz. Therefore, during this 31-year period – through gold’s full bull and bear market cycle – the Gold Price advanced 674%. Over the same timeframe, the ShadowStats inflation measure advanced a nearly identical 688%. By contrast, the CPI increased only 370% during this period. In other words, the cumulative CPI readings from 1970 to 2001 failed to account for all the inflation indicated by the rising Gold Price. The ShadowStats figures, on the other hand, were pretty much bang on target.

Don’t forget to sign up for the FREE weekly “Top 100 Stock Market, Asset Ratio & Economic Indicators in Review.”

I’m staying conservative, and there’s nothing to suggest that just because using the ShadowStats inflation worked for the bear market lows it will work for the bull market highs but if the ShadowStats figures above are a guide, then maybe they point to a price north of $5,000/oz for gold – or even $7,000 for a short time.

Conclusion

I’ve just thrown a lot of numbers at you but the point is this: gold looks like it has plenty of upside. Let’s be really clear about one thing, however. I’m not making a hard prediction or setting a price target here. These figures just provide reference points… [however] I can easily see gold getting into the $2000/oz to $3,000/oz range in the next few years – maybe higher and there is a very real possibility that we will have a short-term spike – a genuine investment bubble – that takes us into the $5,000/oz to $8,000/oz.

None of this is certain and it most likely won’t happen smoothly. There could even be big corrections along the way – like between December 1974 and August 1976 when gold fell 47% before powering ahead again. [Be that as it may] I hope I’ve shown you that there are good reasons to think that gold still has plenty of room on the upside.

If you own plenty of gold already, then hang on for the ride. If not, buy Gold on the dips.

*http://goldnews.bullionvault.com/gold_price_inflation_010620119

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS feed or our FREE Weekly Newsletter.

- Submit a comment. Share your views on the subject with all our readers.

Gold

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

One thing to consider would also be the amount of gold in circulation.

Could it be possible that the reason gold hasn’t kept track with inflation has something to do with the fact that they’re pulling a lot of it out of the ground?

if you read Martin Armstrong … gold has nothing to do with inflation . If it would it would be over $ 5000 or even $ 10,000 . If people would only learn that .Gold rises when there is no confidence in government … like now , NOT because of inflation .

To get better educated and understand gold go to :

http://www.martinarmstrong.org/economic_projections.htm

An article , written by goldrunner from your site informing that gold will be over $ 2000 by mid 2011 and the HUI over 900 … also read Armstrongs article to be better informed .

Heidi