The 4 fundamentals and technicals discussed in this article accurately called stock market crashes in 2000 and 2007 and these same market metrics are again TODAY warning that a possible financial tsunami is brewing on the horizon. No one knows for certain WHEN the tsunami will hit Wall Street…but, without question, today’s stocks exhibit extremely exaggerated valuations, and extremes never last, so make no mistake, a major stock sell-off looms.

2007 and these same market metrics are again TODAY warning that a possible financial tsunami is brewing on the horizon. No one knows for certain WHEN the tsunami will hit Wall Street…but, without question, today’s stocks exhibit extremely exaggerated valuations, and extremes never last, so make no mistake, a major stock sell-off looms.

The above are edited excerpts from an article by Vronsky (gold-eagle.com) entitled Ominous Signs For Stocks Forecast Lower Prices.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Vronsky goes on to say in further edited excerpts:

The following ominous signs – plus the US T-Bonds/Dow Ratio accurately – called the BEAR MARKETS of 2000-2002 & 2007-2008:

- S&P500 dividend yield historically too low

- S&P500 price earnings ratio historically too HIGH

- NYSE margin debt at all-time record high

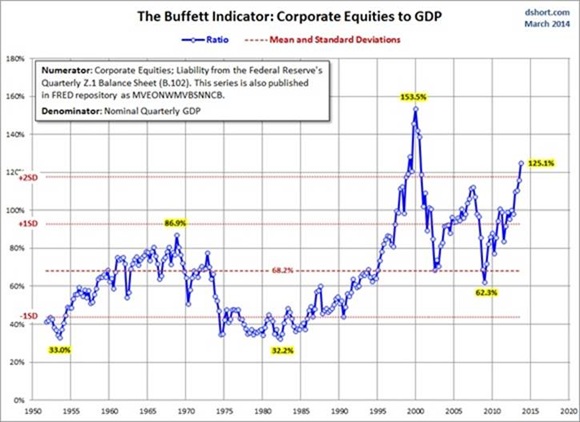

- Warren Buffett’s favorite evaluation metric: Total Market Value/GNP

1. Today’s dividend yield is at:

- the lowest level ever except in 2000 when it sparked a bear market andthe S&P500 lost 51% in value during the subsequent two years…

2. Today’s S&P500 P.E. ratio is at:

- the same level it was in early 1973 just before stocks crashed 45%…

3. Today’s NYSE margin debt is at an all-time high.[It is:]

- higher than in 2000 – when stocks subsequently plummeted -51% – and

- higher than in 2007 – when the Dow Index subsequently was hammered down -54%…

4. Today’s Market Cap/GNP Ratio is the second highest valuation (i.e. over-priced)…since 1950. [It is:]

- Warren Buffett’s favorite valuation metric to determine whether stocks are undervalued or overvalued [and, as such,] demands close attention as…[he] makes all his money investing in stocks. (Noteworthy is that his flagship Berkshire Hathaway recently announced their cash position has been rising rapidly to historically high levels. Obviously, this is done by dumping stocks from its portfolio.)

Warren Buffett’s Berkshire Hathaway’s cash hoard has surged 30% to more than $48 billion, since the end of 2011…[and, as such,] one must ask WHY…[he is doing so] if all is hunky-dory in the stock market. Why is Warren Buffett dumping stocks from his investment portfolio to build a record cash level to more than $48 billion?!

To try to clarify this cash conundrum, let’s take another careful look at the above bar chart again. Notice that in mid-2007 his cash position was about what it is today. Buffett was building a cash pile with the fore-knowledge that a market decline was brewing on the horizon. Likewise today, it seems reasonable the sly Oracle of Omaha has been aggressively building a giant cash pile (by selling stocks) in anticipation of the forth-coming stock market decline of substantial magnitude – and that’s just classic Buffett.

In addition to the four ominous signs described above in detail:

the US T-Bonds/Dow Ratio accurately called the BEAR MARKETS of 2000-2002 & 2007-2008 [and look at where the ratio is today!]

In my opinion fundamental & technical factors are again ripe for another possible BEAR MARKET DEBACLE – Fed driven levitation and tapering notwithstanding.

…As the world famous writer John Steinbeck once said – and all prudent investors should remember his sage logic – “The study of history, while it does not endow with prophecy, may indicate lines of probability.”

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/ominous-signs-stocks-forecast-lower-prices

Related Articles:

1. These Indicators Should Scare the Hell Out of Anyone With A Stock Portfolio

For US stocks — and by implication most other equity markets — the danger signals are piling up to the point where a case can be made that the end is, at last, near. Take a look at these examples of indicators that should scare the hell out of anyone with a big stock portfolio.

2. Extreme Greed By the Crowd Suggests You Show Some Fear! Here’s Why

Greed may have been good for Gordon Gekko. but in the investment world it rarely is. As Warren Buffett is famous for saying “…be fearful when others are greedy and greedy when others are fearful” [and now is such a time]…to start showing some level of fear here in the face of extreme greed by the crowd. The crowd can be right for a long time, but they are rarely right at extremes. While this time may be different, the probabilities suggest that at the very least it will be a more difficult environment for equities going forward.

3. Are You A Bull Or A Bear? Here Are Indicators & Charts That Support Your Thesis

The current U.S. equity market has something for everyone. Whether you are bullish or bearish, there is no shortage of indicators or charts you can use to support your thesis. Let’s run through both the Bull and the Bear case here. In the spirit of Confirmation Bias, feel free to skip ahead to the part that best supports your current positioning. Read More »

4. Remember the “Nifty 50”? It’s Back! What Does It Means For the Markets Going Forward?

Market historians will recall the term “Nifty 50” originated in the 1960’s bull market to describe 50 wildly popular large-cap stocks at the time. Interestingly, some of the same names from that list are leading the market higher today. The question for investors, of course, is what this selective advance means for the markets going forward.

5. Relax! The Stock Market Is Anything But “Scary-Overvalued” – Here’s Why

Are we near the end of one of history’s great stock market rallies? I don’t think so. Yes, prices are in the upper half of their long-term trends, but it’s not what you might call “scary-overvalued.” There is still plenty of room on the upside before historical precedents are violated. Let me explain further. Read More »

6. Are We In Phase 3 – the Final Phase – of This Bull Market Yet?

Are we in the third phase of a bull market? Most who will read this article will immediately say “no” but isn’t that what was always believed during the “mania” phase of every previous bull market cycle? With the current bull market now stretching into its sixth year; it seems appropriate to review the three very distinct phases of historical bull market cycles. Read More »

7. Is Now the Calm Before the Storm?

I’d argue that the record low volume shows investors aren’t looking ahead as much as looking behind and reminiscing at how good things have been over the past five years or so. They’re expecting more of the same even though it’s mathematically impossible people. Read More »

8. Should You Care What’s Happening On the Nikkei 225? YES! Here’s Why

Should markets around the world really care about what the Nikkei 225 Index does? The Power of the Pattern suggests “yes”! Here’s why. Read More »

9. Collapse of S&P 500 May Be Only Weeks Ahead! Here’s Why

When Staple sector (i.e. defensive) stocks started to reflect greater relative strength than Discretionary sector stocks back in 2000 and again in 2007, the S&P 500 began to fall dramatically in the ensuing months. That’s happening again. Can a collapse of the S&P 500 be far behind? Read More »

10. There’s Evidence – Plenty of It – That the Bear Is No Longer Hibernating. Here’s Why

The health of a market is best assessed along three vectors: fundamentals, technicals (price action) and sentiment and this is what each is saying about the health of the markets these days. Read More »

11. A 20%+ Sell-off is Brewing In the Lofty U.S. Stock Markets – Here’s Why & What the Future Holds

For today’s seriously overextended and overvalued US stock markets the best-case scenario is a full-blown correction approaching 20% emerging soon while the worst case is a new cyclical bear market that ultimately leads to catastrophic 50% losses. Read More »

12. Margin Debt: It Doesn’t Matter ’til It Matters! Is Now the Time to Be Worried About the S&P 500?

It doesn’t matter until it matters! IF margin debt should start decreasing swiftly, history would suggest something different is taking place in the mind of aggressive investors. Will a decline in margin debt from all-time highs matter this time? Read More »

Last year’s “Sell in May” period was only the third time since the turn of the century that stocks have postedstockcrash-2 double-digit gains from May through October so, with stocks still near all-time highs as the calendar flips to May, do the law of averages suggest we’re on the brink of a major pullback over the next six months? Read More »

14. 2 Stock Market Indicators Are Saying “Be careful, don’t get caught up in the euphoria”

In the midst of all the optimism we see towards key stock indices these days, there are two leading indicators that are flashing warning signals. They say, “Be careful, and don’t get caught up in the euphoria.” Read More »

15. Beginnings of Massive Stock Market Correction Developing: Don’t Delay, Prepare Today!

No stock can resist gravity forever. What goes up must eventually come down. This is especially true for stock prices that become grotesquely distorted. We have been – and still are – living in another dotcom bubble, and – like the last one – it is inevitable that it is going to burst. Read More »

16. No Problems Foreseen – Yet – from Sky Rocketing Margin Debt BUT

Is the latest credit-balance trough a definitive warning for U.S. equities? In this article we examine the numbers and study the relationship between margin debt and the market, using the S&P 500 as the surrogate for the latter. Read More »

17. 3 Historically Proven Market Indicators Warn of an Impending Market Top

It’s frustrating to see key stock indices keep pushing higher when historically proven market indicators are all warning of a crash ahead. Irrationality is exuberant to say the very least, and that’s why I believe this rally is counting its last days. Read More »

18. Time the Market With These Market Strength & Volatility Indicators

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974 Read More »

19. The Stock Market Is a Risky Place to Be – Here’s Why

With both the fundamentals and the technicals saying the stock market is a risky place to be, we await its crash back to reality. Here’s why. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money