Do I need to invest in foreign stocks when the U.S. companies are now so global and the markets are so highly correlated?

The edited excerpts above, and those below, are from an article* by Ben Carlson (awealthofcommonsense.com) originally entitled Is International Diversification Worth The Risk? which can be read in its entirety HERE.

It’s a legitimate question.

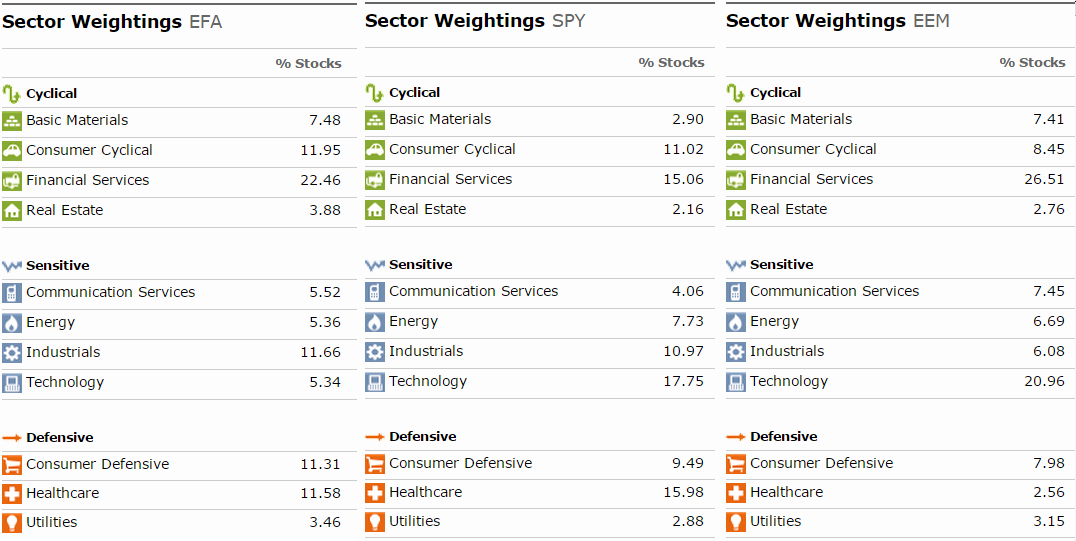

Difference in Sector Weightings By Region

Due to globalization the S&P 500 now gets something in the order of 40% of its sales from overseas but, that being said, industry make-up of each market varies by region. Take a look at the industry breakdown for the S&P 500, MSCI EAFE and MSCI Emerging Markets indexes:

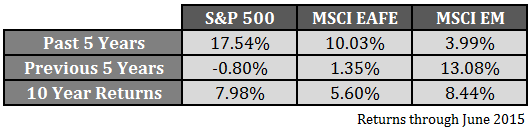

Differences in Performance By Region

Since stocks generally go up over time, investors have to expect that different markets will be correlated with one another, but correlation says nothing about the differences in performance. It’s just statistical relationship that shows they’re generally moving in the same direction.

Differences in Correlations By Region

Differences in Correlations By Region

By investing abroad you’re not only gaining exposure to different countries, industries, currencies and individual companies, but there’s also a cultural element that I think is under-appreciated. No matter how globalized the world becomes, there will always be cultural differences. These differences will affect the way that investors in certain countries or regions will invest. Global diversification allows intelligent investors to take advantage of the reactions, biases and mistakes of investors in other markets. Even with increased correlations, investors around the globe are never going to be completely in sync with one another.

Take a look below at the past five year’s worth of returns for these markets along with the previous five years and the past ten years:

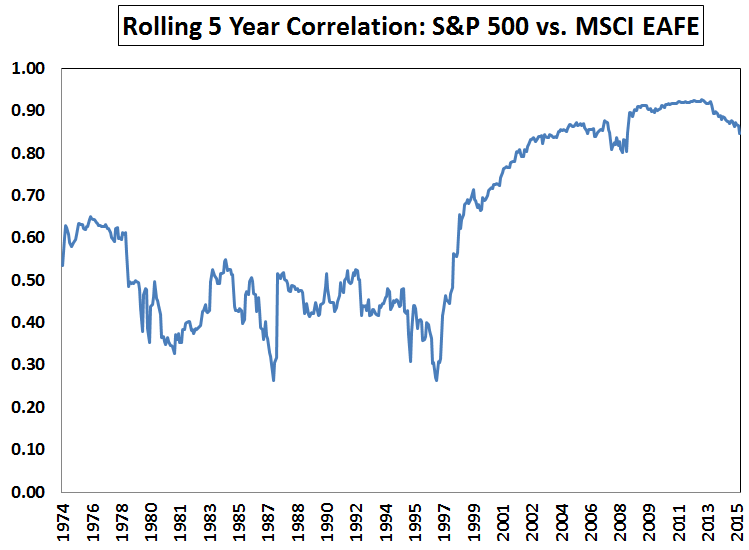

The S&P 500 against the MSCI EAFE index of developed foreign markets:

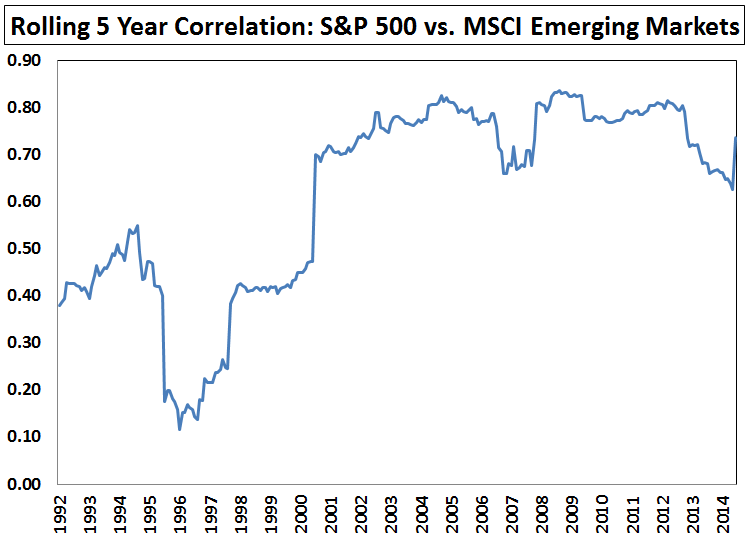

The S&P against the MSCI Emerging Markets Index:

The correlations with the S&P 500 to foreign developed and emerging market stocks over the past 5 years were 0.86 and 0.75, respectively. In the previous 5 year period, they were 0.91 and 0.83.

Conclusion

Diversification is a willingness to admit that you have no idea what’s going to happen in the future. I’m sure investors who stick exclusively with U.S. stocks will probably do just fine in the future but – why take the risk?

*http://awealthofcommonsense.com/is-international-diversification-worth-the-risk/

Related Articles from the munKNEE Vault:

April 29, 2015

Even seasoned U.S. investors can make basic (and wrong) assumptions and generalizations when it comes to investing internationally. Here are a few common traps that investors tend to fall into when they start looking outside their own country’s borders.

April 29, 2015

Most investors don’t know anything more about diversification than you “shouldn’t put all your eggs in one basket” [but] spending some time trying to understand the ways you might be shooting yourself in the foot could seriously enhance your portfolio returns and stop catastrophic risk. [There are some advantages to diversification if you REALLY know what you are doing but the shortcomings can go a long way towards killing your portfolio returns. In this article we identify what they are and how best to avoid them.] Words: 1055

June 11, 2015

Asset allocation is the most essential factor in building a high performing portfolio. Paying attention to the risk of each asset class allows you to create a portfolio that can beat the market in good times as well as bad.

July 8, 2015

It would seem we could be entering a rocky market stretch given China’s collapsing stock market, the Greek and Puerto Rican debt crises, etc. Today’s infographic compares how 14 different asset classes have performed during the last five crises.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money