What Really Defines a Financial Recovery?

Until people understand the reality of this supposed financial recovery and realize that unless major changes are made the deck chairs on the Titanic will just keep being rearranged resulting in the wealthy being even wealthier and the middle class being a shell of what it once was in the United States. [Let me explain more fully.] Words: 1260

So says an article* at www.mybudget360.com which Lorimer Wilson, editor of www.munKNEE.com , has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. The article goes on to say:

According to the NBER the recession was over in June of 2009 [but] this economic recovery has excluded working and middle class Americans which begs the question, what really defines a financial recovery? In past…recoveries the economic gains were widely distributed amongst all Americans. Most realize that income gains will never be equal simply because in a market based economy those with certain desirable skills will be rewarded more than others… [but recent research revealing] that 50.1% of Americans are unable to come up with $2,000 in 30 days if an emergency came up is startling. $2,000 for most is the basic monthly expenses on food, home, and other little items so half our country is living one paycheck away from financial collapse [of which] 44,000,000 are living with food assistance from the government already. The fact that $2,000 is enough to bankrupt half of American households tells you about the new state of our economic recovery.

Sign up for our FREE weekly “Top 100 Stock Index, Asset Ratio & Economic Indicators in Review” report

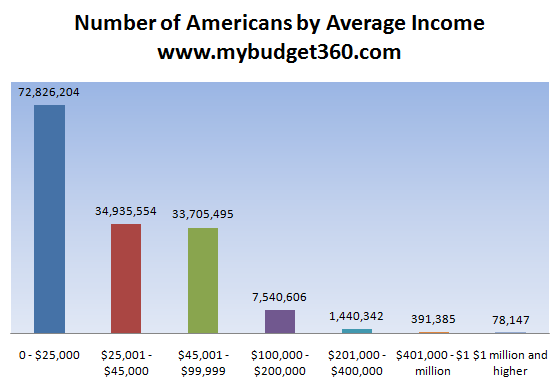

The Average American’s Per Capita Income is Only $25,000!

The average per capita income for the United States is $25,000 which surprises… [most] when they hear this figure because it seems low for the most wealthy nation in the world…yet most [of those] that are surprised do not live in the bottom half. [Also,] keep in mind [that] many of these families are in the two income trap meaning both spouses have to work in order to keep things moving financially. [Below is a chart of the number of Americans by average income.]

Source: Social Security

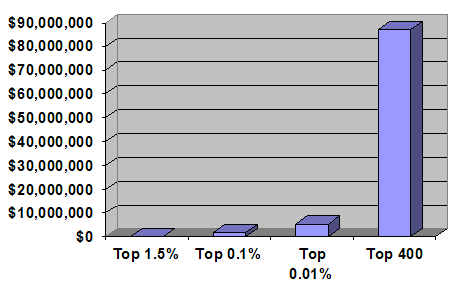

Largest Gains from the “Recovery” Have Gone to the Top 1% of Earners!

This brings up the question of recovery once again. If half of Americans are teetering on financial disasters and all it would take is $2,000 in unexpected expenses, what do we really mean by a middle class lifestyle? The last two years have not been supportive to the working people of America. The large gains have gone directly to the top 1 percent [as can be seen in the following graph].

Greatest Financial Gains Have Come From the Stock Market – Not Real Estate!

These kinds of gains in income are going to the wealthiest in our country because the current bailouts have rewarded those with large financial positions in stocks [as shown in the graph below]:

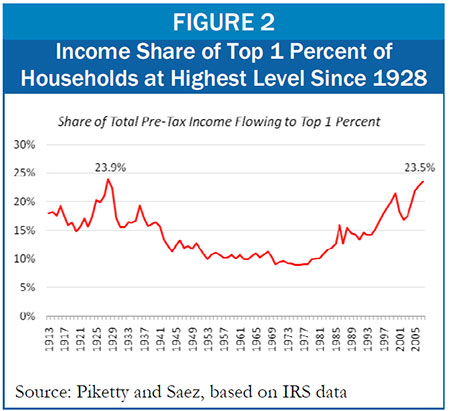

Wealth Inequality at the Highest Level Since the Great Depression!

Most Americans derive their net worth from home values, not stock market gains, [however,] so the 100 percent run-up of the stock market has done very little for the majority in the country – and this can be seen by Gallup’s 19 percent underemployment figure. Do we think that those that are $2,000 away from financial ruin are loading up on stocks in their retirement accounts? They are simply getting by. This is why wealth inequality is now at levels not seen since the Great Depression [as shown in the graph below]:

The Rich are – and Will Continue – Getting Richer!

An interesting report from Deloitte came out showing [see chart below] that over the next decade the rich in the world will simply get richer by using the current system that pillages the working classes around the globe:

Source: Zero Hedge

“(Zero Hedge) A new study by Deloitte confirms…[that] the wealth amassed by millionaire households is set to increase by more than 100% over the next 9 years…[and] although much of the move up is attributed to the wealth surge in the developing world, the biggest beneficiary is, you guessed it, the United States where the millionaires…will see their assets increased by 225%…so if anyone harbored any illusions that the current status quo was about anything but the rich getting richer, all those can be promptly swiped aside.”

…Again the question becomes what do we mean by recovery? Is it a recovery if the majority of American families are left in a financially destitute situation just to bailout too-big-to-fail financial institutions to protect the wealth of the top one percent? Keep in mind these are the individuals that have set fire to the economy and have put a match to the home equity of most Americans. This is the system that is being protected but not for the majority.

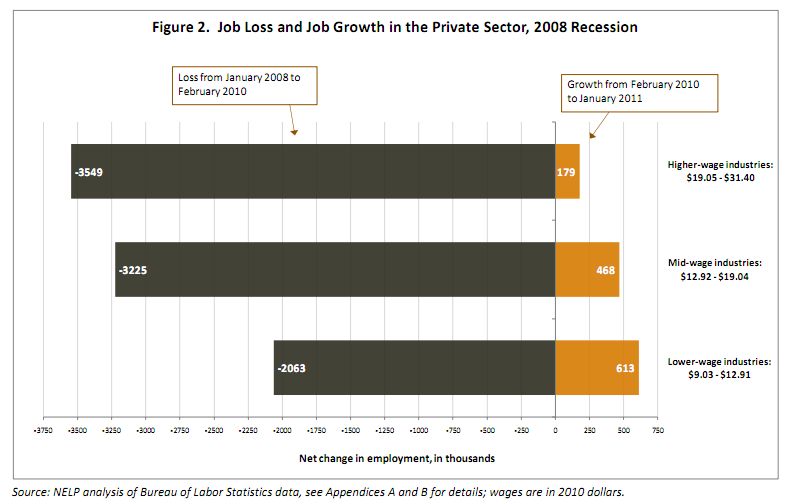

Higher-Wage Jobs Lost Being Replaced by Growth in Lower-Wage Industries!

We would expect that a recovery would occur with good paying jobs dominating the new workforce. That is not the case [as the graph below so clearly shows]:

Source: NELP

As you can see from the chart above most of the jobs being added in the recovery are from lower paying job sectors. The middle class is seeing more and more strains being placed on their monthly budgets. Trading good blue collar jobs in, say, building cars into burger-flipping McDonald’s jobs. Anyone who has followed the trends closely realizes that seeing 50 percent of Americans only $2,000 away from major financial issues is no surprise. In fact 1 out of 3 Americans doesn’t even have a penny to their name! This is the issue at hand and while too-big-to-fail banks leverage the Federal Reserve for zero percent loans and a place to trash toxic waste loans, many Americans do not even share in their rising productivity.

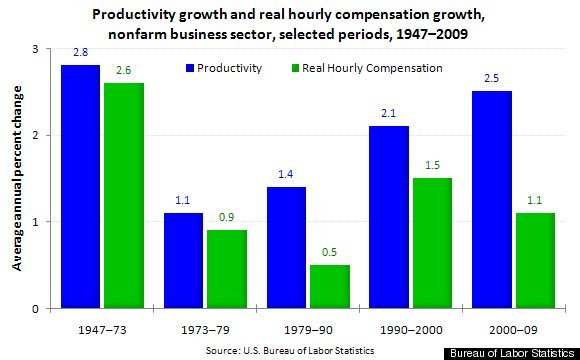

Working and Middle Class Americans Not Benefiting From Higher Productivity!

[As the chart below shows] the working and middle class Americans keep increasing their productivity with no rewards:

No wonder profits are up and wages are down – less is being given to those creating the new gains under the guise that things are financially tight. Tight for who – the CEO of JP Morgan that makes 800+ times the median household income of Americans for foreclosing on millions and gambling in speculative investments that hurt the real economy?

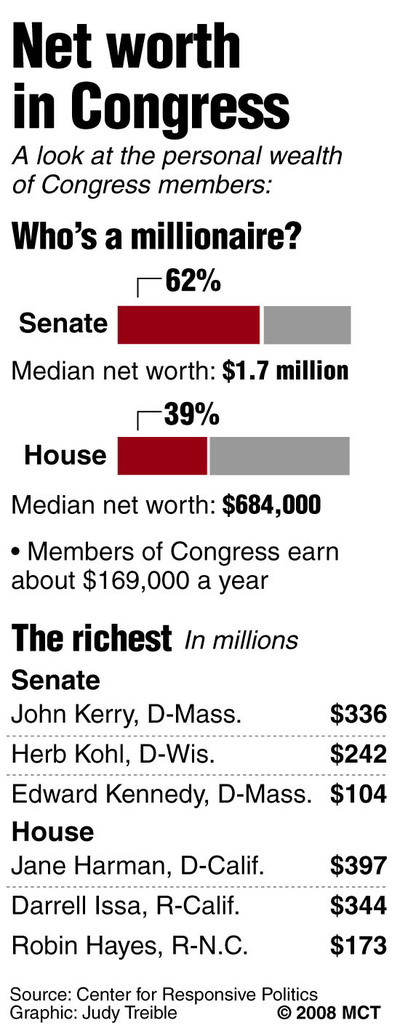

Majority of Washington Politicians Support the Elite Class and Not Working or Middle Class!

If you wonder why nothing is done in Washington D.C. the vast majority of representatives support the elite class because they are part of it:

Conclusion

Until people start making these wider connections we will keep rearranging the deck chairs on the Titanic and by 2020 the wealthy will be even wealthier and the middle class will be a shell of what it once was in the United States. This is the new recovery according to the large financial interest that controls our government

*http://www.mybudget360.com/brittle-financial-american-middle-class-50-percent-of-americans-no-savings-2000-bankrupt-202-trillion-in-wealth-deloitte-finds-rich-get-richers-by-2020/

Related articles:

- America: The 42nd Most Unequal Country in the World! https://munknee.com/2011/03/america-the-42nd-most-unequal-country-in-the-world/

- Are America’s Wealthy Unpatriotic? https://munknee.com/2011/03/in-this-time-of-economic-crisis-are-americas-wealthy-unpatriotic/

- Our Income and Wealth are Under Attack! https://munknee.com/2011/01/our-income-and-wealth-are-under-attack/

Editor’s Note:

- The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

- Permission to reprint in whole or in part is gladly granted, provided full credit is given as per paragraph 2 above.

- Sign up to receive every article posted via Twitter, Facebook, RSS Feed or our FREE Weekly Newsletter.

Financial Recovery

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money