…Retail sales numbers for July came in at a disappointing 0.0% and, after backing out auto sales, retail sales actually declined by 0.3%…[That’s in spite of] much lower gas prices and (supposedly) an improving job market [so] my guess is that American consumers are simply running into a brick wall of too much debt. [This article suggests] 9 companies that could prosper from such financially stressed-out consumers.

retail sales actually declined by 0.3%…[That’s in spite of] much lower gas prices and (supposedly) an improving job market [so] my guess is that American consumers are simply running into a brick wall of too much debt. [This article suggests] 9 companies that could prosper from such financially stressed-out consumers.

The comments above and below are excerpts from an article by Tony Sagami (MauldinEconomics.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

Tapped Out

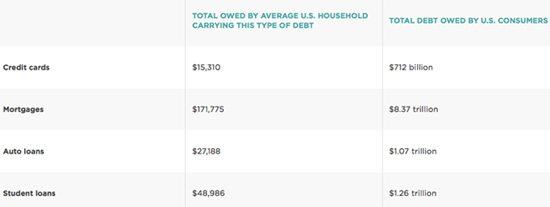

This consumer-spending slowdown is happening against a backdrop of much lower gas prices and (supposedly) an improving job market [so] my guess is that American consumers are simply running into a brick wall of too much debt.

For households with all four types of debt, that’s a combined average of $263,259. That translates into an average of $6,658 a year just in interest payments alone, which is especially tough when compared to the median household income of $75,591. That means [the average] American household [with all four types of debt is] spending 9% of their gross income just on interest payments alone.

Stressed Out

Here is how that debt translates into financial stress:

- 14% of Americans have more debts than assets, which puts their net worth in negative territory.

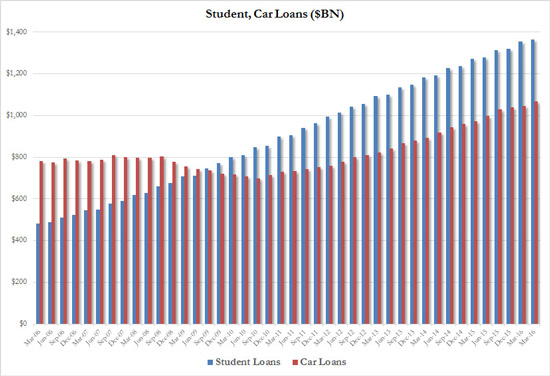

- People are piling up a tremendous amount of new debt in two areas: auto and student loans. Outstanding car loans and student loans have climbed to $1.1 trillion and $1.4 trillion respectively, both record highs.

Those are troubling numbers, and personally, I find great comfort in the knowledge that I don’t owe a penny to anybody in the world. I suspect that readers of this column are in a similar boat, looking for places to invest the dollars you’ve accumulated.

Investment Opportunities

There are three investment themes behind those debt numbers:

Stressed-Out Opportunity #1:

The flipside of that explosive debt growth is to be a lender. Nobody likes to make loan payments, but I don’t know anybody who doesn’t like to receive them. Companies that are doing a lot of the lending are:

- SLM Corporation (SLM) also known as Sallie Mae

- Santander Consumer USA Holdings (SC), one of the largest auto lenders in the US

- Capital One Financial Corp. (COF), one of the largest credit card issuers in the US

Stressed-Out Opportunity #2:

Cash-strapped consumers may not be spending as much as they used to but they are selectively spending their dollars where they get the most bang for their bucks. I’m talking about discount retailers like:

- Wal-Mart Stores Inc. (WMT)

- Dollar General Corp. (DG)

- Costco Wholesale Corp. (COST)

Stressed-Out Opportunity #3:

Debt collectors may rank up there with used-car salesman and IRS agents, but the business of debt collection is very lucrative. There are three publicly traded companies that derive the bulk of their revenue from debt collection:

- Asta Funding (ASFI)

- Encore Capital Group (ECPG)

- Portfolio Recovery Associates (PRAA)

I’m not suggesting you rush out and buy any of these stocks tomorrow morning. As always, timing is everything, but the above are companies that could prosper from financially stressed-out consumers.

For more investment ideas, read the current issue of Yield Shark, which is being published today. As the stock of the month, I recommend an investment specializing in the luxury hotel and resort sector. As the 1% and the 99% keep drifting apart, it’s no coincidence that Walmart and top-notch hotels could both gain in popularity. Try Yield Shark risk-free for 90 days and find out how to profit from this trend.

Tony Sagami

![]()

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; EconMatters; CreditWriteDowns;

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money